According to Kitco News, gold prices rose sharply against the Yen after the Bank of Japan (BOJ) raised interest rates to 0.5%, the highest in 17 years. At the same time, the bank also signaled the possibility of further tightening.

“If the expectations presented in the January outlook report materialize, the BOJ will continue to raise the policy rate and adjust the level of monetary support,” the BOJ said in its monetary policy statement.

The BoJ also warned that “the healthy cycle between wages and prices will continue to strengthen” as businesses increasingly aim to raise wages and prices.

Experts said the rise in gold prices against the yen was somewhat "surprising". Higher interest rates are usually negative for gold, as they increase the opportunity cost of holding non-yielding assets. However, gold prices rose even as the yen strengthened after the expected rate hike.

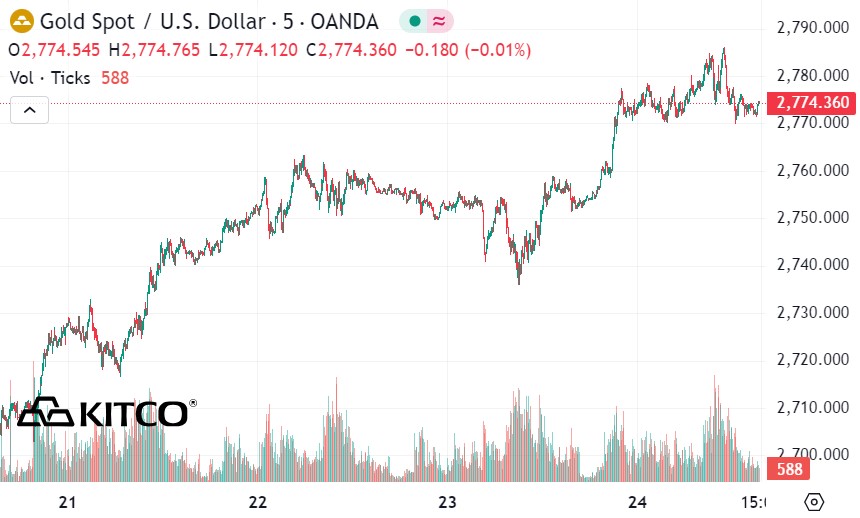

The precious metal has also shown similar strength against the US dollar, said Neils Christensen, an analyst at Kitco News. Gold prices are trading near record highs despite the US Federal Reserve's efforts to shorten its easing cycle, with only one rate cut likely this year. The shift in US monetary policy has pushed bond yields and the US dollar to multi-year highs.

Some analysts note that gold has overcome these traditional hurdles, maintaining its status as an important safe-haven asset amid growing uncertainty in global financial markets.

In recent interviews with Kitco News, Dennis Gartman, a renowned commodities investor and founder of the Gartman Letter, expressed optimism about gold due to its performance against global currencies. In a note published Thursday evening, he predicted that the precious metal could reach 450,000 yen this year.

In another interview with Kitco News, Michele Schneider, chief strategist at MarketGauge, shared a bullish view on gold, stressing that tight monetary policies are a sign of a larger problem, which is inflation.

Schneider explained that the world is facing a new inflationary threat, with supply issues likely to push up prices for commodities such as food and essential metals. For example, recent severe droughts have pushed coffee prices to record levels.

“This is the kind of inflation that central banks really can't solve because it's a supply-demand issue,” she said.

Schneider added that if gold prices break above $2,800 an ounce, they could easily rise to $3,000 an ounce.

See more news related to gold prices HERE...