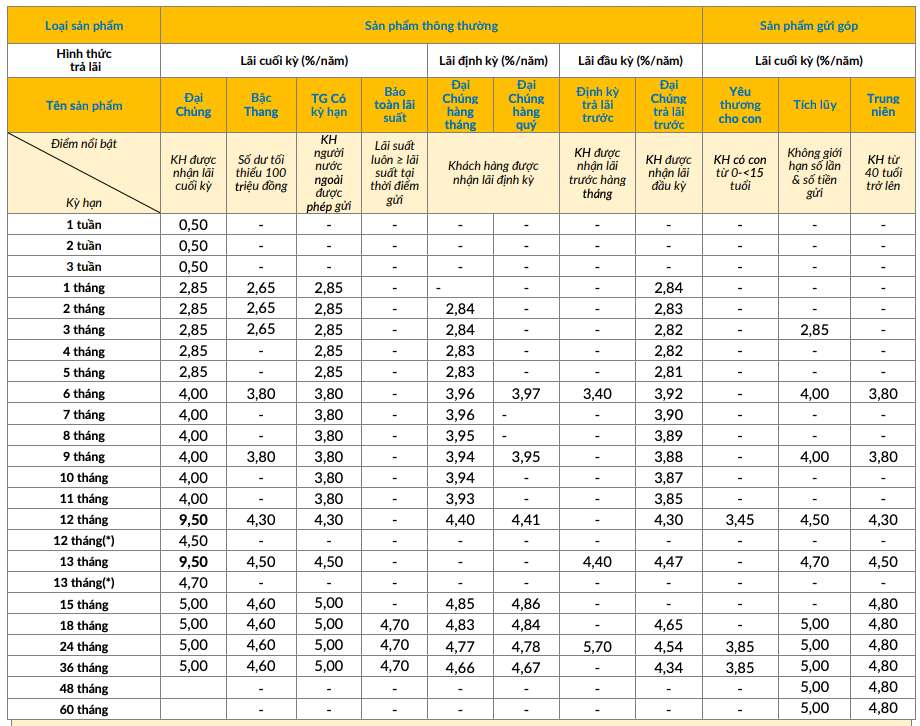

Leading the 12-month savings interest rate chart, PVcomBank lists an interest rate of up to 9.5% per year. However, to enjoy this extremely high interest rate, customers need to meet the condition of depositing a minimum of 2,000 billion VND at the counter and it only applies to the product with interest paid at the end of the term.

Under normal conditions, PVcomBank is listing the highest interest rate at 4.8% per year when customers save online, with interest paid at the end of the term. If customers deposit money at the counter, they only receive an interest rate of 4.5% per year.

