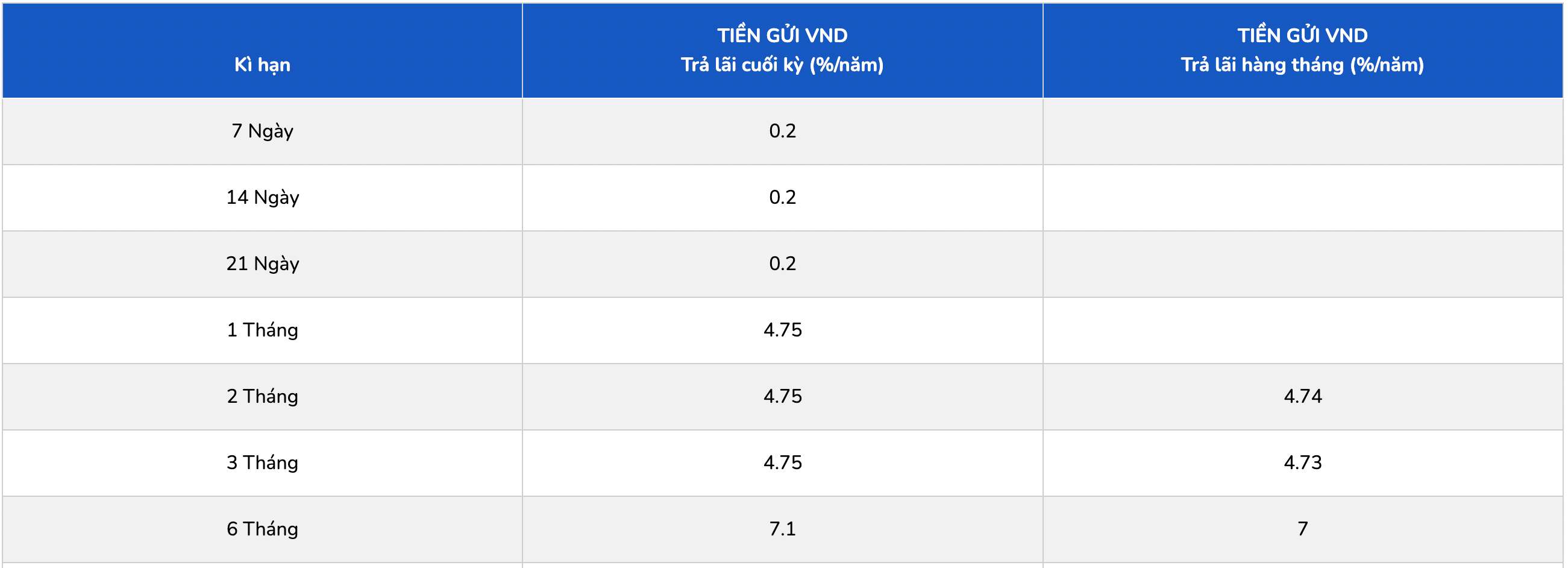

First, Cake by VPBank is listing the highest interest rate for a 6-month term at 7.1%/year when customers receive interest at the end of the term. When customers receive interest at the beginning of the term, monthly and quarterly, they will receive interest rates of 6.04%, 6.19% and 6.24%/year respectively.

From January 1, 2026 to the end of February 28, 2026, Cake by VPBank offers an additional interest rate of 0.9%/year for individual customers who first use term deposit products at CAKE by VPBank Digital Bank (including CAKE BANK application and other platforms). Conditions to receive additional interest rates are the interest receiving method: At the end of the term, at the beginning of the term, monthly, quarterly; Deposit term from 6 months or more and no early settlement.

