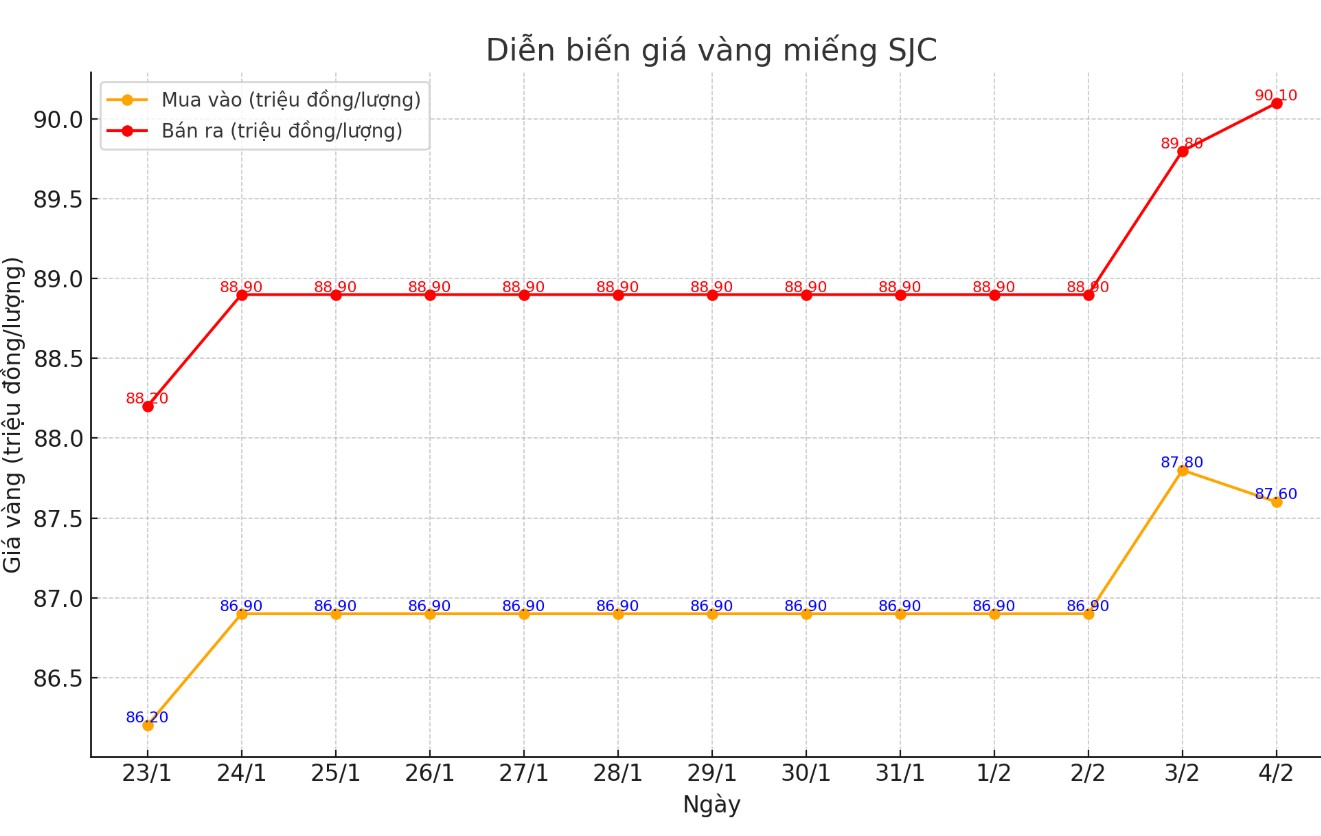

Update SJC gold price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND87.6-90.1 million/tael (buy - sell); down VND200,000/tael for buying and up VND300,000/tael for selling compared to the close of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 87.6-90.1 million VND/tael (buy - sell); down 200,000 VND/tael for buying and up 300,000 VND/tael for selling compared to the close of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

