PVcombank interest rates are currently the highest in the market, up to 9% for 12 -month term with a minimum deposit of VND 2,000 billion, but customers must meet special conditions.

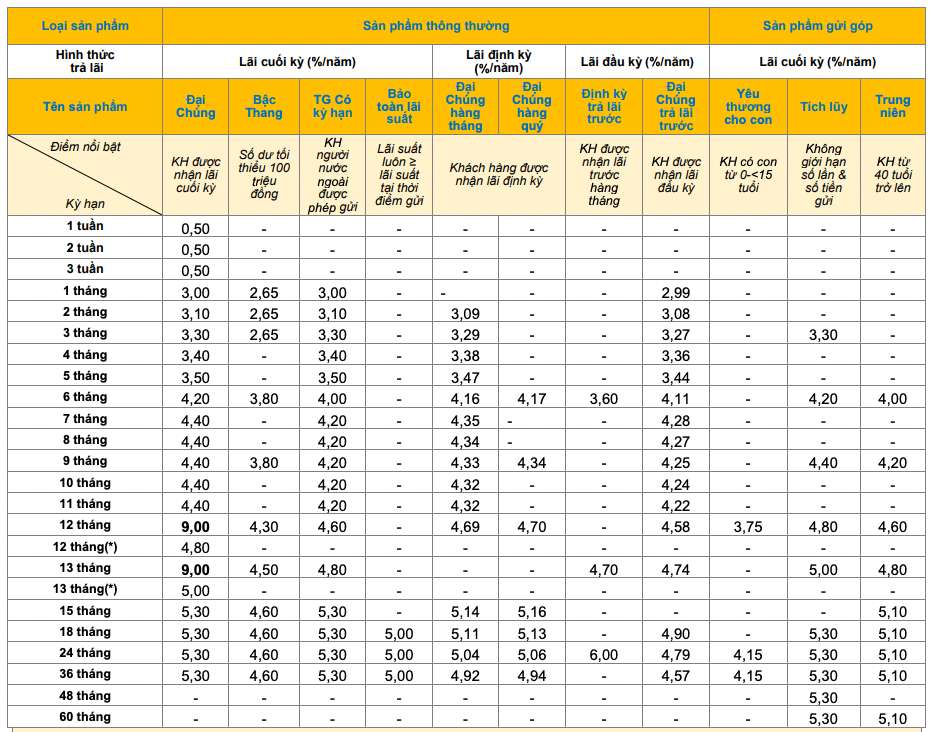

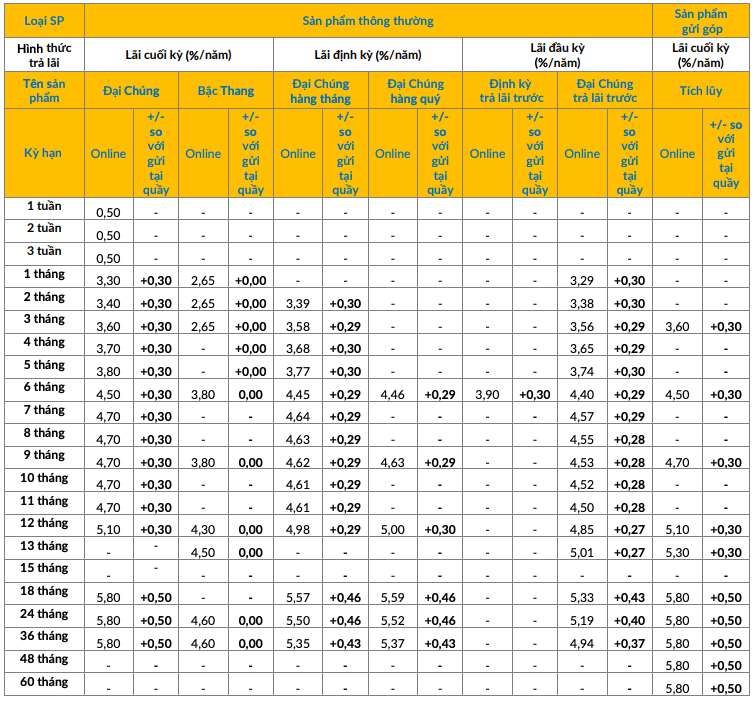

Under normal conditions, PVcomBank listed the highest 12 -month interest rate at 5.1% when customers deposited online and 4.8% when deposited at the counter.