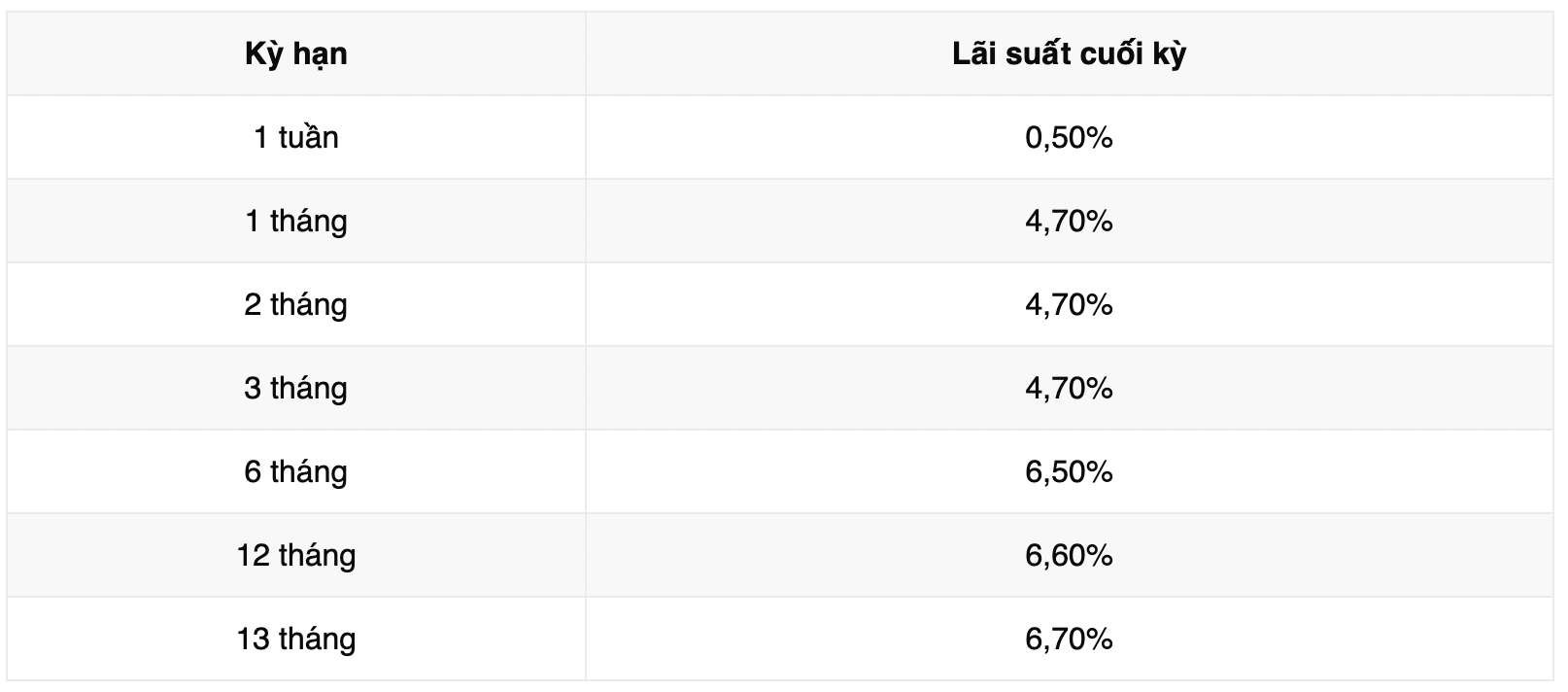

PGBank lists the highest interest rate for a 6-month term at 7.1%/year when customers receive interest at the end of the term; if receiving interest monthly, they receive an interest rate of 7%. PGBank lists the highest interest rate at 7.3% when customers deposit money for terms of 18, 24, 36 months.

