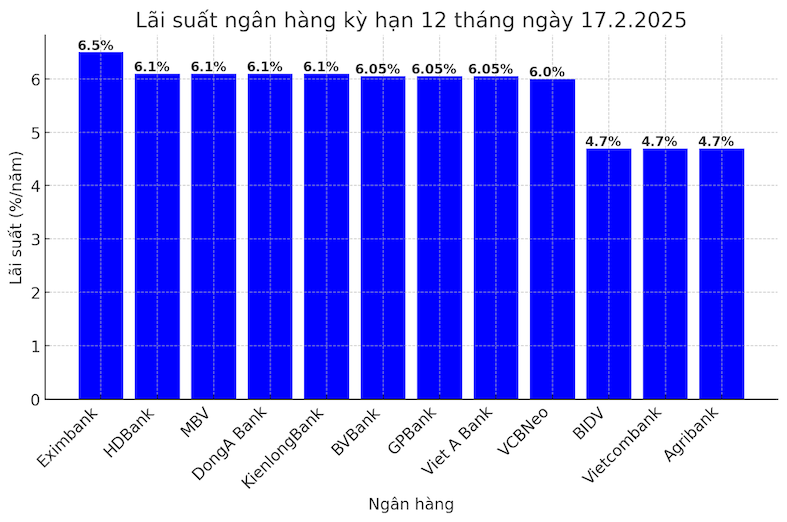

Highest online savings interest rate is 6.5%/year

Currently, Eximbank is still leading the market with a 12-month term interest rate of 6.5%/year, followed by HDBank, MBV, DongA Bank, KienlongBank with 6.1%/year.

6-month term: Eximbank 5.6%/year, Viet A Bank, Saigonbank, MBV 5.5%/year.

9-month term: KienlongBank, DongA Bank 5.8%/year, Viet A Bank, MBV 5.5%/year.

12-month term: Eximbank 6.5%/year, HDBank, MBV, DongA Bank, KienlongBank 6.1%/year.

18-month term: BVBank, GPBank 6.05%/year, KienlongBank, MBV, DongA Bank, HDBank 6.1%/year.

24 - 36 month term: Eximbank, Viet A Bank, GPBank, KienlongBank ranges from 6 - 6.2%/year.

Meanwhile, the Big 4 group (Vietcombank, BIDV, VietinBank, Agribank) still holds the 12-month term interest rate at 4.7%/year - significantly lower than the private banking group.

SCB is still the bank with the lowest interest rate for this term, only 3.7%/year.

Special savings interest rate from 7-9%/year

The highest interest rate for 12-month terms is up to 7-9%, but to enjoy this interest rate, customers must meet special conditions.

PVcomBank leads with a special interest rate of 9%/year for a term of 12-13 months when depositing money at the counter. The applicable condition is that customers must maintain a minimum balance of VND 2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion. In addition, the 18-month term is subject to a 6% interest rate.

MSB listed an interest rate of 8%/year for a 13-month term and 7%/year for a 12-month term. The condition is that the minimum deposit is 500 billion VND from newly opened or automatically renewed savings books from January 1, 2018.

Dong A Bank applies an interest rate of 7.5%/year for term deposits of 13 months or more, with a minimum amount of VND200 billion. The 24-month term is subject to an interest rate of 6.1%/year.

Bac A Bank has the highest interest rate of 6.2%/year for a term of 18-36 months, with a deposit of over 1 billion VND.

Interest rate trends in the coming time

According to KB Vietnam Securities Company (KBSV), the SBV will continue to maintain a loose monetary policy to promote economic growth. It is forecasted that deposit interest rates may increase slightly by 30-100 basis points (0.3 - 1 percentage point) depending on the banking group.

State-owned banking group (Vietcombank, BIDV, VietinBank, Agribank): Interest rates may increase by 30-50 basis points but are still lower than private banks due to support from State Treasury deposits.

Joint Stock commercial bank group: Deposit interest rates may increase by 50-100 basis points, in which small-scale banks will be under stronger pressure to increase due to no advantage in non-term deposits (CASA).

In 2024, the SBV used flexible measures in the interbank market to control exchange rates and liquidity, especially issuing bonds to attract coins during periods of high exchange rate pressure (May - June 2024 and the end of the year).

In early 2024, deposit interest rates have hit rock bottom, even lower than the entire COVID-19 period. However, from April onwards, interest rates have increased slightly, focusing on short terms, while the Big 4 group has remained almost unchanged.

It is forecasted that in the coming time, interest rates may continue to increase but not significantly, except for some small banks with high capital mobilization needs. Savings depositors should consider terms from 12 to 24 months to enjoy the best interest rate.