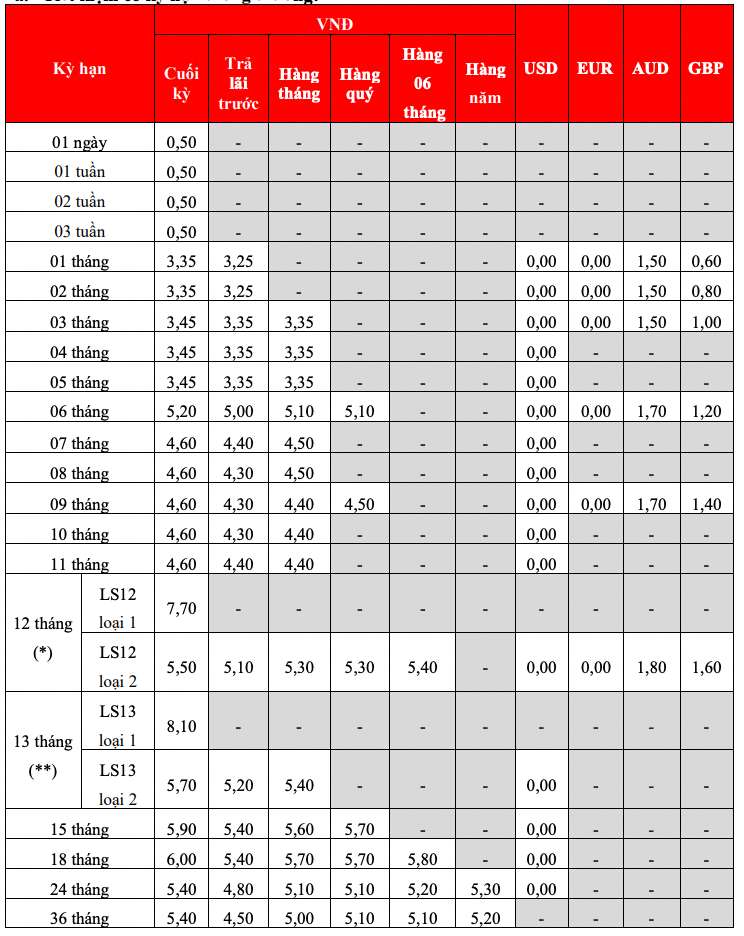

Following, HDBank with an interest rate of 7.7% for a 12 -month term, conditions for maintaining a minimum balance of VND 500 billion. Under normal conditions, HDBank listed the highest 12 -month interest rate at 5.6% when customers deposited online and 5.5% when deposited at the counter.

Top banks with the highest interest rate of 12 months under the usual conditions such as Kienlongbank, GPBank, Cake by VPBank, CBBank ...

