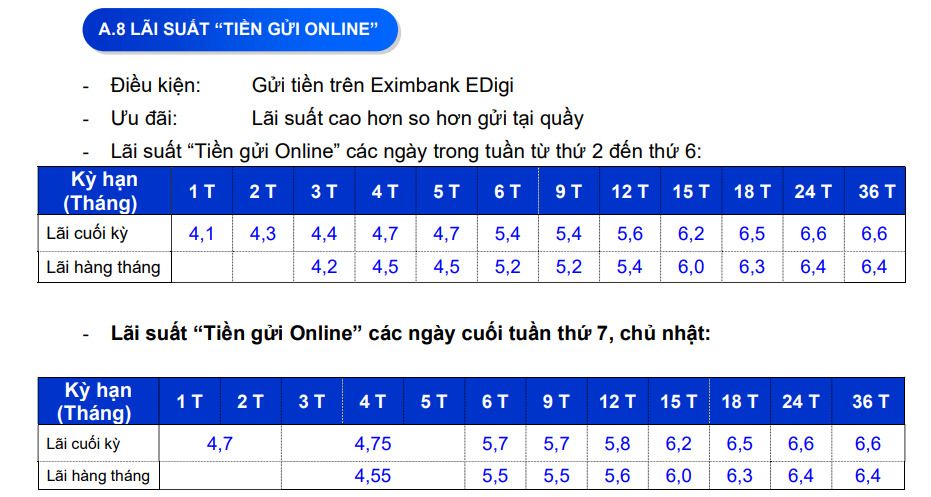

As noted by labor, on July 7, the import-export commercial bank (Eximbank) adjusted the interest rate increase of terms of 1-12 months and reduced interest rates for 15-36 months. Notably, the 9-month term interest rate increased sharply by 0.9%to 5.4%/year, while the 24-36 month term decreased to 6.6%/year, officially no longer 6.8 landmarks. %/year earlier.

Eximbank also continues to apply a separate deposit rate for the weekend, with higher interest rates than weekdays. Customers who send online savings on weekends can enjoy an interest rate of up to 5.8%/year for a 12 -month term.

The highest interest rate?

1 month term:

Eximbank is currently leading with the highest interest rate, reaching 4.7%/year (weekend). The second rank is MBV, Kienlongbank with 4.3%/year. Bac A Bank and OCB are third, applying interest rates 4.0%/year.

3 -month term:

Eximbank continues to lead with the highest interest rate of 4.75%/year (weekend). MBV ranked second with 4.6%/year. Bac A Bank and NCB ranked third, respectively with interest rates 4.2%/year and 4.3%/year.

6 -month term:

CBBank stands out with the highest interest rate, reaching 5.85%/year, right after Kienlongbank with an interest rate of 5.8%/year. Bac A Bank ranked third with 5.55%/year. MBV and NCB followed, applying interest rates 5.5%/year.

9 -month term:

CBBank continues to lead with an interest rate of 5.85%/year. MBV ranked second with 5.6%/year. Bac A Bank ranked third, with an interest rate of 5.45%/year.

12 -month term:

MBV and GPBank Dong led with an interest rate of 6%/year. Bac A Bank ranked second with 5.8%/year. CBBank ranked third, also with 6.0%/year.

18 months term:

Eximbank led the long term with an interest rate of 6.4%/year. Bac A Bank followed with an interest rate of 6.2%/year. MBV and Oceanbank, Kienlongbank ranked third, with 6.1%/year.