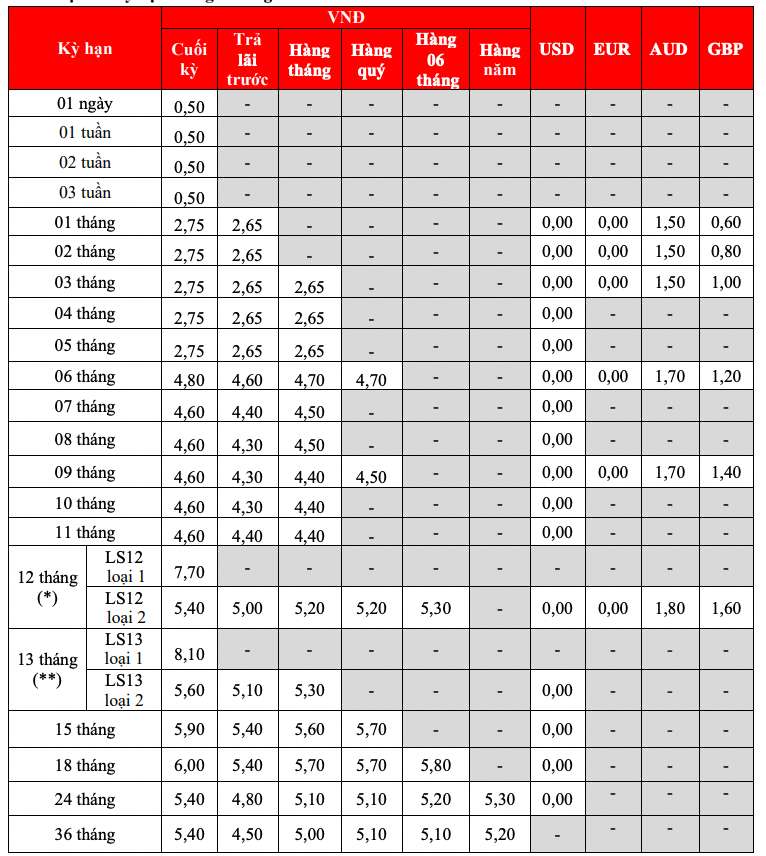

HDBank lists the highest 12-month savings interest rate at 7.7% per year with the condition of maintaining a minimum balance of 300 billion VND. Under normal conditions, when saving online for a 12-month term, customers receive an interest rate of 5.5% per year. If customers deposit money at the counter, they only receive an interest rate of 5.4% per year.