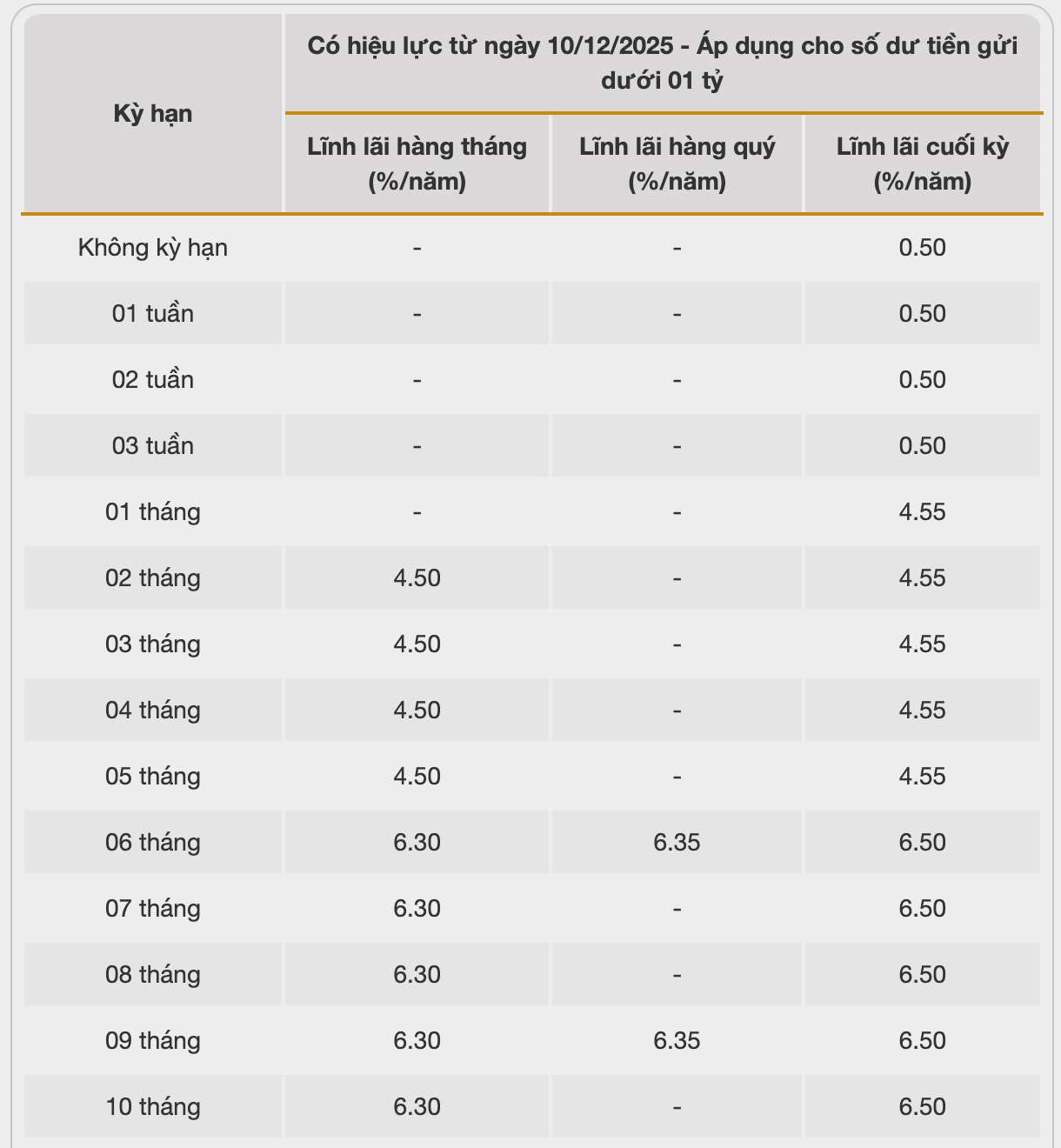

BacABank lists the highest interest rate for a 6-month term at 6.5%/year when customers deposit money online, receiving interest at the end of the term. BacABank lists the highest interest rate at 6.7% when customers deposit money for terms of 18, 24, 36 and above.

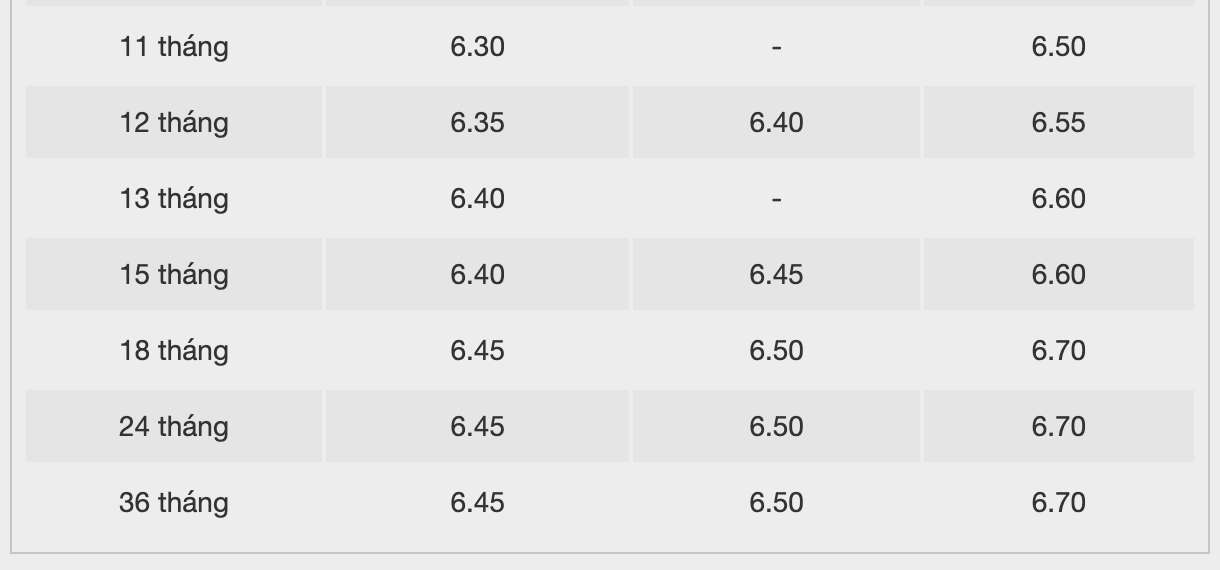

Vikki Bank is listing the highest interest rate for a 6-month term at 6.5%/year when customers deposit money online, receiving interest at the end of the term. The highest term this unit is listing the highest interest rate is 13 months, at 6.7%.

NCB has just announced an additional interest rate of up to 2%/year when all individual customers deposit online savings through NCB's digital banking application. The condition is widely applied to deposits with terms from 6 months or more and is extended until January 31, 2026.

With the addition of an interest rate of 2%/year, the interest rate on online deposits at NCB for terms of 6 - 8 months will be up to 8.2%/year; terms of 9 - 11 months up to 8.25%/year; terms of 12 - 36 months is 8.3%/year.

How do you receive interest from a 6-month savings deposit?

Formula for calculating interest on 6-month savings deposits at banks:

Interest = Deposit amount x interest rate (%)/12 months x number of months deposited

Deposit 500 million VND into Bank A, with an interest rate of 7.1% for a 6-month term. The interest you receive is estimated at:

500 million VND x 7.1%/12 x 6 months = 17.75 million VND.

Before depositing savings, readers should compare savings interest rates between banks, interest rates between terms to enjoy the highest interest.

* Interest rate information is for reference only and may change in each period. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.