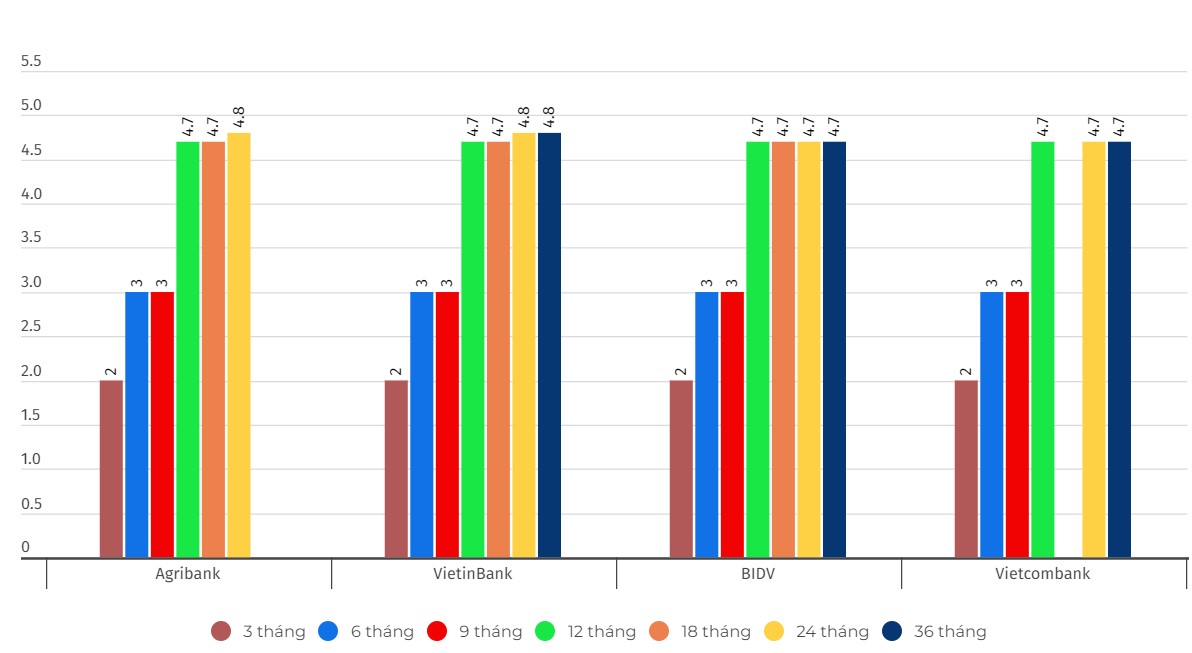

Latest Interest Rate Agribank, VietinBank, Vietcombank and BIDV

According to Lao Dong reporters' records with 4 banks Vietcombank, Agribank, VietinBank and BIDV on October 27, 2024, the mobilization interest rate table is currently listed around the threshold of 1.6-4.8%/year.

Of which, VietinBank has the highest interest rate (4.8% for terms over 24 months); Agribank fluctuates between 1.6-4.8%/year. Following is BIDV's interest rate currently fluctuating between 1.7-4.7%/year, Vietcombank's interest rate currently fluctuates between 1.6-4.7%/year.