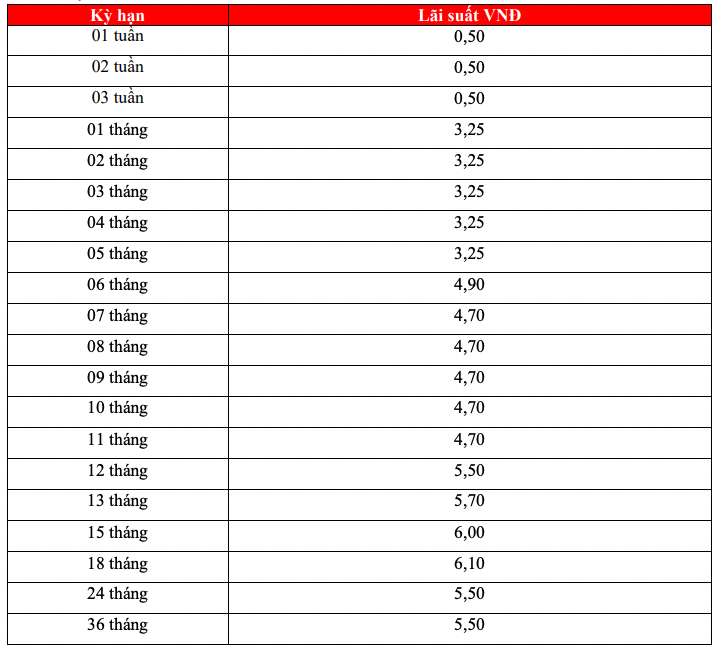

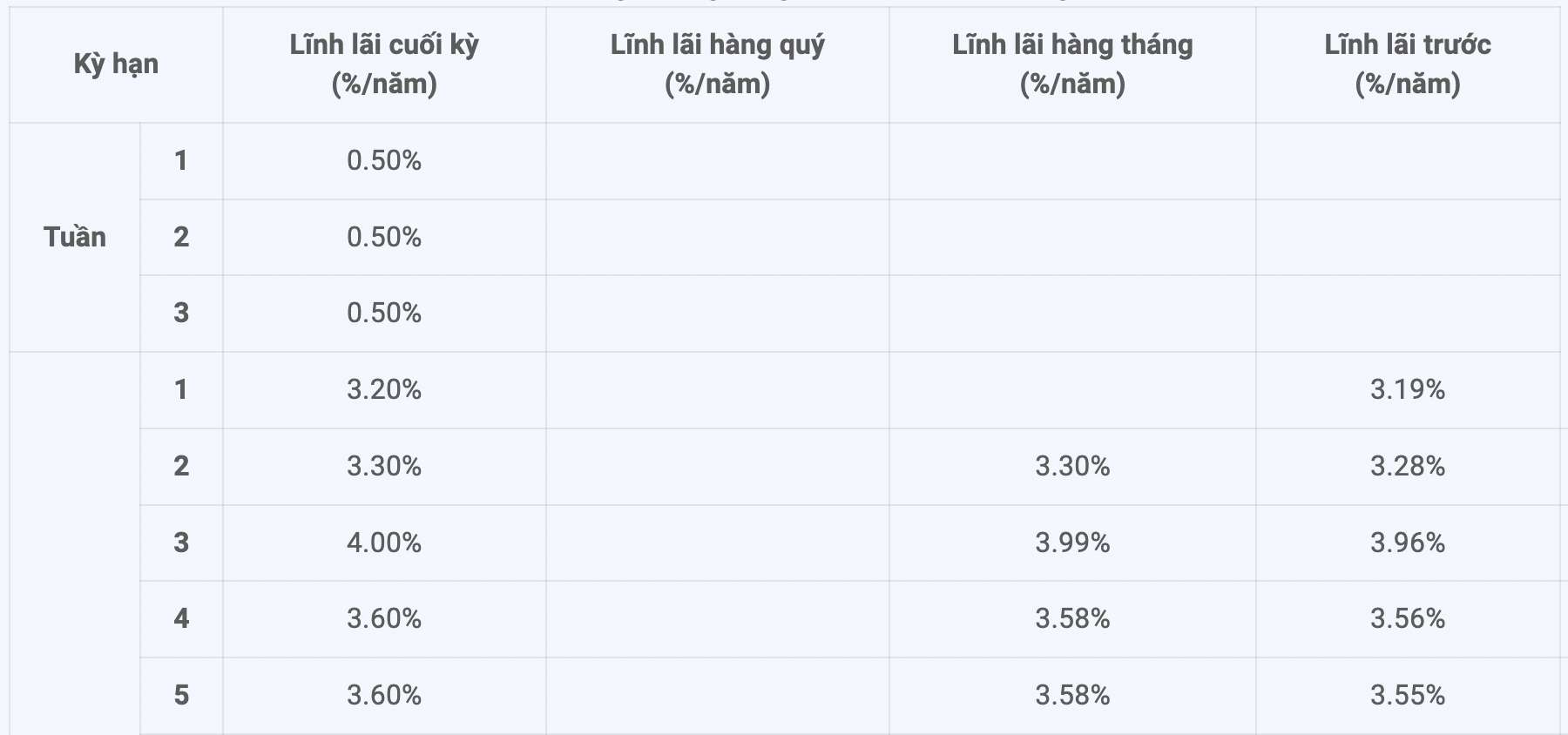

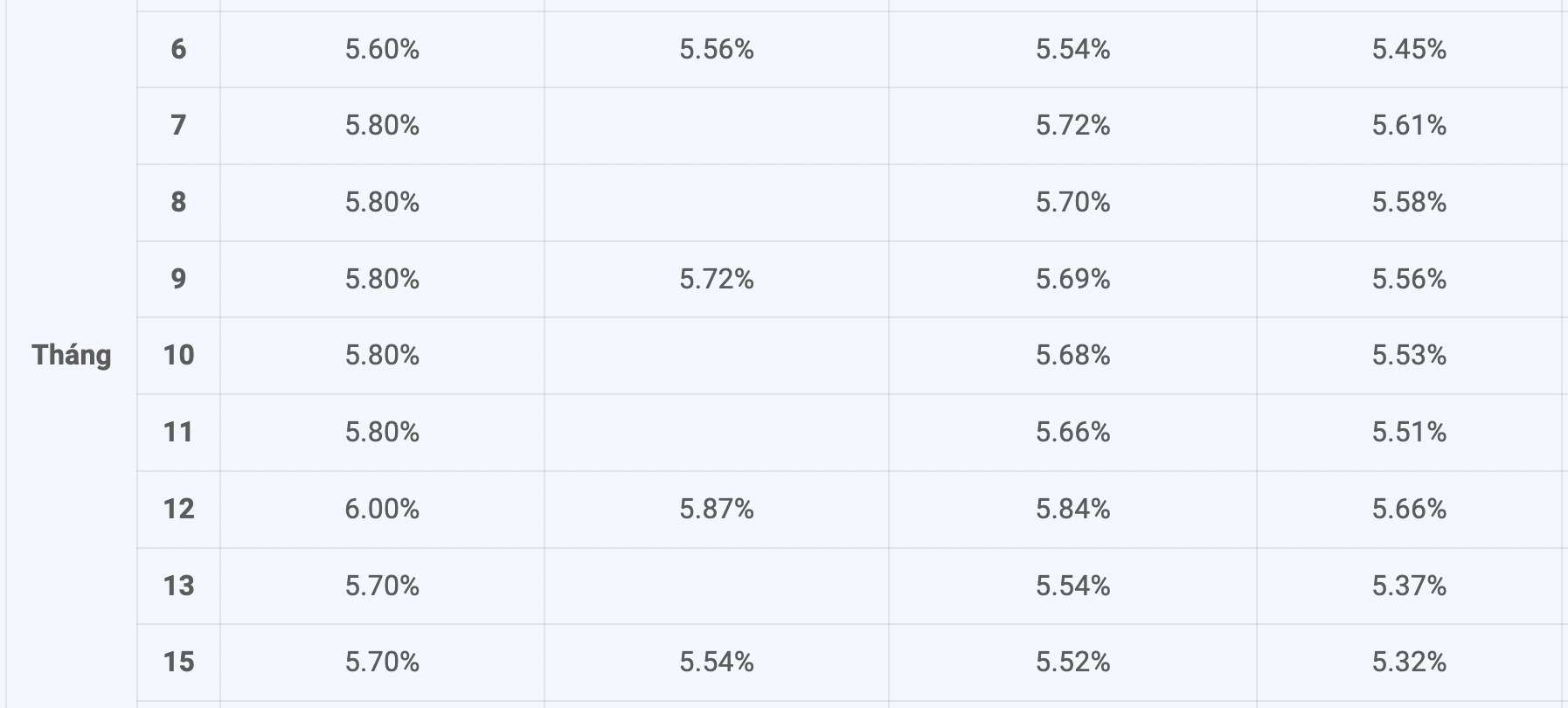

ABBank is listing the highest 12-month term interest rate at 6% per year when customers receive interest at the end of the term. Customers receiving interest in advance, monthly, and quarterly receive interest rates of 5.66%, 5.84%, and 5.87% per year, respectively.

