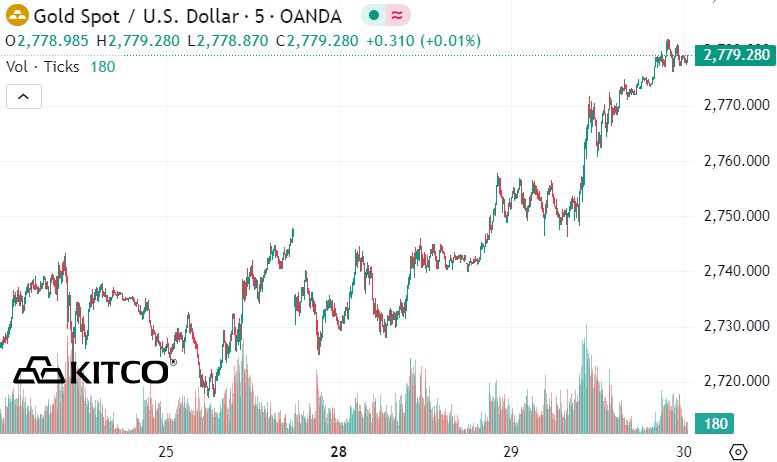

Gold's rally reflected a completely bullish market sentiment, while the USD index was essentially flat at 104.363, down just 0.02%.

The historic rally in gold prices (up about 35% this year) is the result of a combination of factors. Political conflicts, interest rate adjustments by the US Federal Reserve (FED), continued strong demand from global central banks, and uncertainty about the outcome of the upcoming US presidential election and the possibility of further fiscal stimulus are the main ingredients driving gold higher.

Safe-haven demand is keeping a floor for the precious metal ahead of key U.S. economic data later this week and next week’s U.S. presidential election, said Jim Wyckoff, senior analyst at Kitco. Technical buying in gold is also taking place amid bullish charts.

"The big US jobs report on Friday and then the US election next week have the market focused on now. That anxiety is supporting demand for gold - an item always considered a safe haven" - Jim Wyckoff said.

Notably, TD Securities commodity strategist Daniel Ghali said that gold is certain to hit 2,800 USD an ounce this week. According to him, the elections are hampering selling demand, so any catalyst for increased buying will have a significant impact on prices.

According to Dow Jones Newswires, central banks, especially in emerging markets, have been active buyers as they seek to reduce their dependence on the US dollar. Sustained demand from these institutions has provided significant support for gold prices throughout the year.

In addition, many geopolitical hotspots have increased investors' concerns.

Market participants are closely watching the upcoming release of the US Personal Consumption Expenditures (PCE) index as investors expect the Fed to cut interest rates by 25 basis points at each of the remaining Federal Open Market Committee (FOMC) meetings this year. This expected shift in monetary policy has contributed to the appeal of gold as a safe haven for cash flows.

Key data releases this week include the US September jobs report due out Friday morning; ADP employment data, Q3 GDP and pending home sales in the US; Bank of Japan monetary policy decision; and traders are now pricing in a 95% chance of a 25 basis point rate cut by the Fed in November, which would provide further support for gold.

See more news related to gold prices HERE...