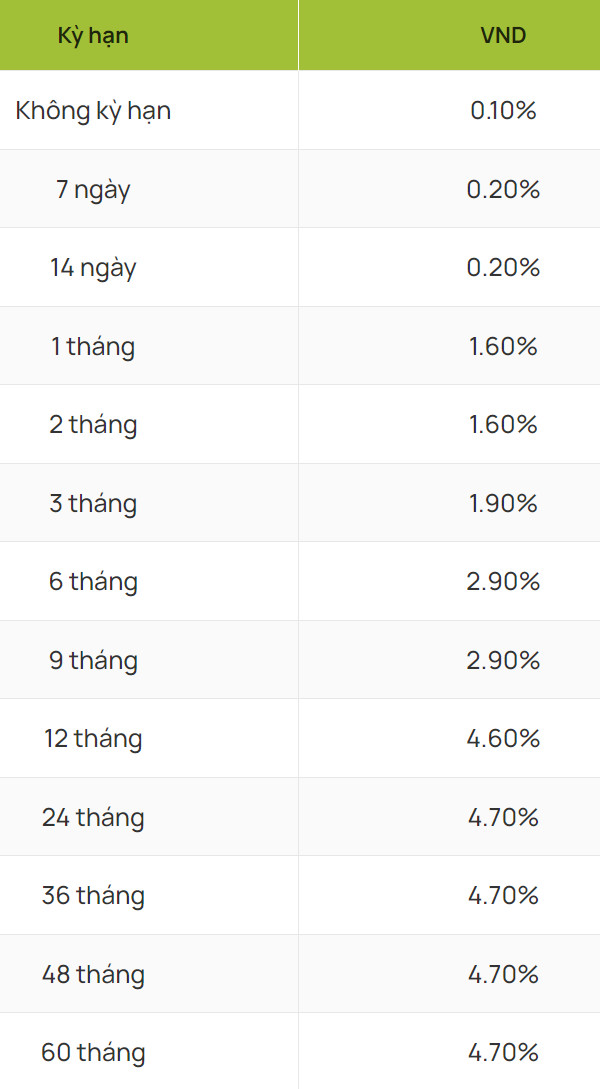

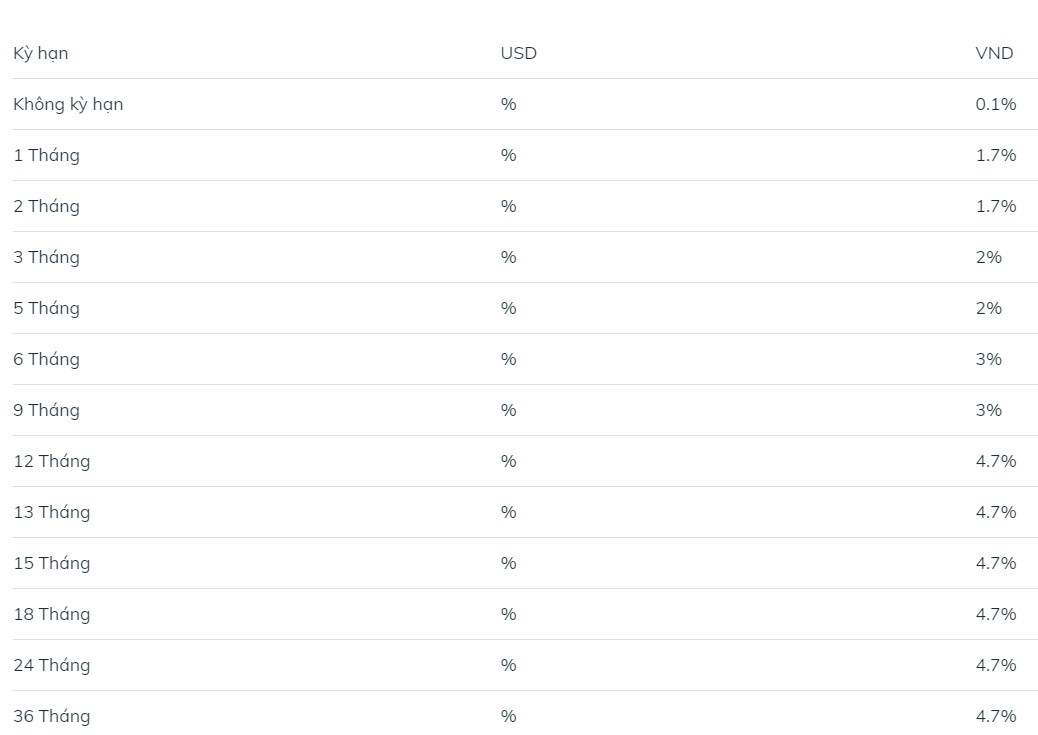

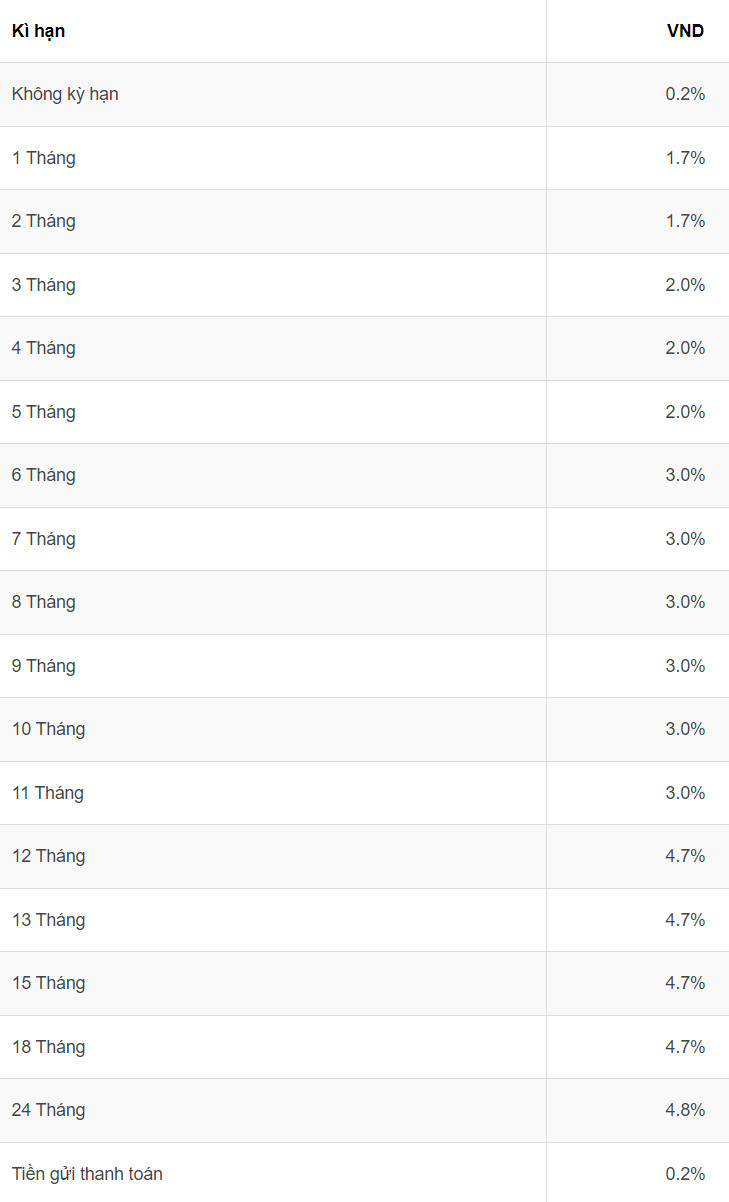

Below are the latest Big 4 interest rate details:

Below is a detailed update of interest rates of banks in the Big 4 group:

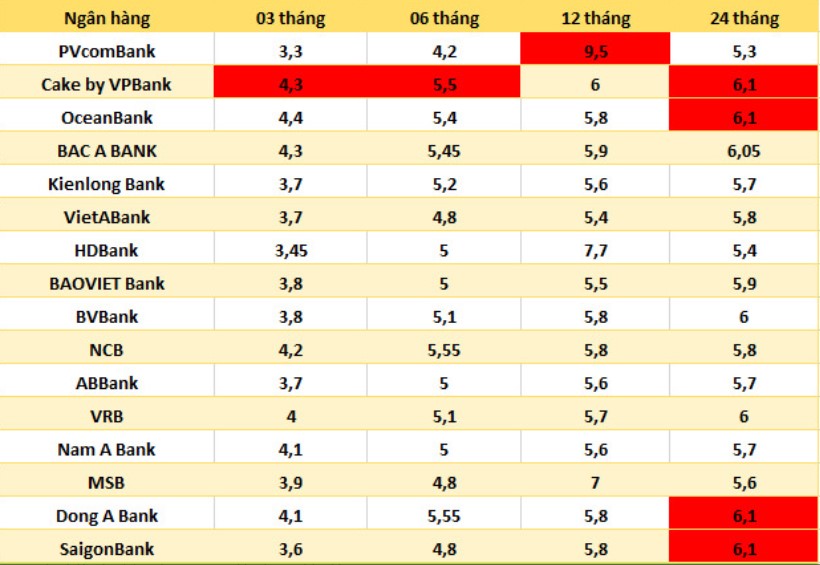

Readers can refer to interest rates of some other banks through the following table:

The highest bank interest rate today is up to 7-9.5%/year. However, to receive this interest rate, special conditions must be met.

PVcomBank is currently leading in special interest rates when customers deposit money at the counter, with a rate of 9.5% for a term of 12-13 months. However, the condition to receive this interest rate is that customers must have a minimum deposit balance of VND2,000 billion.

Next is HDBank with a particularly high interest rate, up to 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB applies interest rates for deposits at the counter up to 8%/year for a 13-month term and 7% for a 12-month term. The applicable conditions are that the savings book is newly opened or the savings book is opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and the deposit amount is from 500 billion VND.

Dong A Bank has a deposit interest rate of 13 months or more, the final interest rate for deposits of 200 billion VND or more is 7.5%/year. This bank also applies an interest rate of 6.1% for a 24-month term.

In addition, many banks are currently applying interest rates of over 6%/year, which are being listed by some banks for long-term deposits but do not require a minimum deposit amount.

Currently, Cake by VPBank applies an interest rate of 6.1% for a 12-month term; OceanBank applies an interest rate of 6.1% for a 24-month term; Bac A Bank applies an interest rate of 6.05% for a 24-month term.

BVBank and Cake by VPBank also apply an interest rate of 6% for 24-month and 12-month terms; VRB and Dong A Bank apply an interest rate of 6% for 24-month terms; SaigonBank applies an interest rate of 6% for 13, 18 and 24-month terms, and 6.1% for 36-month terms.

How to receive interest if saving 300 million VND at Big 4?

To calculate interest on savings deposits at the bank, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit

For example, if you deposit 300 million VND for a 24-month term at Bank A with an interest rate of 4.7%/year, you can receive: 300 million VND x 4.7%/12 x 24 = 28.2 million VND.

With the same amount and term above, if you save at Bank B with an interest rate of 4.8%, the interest you receive will be: 300 million VND x 4.8%/12 x 24 = 28.8 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.