Latest interest rates of Agribank, VietinBank, Vietcombank and BIDV

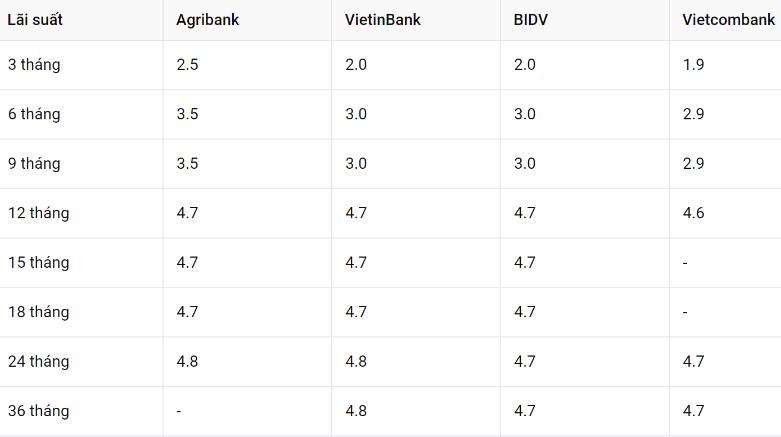

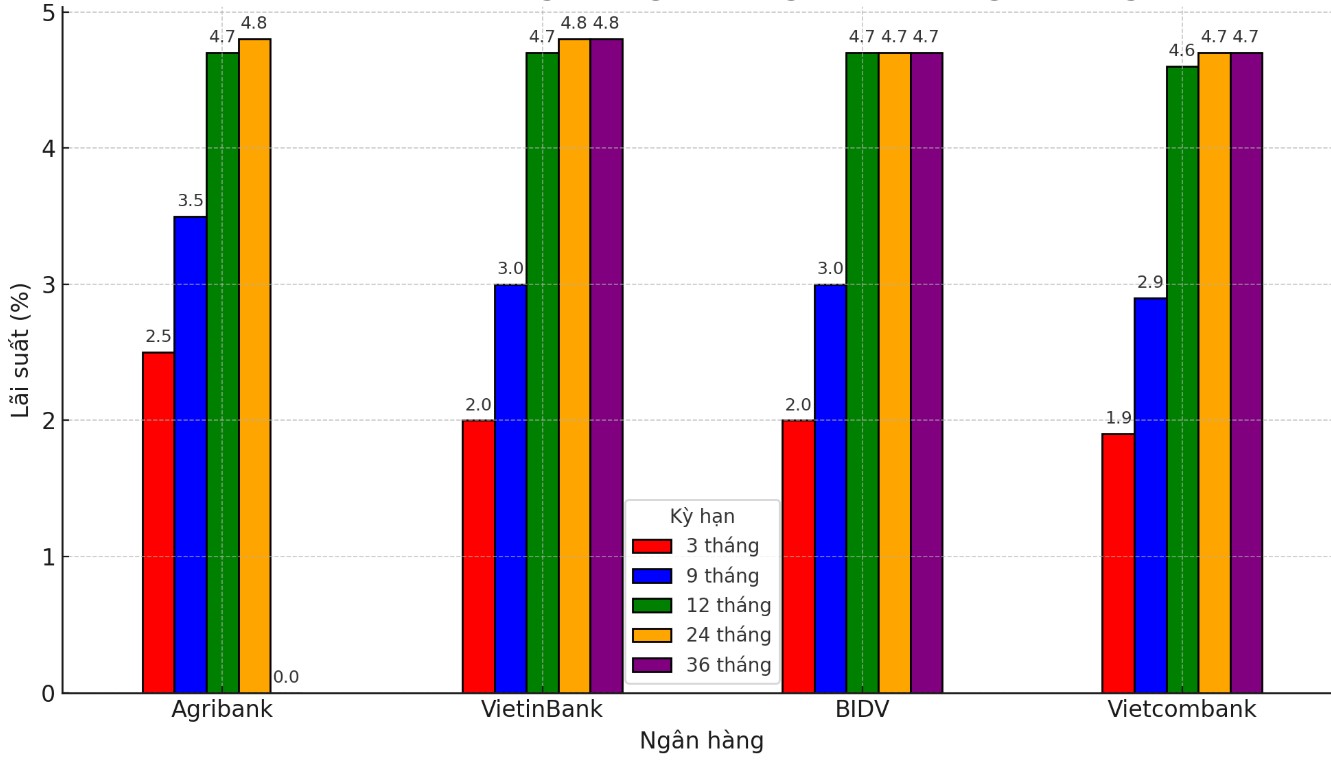

According to Lao Dong reporter's records with 4 banks Vietcombank, Agribank, VietinBank and BIDV on January 26, 2025, the mobilization interest rate table is being listed around the threshold of 1.9-4.8%/year.

