Savings interest rates increase but there is differentiation

Savings interest rates in Vietnam are currently showing a slight upward trend, reflecting fluctuations in the financial market and monetary policy.

Many economic experts say that the trend of increasing savings interest rates will continue in the coming time.

VNDIRECT Securities Company forecasts that the average 12-month term deposit interest rate may increase by about 0.3 percentage points, reaching 5.2% to 5.3% per year by the end of 2025. This is explained by the need for banks to increase their capital mobilization to meet the minimum capital requirements under Basel II standards and support lending activities in the context of the economy showing signs of recovery after the pandemic.

Not only VNDIRECT, Tien Phong Securities Company (TPS) also made a similar prediction. According to TPS, deposit interest rates are likely to increase in the final period of this year and will remain stable or increase slightly in 2025.

However, this interest rate can have a clear differentiation between banking groups. Small-scale banks, with the aim of competing and attracting customers, can apply higher interest rates than large banks, which already have a stable customer network.

In addition, Mr. Can Van Luc - Chief Economist of BIDV Bank - warned that increasing savings interest rates could put considerable pressure on lending interest rates. This would not only increase the cost of borrowing for businesses and individuals but could also affect the attractiveness of loans in the market.

According to him, the recent increase in savings interest rates by some private banks has begun to impact lending interest rates, requiring careful consideration from management agencies to maintain the stability of the financial system.

What is the highest interest rate?

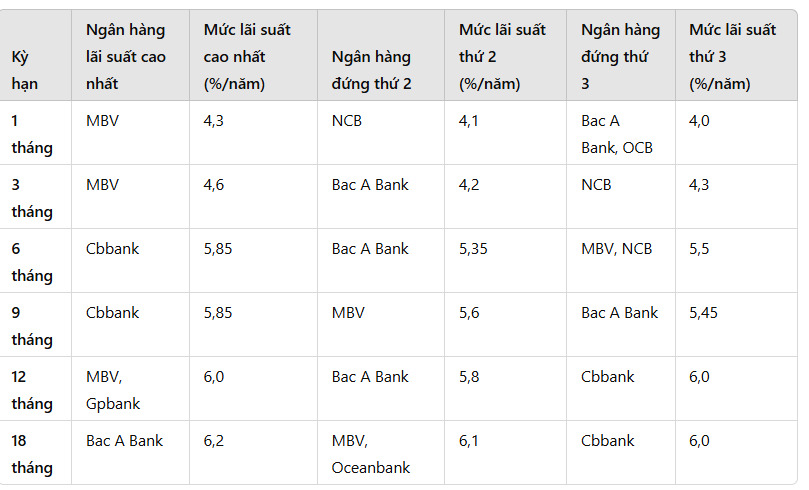

1 month term:

The bank with the highest interest rate is MBV, at 4.3%/year. Second is NCB, applying an interest rate of 4.1%/year. Third place is Bac A Bank and OCB, with the same interest rate of 4.0%/year.

3 month term:

MBV leads with the highest interest rate, reaching 4.6%/year. Second is Bac A Bank with 4.2%/year. Third place belongs to NCB, with an interest rate of 4.3%/year.

6 month term:

CBBank stands out with the highest interest rate, reaching 5.85%/year. Bac A Bank ranks second with 5.35%/year. MBV and NCB are tied for third place, both applying an interest rate of 5.5%/year.

9 month term:

CBBank continues to lead with an interest rate of 5.85%/year. MBV ranks second with 5.6%/year. Bac A Bank ranks third, with an interest rate of 5.45%/year.

12 month term:

MBV and Gpbank are in the lead with an interest rate of 6%/year. Bac A Bank is in second place with 5.8%/year. Cbbank is in third place, also with 6.0%/year.

18 month term:

Bac A Bank has the highest interest rate, reaching 6.2%/year. MBV and Oceanbank are ranked second, with 6.1%/year. Cbbank is ranked third with an interest rate of 6.0%/year.

See the latest bank interest rates HERE