High interest rates are not necessarily attracted deposits

Many small banks are promoting mobilized interest rates to a high level, but the financial statements for the fourth quarter of 2024 shows that the deposit flow is still focusing strongly on the big bank group. This trend reflects the cautious psychology of depositors before the fluctuations in the financial market.

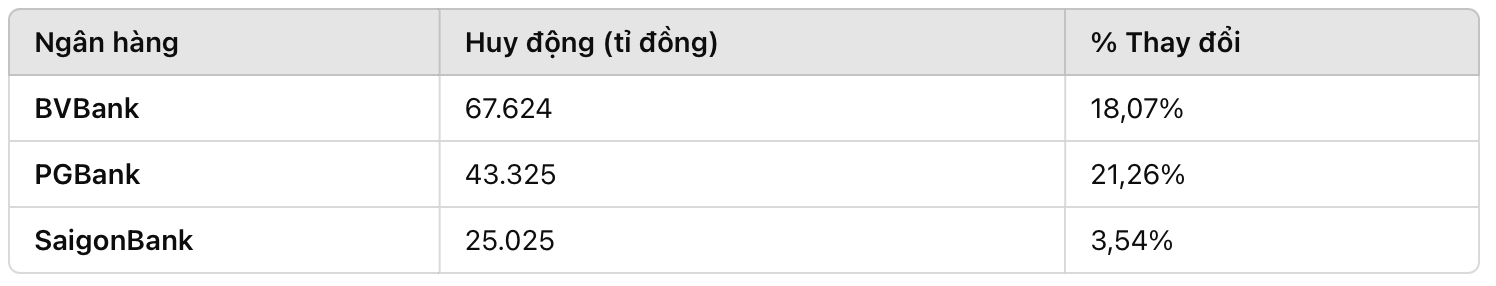

According to the survey, many banks such as BVBank, OCB, NamABank, PGBank have raised the 12 -month term deposit interest rates to 6.3 - 6.8%/year, significantly higher than the Big 4 group (Vietcombank, BIDV , Vietinbank, Agribank) is maintaining at 4.6 - 4.7%/year.

However, according to actual data, raising interest rates does not mean that small banks attract large cash flow.

Big 4 still dominates capital mobilization

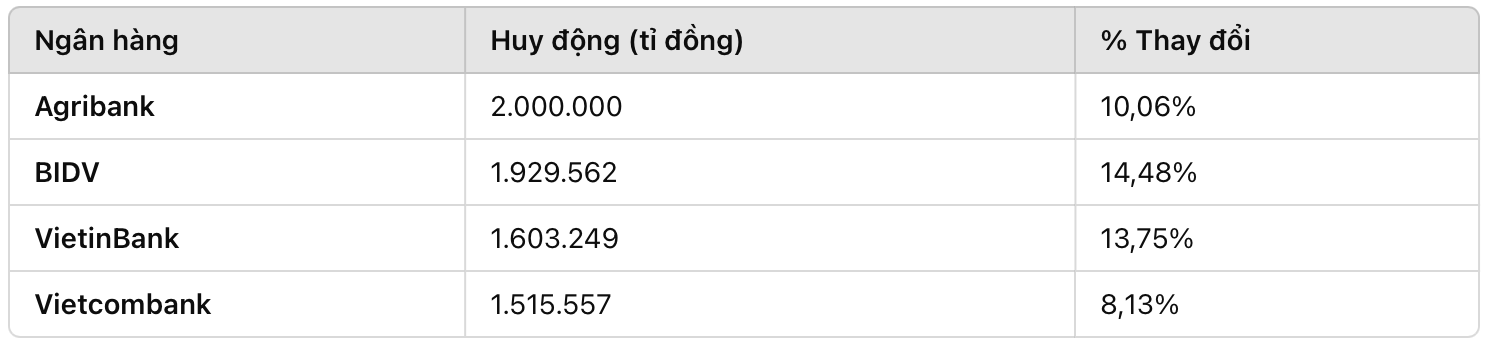

Data from the financial statements in the fourth quarter of 2024 shows that the Big 4 group continues to dominate the mobilization market share, with a total deposit of 7.2 million billion dong, accounting for 56% of the total deposit of the whole system bank.