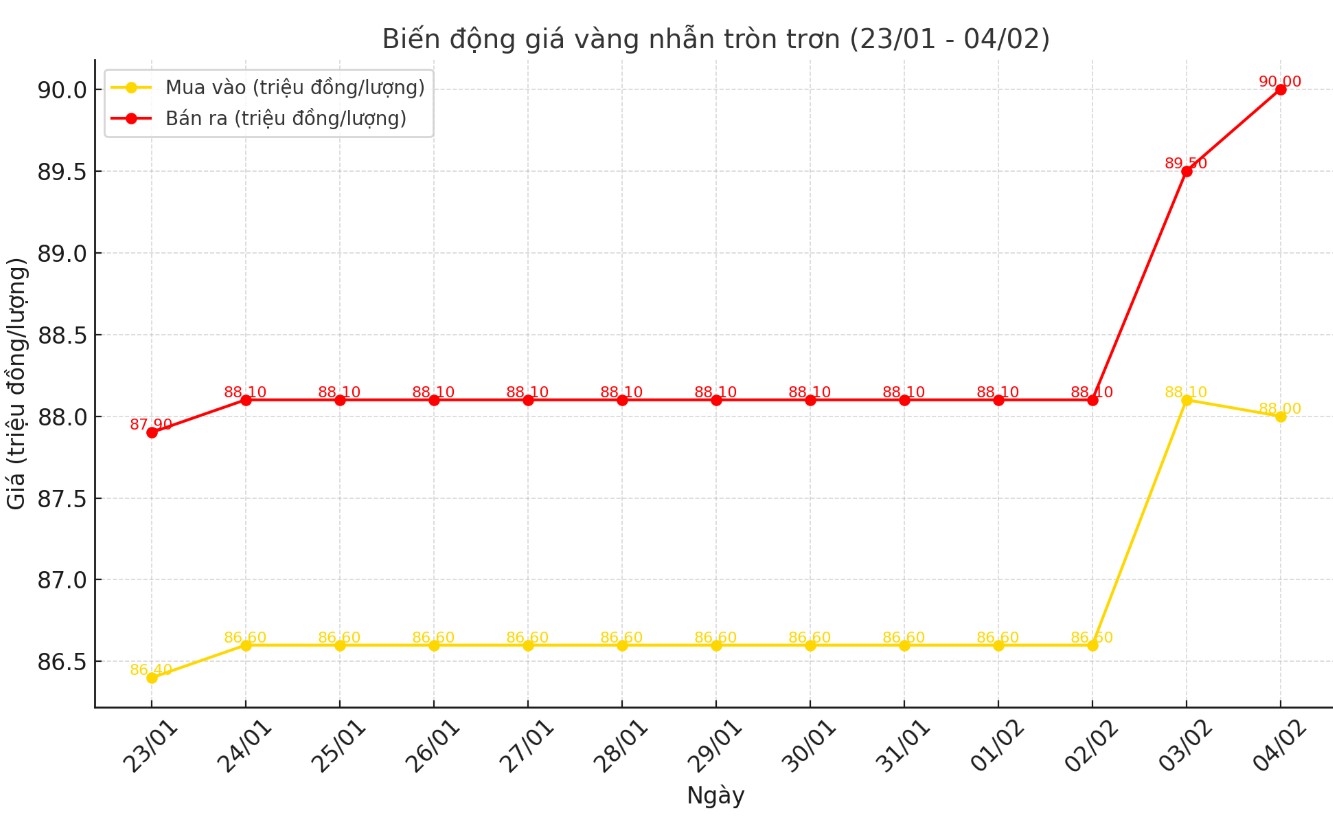

9999 round gold ring price

As of 6:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88-90 million VND/tael (buy - sell); down 100,000 VND/tael for buying and up 500,000 VND/tael for selling compared to the closing price of yesterday's trading session.

The difference between buying and selling price of 9999 Hung Thinh Vuong round gold ring at DOJI increased from 1.4 million to 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.1-90.05 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling compared to the closing price of yesterday's trading session. The difference between buying and selling is at 1.95 million VND/tael.

Despite the high prices, today many people flocked to gold and gemstone stores in Hanoi to buy.

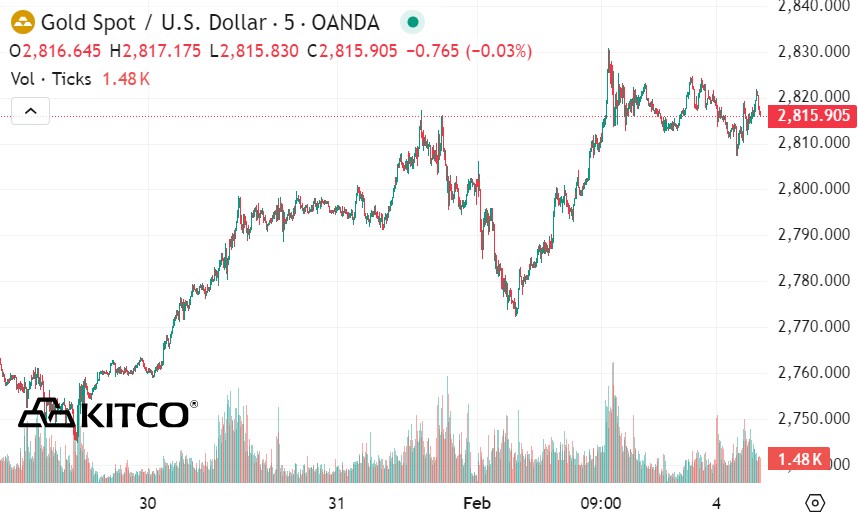

World gold price

As of 5:20 p.m., the world gold price listed on Kitco was at 2,815.9 USD/ounce, up 16.8 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased sharply in the context of a sharp decline in the USD index. Recorded at 5:25 p.m. on February 4, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.360 points (down 0.47%).

According to Reuters - Gold prices set a new record supported by safe-haven flows after US President Donald Trump's move to impose tariffs.

"Despite the usual impact of a strong US dollar on the gold market, the precious metal's price still increased due to safe-haven demand due to the uncertainty caused by Donald Trump's tariffs," said David Meger, director of metals trading at High Ridge Futures.

Bart Melek, head of commodity strategy at TD Securities, said: "The market still doesn't fully believe in the scale of the trade war."

Gold is often considered a safe haven asset during times of economic or geopolitical uncertainty.

J.P. Morgan said that while pressure from the stock market may weigh on gold in the short term, tariffs could become a supporting factor for gold prices in the medium term.

Important economic data this week

Tuesday: US JOLTS job vacancies.

Wednesday: ADP jobs report, US ISM services PMI.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

Friday: US nonfarm payrolls report, University of Michigan preliminary index of consumer sentiment.

See more news related to gold prices HERE...