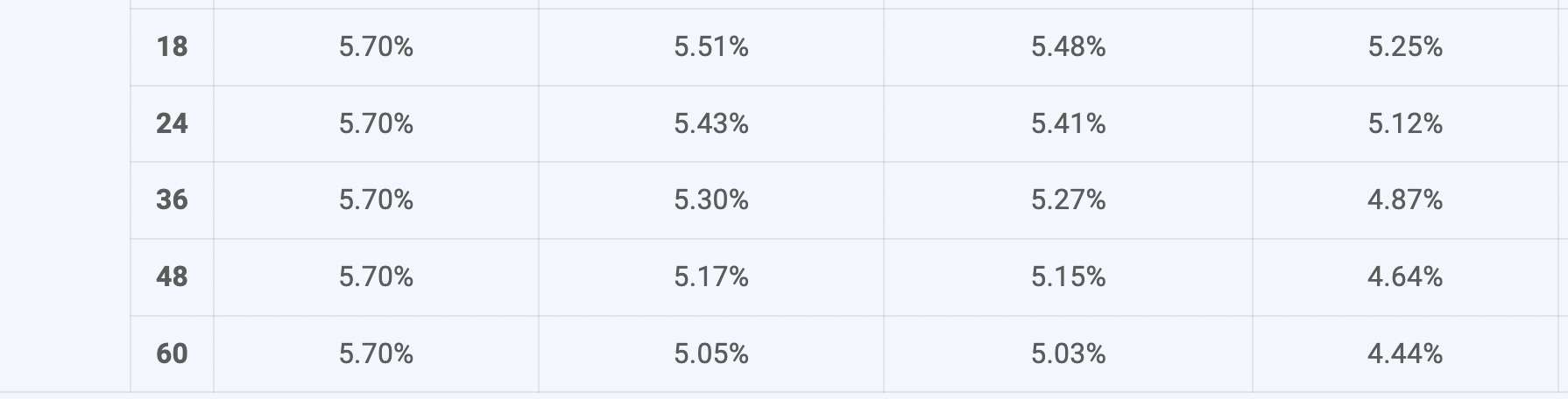

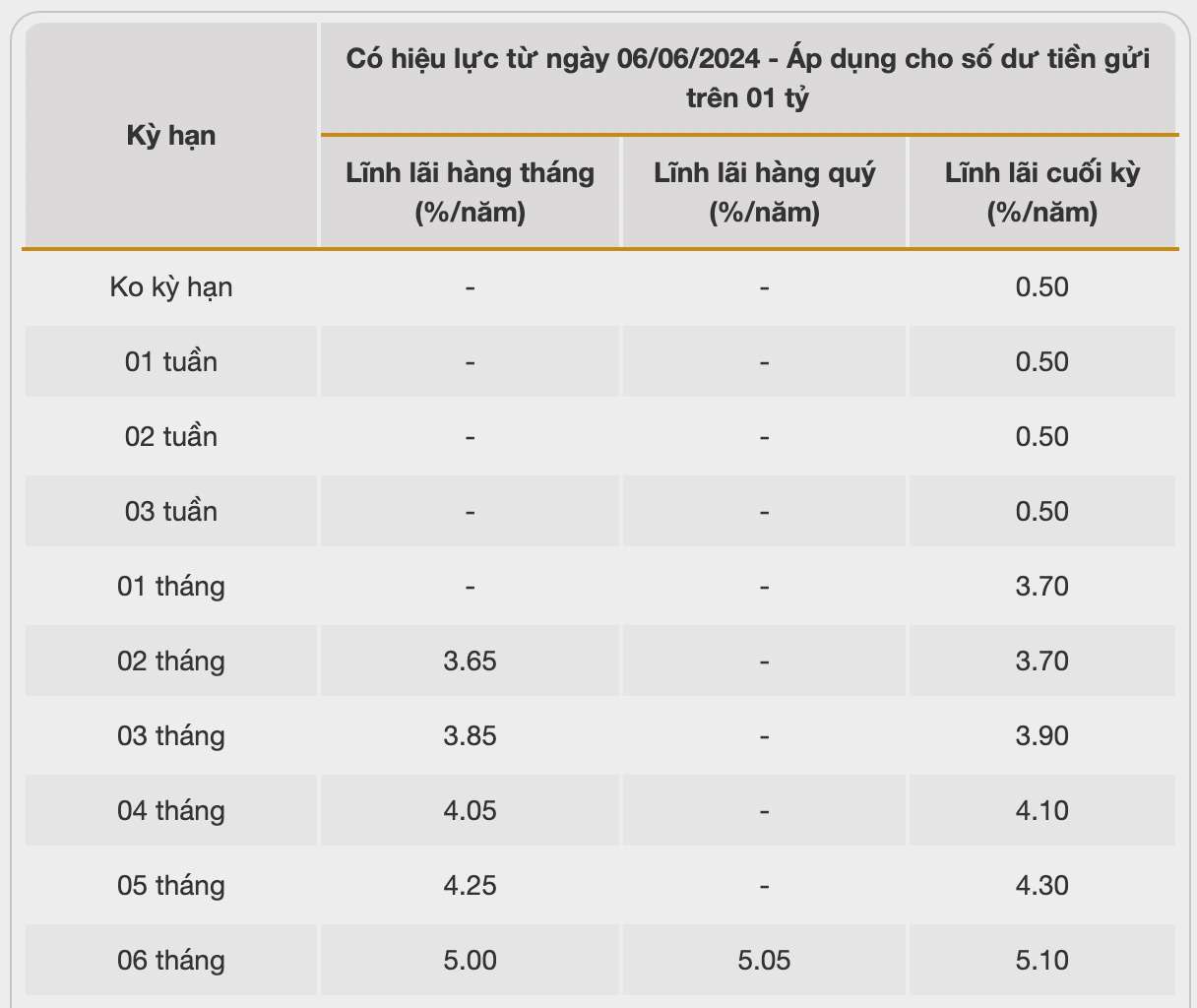

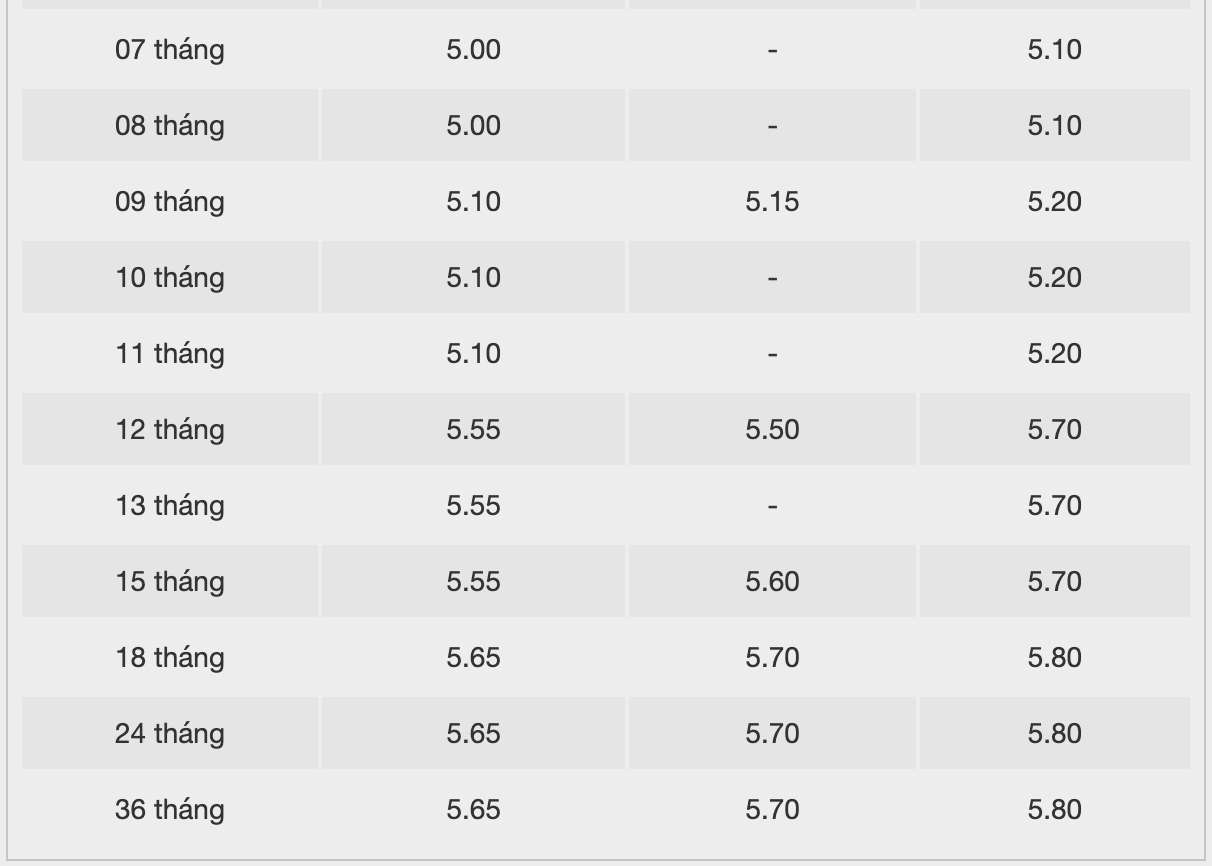

BacABank is listing the highest 12-month term interest rate at 5.7% per year when customers receive interest at the end of the term, depositing over 1 billion VND. Customers receiving interest monthly and quarterly receive interest rates of 5.55% and 5.50%, respectively. The highest interest rate listed by BacABank is 5.8% when customers deposit money for 18-36 months.

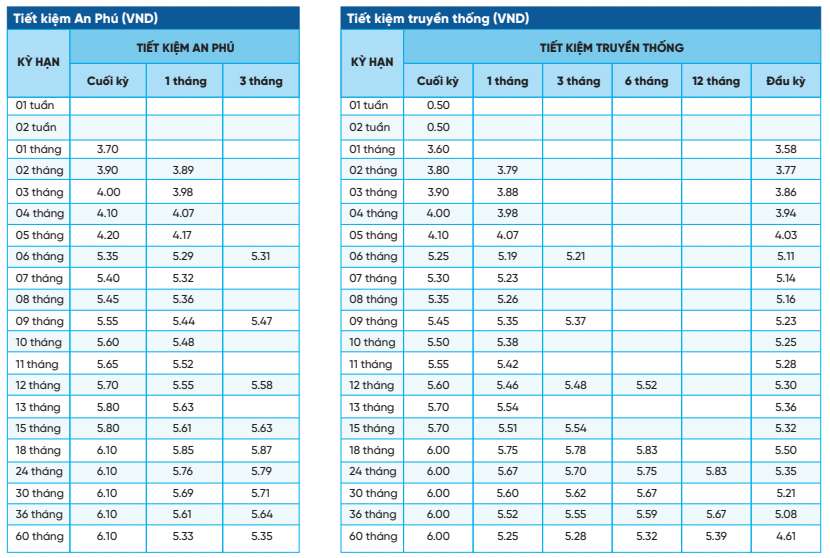

NCB is listing the highest 12-month term interest rate at 5.7% per year when customers save with An Phú, receiving interest at the end of the term. Customers saving traditionally, with interest paid at the end of the term, receive an interest rate of 5.6% per year.

How much interest will you receive for saving 600 million VND for 12 months?

You can refer to the interest calculation method to know how much interest you will receive after saving. To calculate interest, you can apply the formula:

Interest = deposit amount x interest rate %/12 x number of months deposited.

For example, you deposit 600 million VND into Bank A, with a 12-month term and an interest rate of 6% per year, the interest received is as follows:

600 million VND x 6%/12 x 12 = 36 million VND.

* Interest rate information is for reference only and may change over time. Please contact the nearest bank branch or hotline for specific advice.

Readers can refer to more interest rate information HERE.