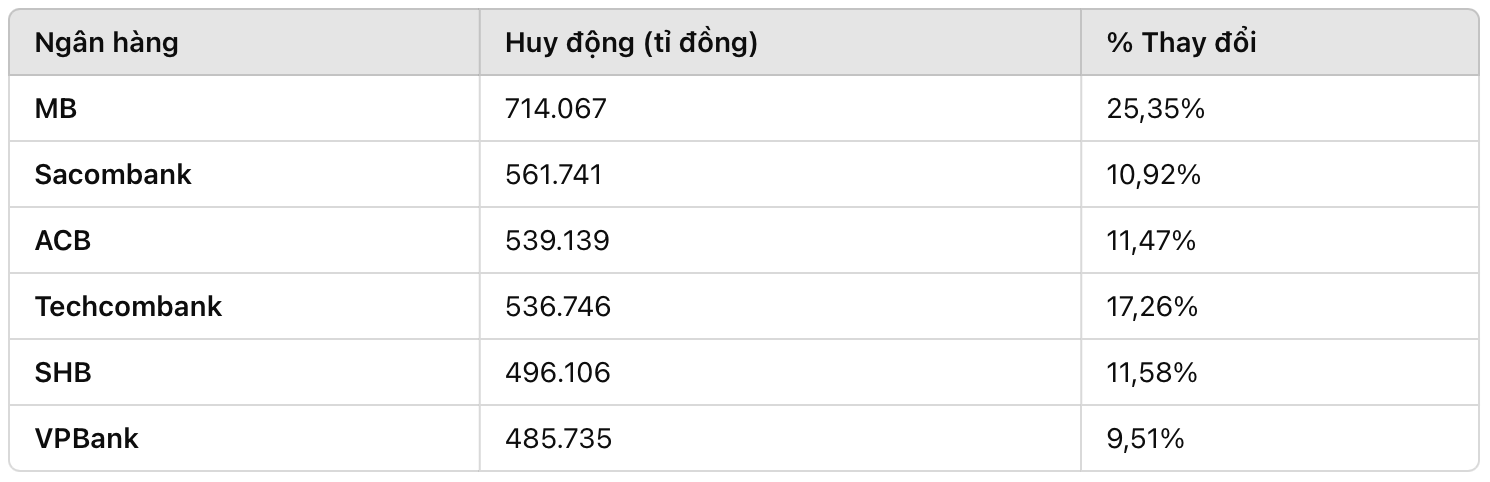

Meanwhile, some other large banks have strong growth, but still significantly gap in the total mobilization balance.

Despite the high interest rate, the small bank group has not been able to break through in the capital mobilization race:

The clear difference between Big 4 group and private banks, especially small banks, shows the caution of depositors when choosing a bank to ensure capital safety.

The reason Big 4 still smokes strong deposits despite low interest rates

Financial experts say that there are many factors that help the state -owned banking group continue to attract cash flow, despite interest rates not too attractive.

The first is about the reputation and guarantee from the state. Customers believe in liquidity and safety than private banks.

The second is a widespread network: the branch system and transaction offices cover the whole country to make it easier for large banks to reach customers.

Third about the high CASA ratio: This bank has a large number of demand deposits (CASA), which helps reduce capital costs without increasing interest rates to compete.

PhD. Chau Dinh Linh - Finance - Banking expert - said: "The cash flow into Big 4 is not only due to the brand but also for psychology of safety. Even if some private banks offer interest rates. Higher, customers still give priority to large banks. "

Small bank pressure and risk

The increase in interest rates helps small banks to compete but also set many risks.

As the mobilization interest rate increases, the profit margin is narrowed if it is impossible to lend with the corresponding interest rate. In addition, if customers withdraw suddenly, small banks may have great pressure on cash flow. Maintaining high interest rates to smoke deposits is not always an effective strategy, especially when large banks have a clear advantage of liquidity and network.

According to Assoc. Dr. Dinh Trong Thinh - Financial expert, raising interest rates is not always an effective strategy. If only focusing on interest race without a reasonable capital use plan, small banks may fall into a state of financial imbalance.

Interest rate trend next time

In the coming time, experts predict interest rates will continue to divide. Small banks can continue to maintain high interest rates to attract customers but face profit pressure.

While the Big 4 banking group may not need to raise interest rates, due to the advantage of brand and stable deposit.

Notably, the State Bank will still be between the view of flexible monetary policy management, creating a balance between capital mobilization and credit growth.

In 2025, the SBV aims to grow credit about 16% to support the 8% economic growth target. To achieve this goal, the SBV will manage monetary policies flexibly, tightly, in accordance with fiscal policies and other macroeconomic policies.

In short, although small banks try to raise interest rates to attract deposits, cash flow still focuses on the Big 4 group thanks to the higher safety and stability. The cautious psychology of depositors has been directly affecting the trend of capital mobilization in the banking system.

Deposites need to consider the safety, liquidity and reputation factor of the bank before deciding to invest.