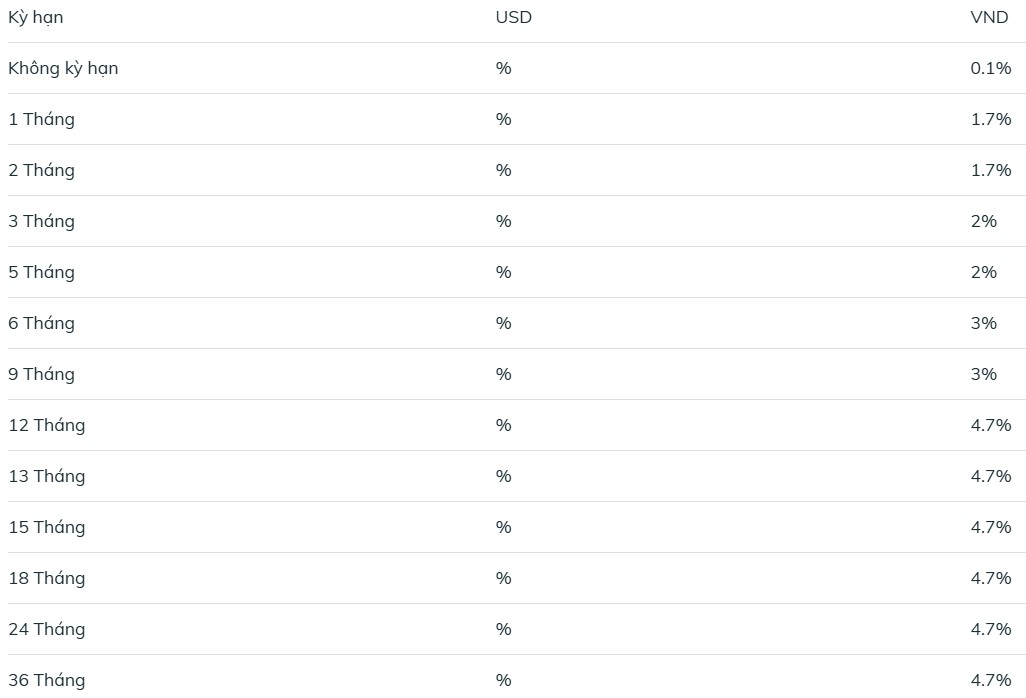

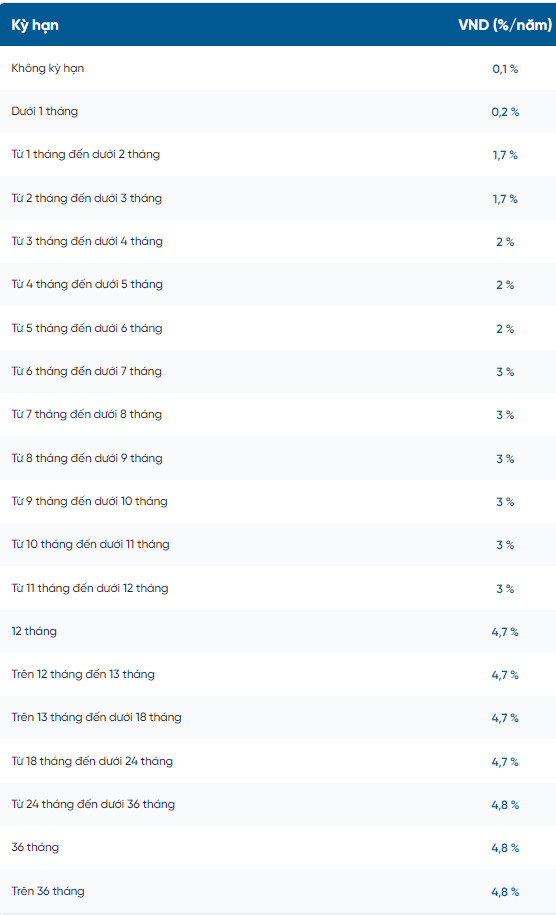

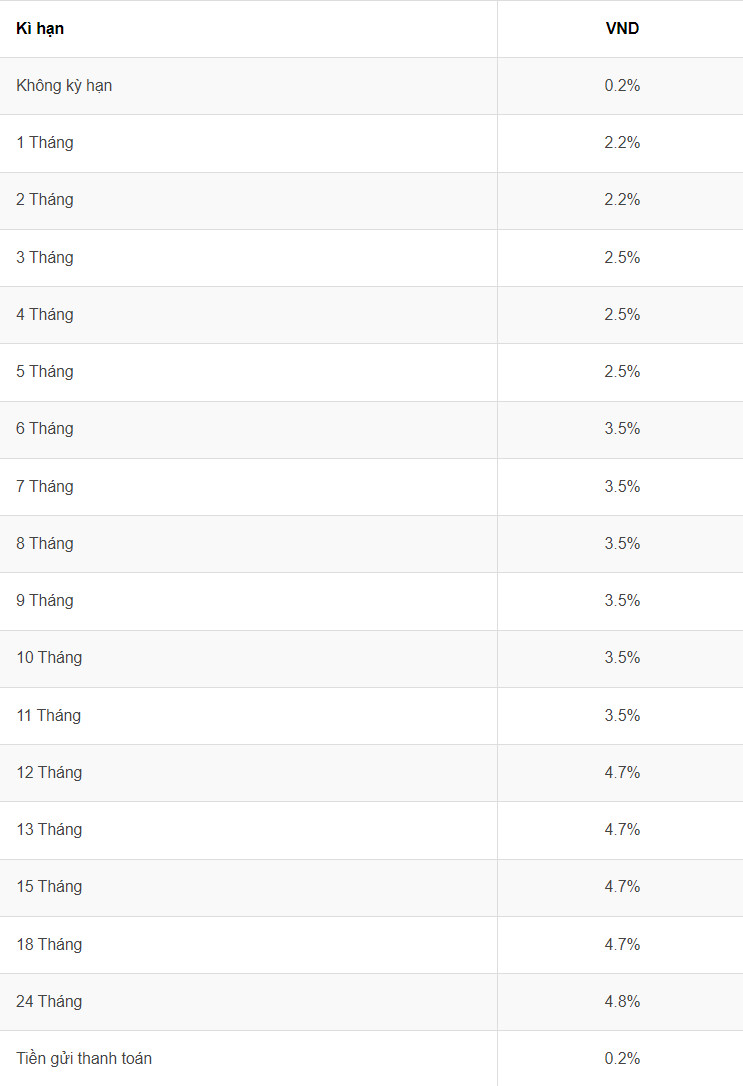

Of these, Agribank and VietinBank have the highest interest rates (4.8% for terms over 24 months). BIDV's interest rates currently range from 2-4.7%/year, while Vietcombank's interest rates range from 1.9-4.7%/year.

Below are the latest Big 4 interest rate details:

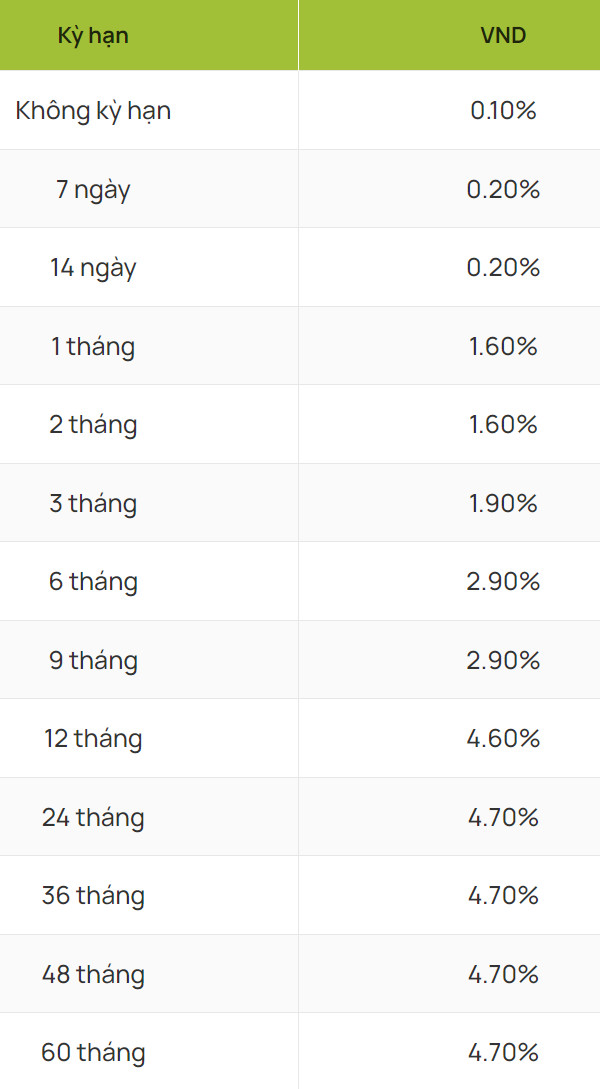

Below is a detailed update of interest rates of banks in the Big 4 group:

How much interest do you get if you save 100 million VND at Big 4?

To calculate interest on savings deposits at the bank, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit

For example, if you deposit 100 million VND for a 24-month term at Bank A with an interest rate of 4.7%/year, you can receive: 100 million VND x 4.7%/12 x 24 = 9.4 million VND.

With the same amount and term above, if you save at Bank B with an interest rate of 4.8%, the interest you receive will be: 100 million VND x 4.8%/12 x 24 = 9.6 million VND.

In addition, readers can refer to interest rates of some other banks through the following table.

Interest rates are listed at high levels by many banks, from 7% to 9%, but to enjoy this interest rate, customers must meet special conditions.

PVcomBank leads with a special interest rate of 9%/year for a 12-13 month term when depositing money at the counter. The condition is that customers must maintain a minimum balance of VND2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion. In addition, an interest rate of 6% is applied for an 18-month term.

MSB listed interest rates of 8%/year for 13-month terms and 7%/year for 12-month terms. The condition is a minimum deposit of VND500 billion from newly opened or automatically renewed savings accounts from January 1, 2018.

Dong A Bank applies an interest rate of 7.5%/year for deposits with a term of 13 months or more, with a minimum amount of VND 200 billion. A 24-month term applies an interest rate of 6.1%/year.

Bac A Bank has the highest interest rate of 6.2%/year for terms of 18-36 months, with deposits of over 1 billion VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.