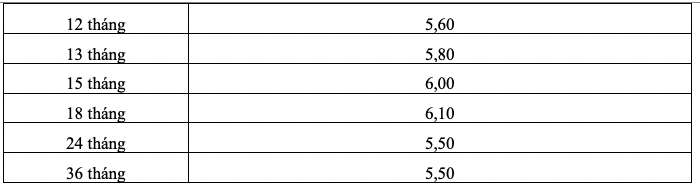

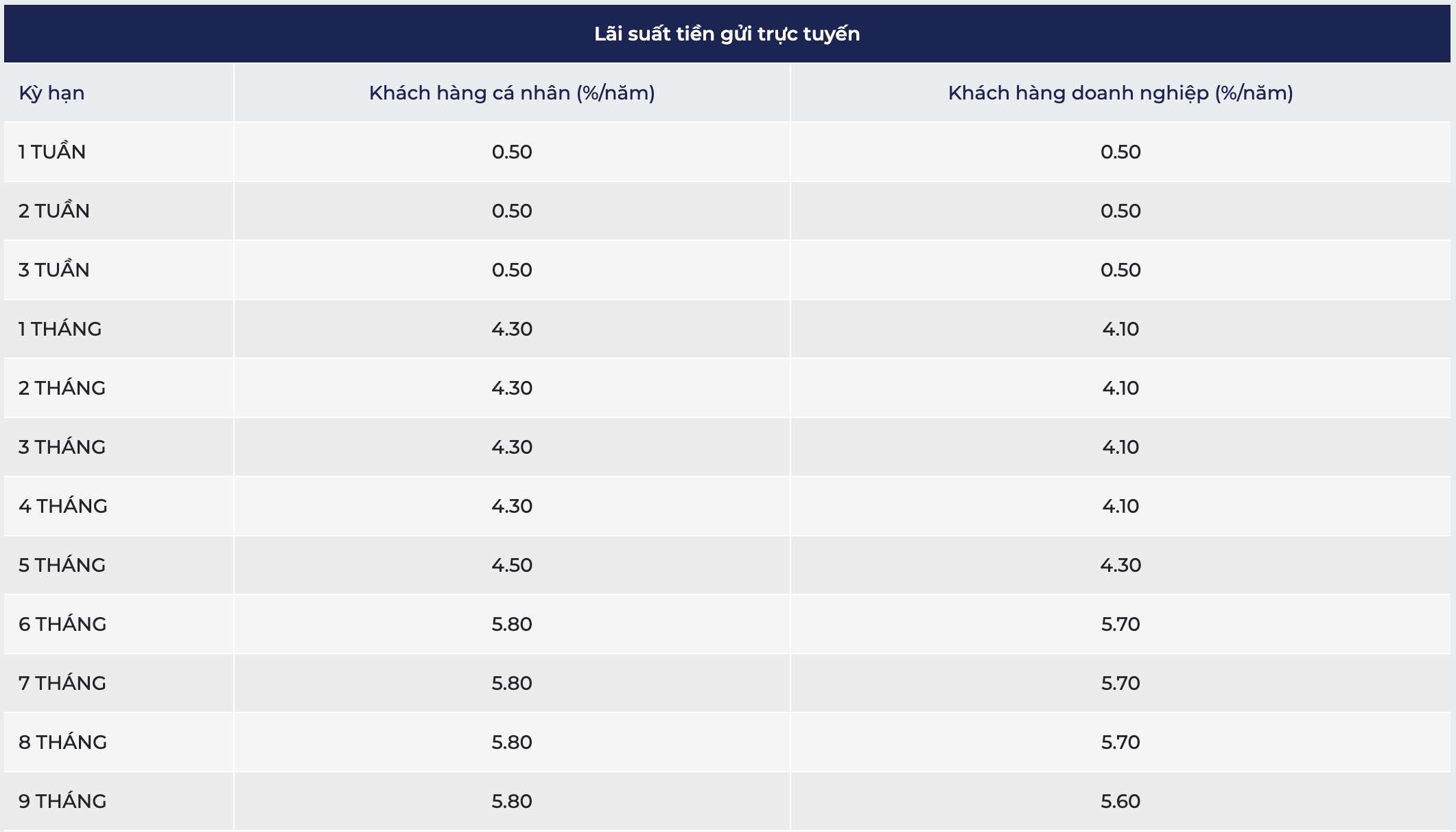

Kienlongbank is listing the highest interest rate of 12 months at 6.1% when individual customers send money online. Currently, the interest rate of this bank is 6.4%/year when customers send 60 months.

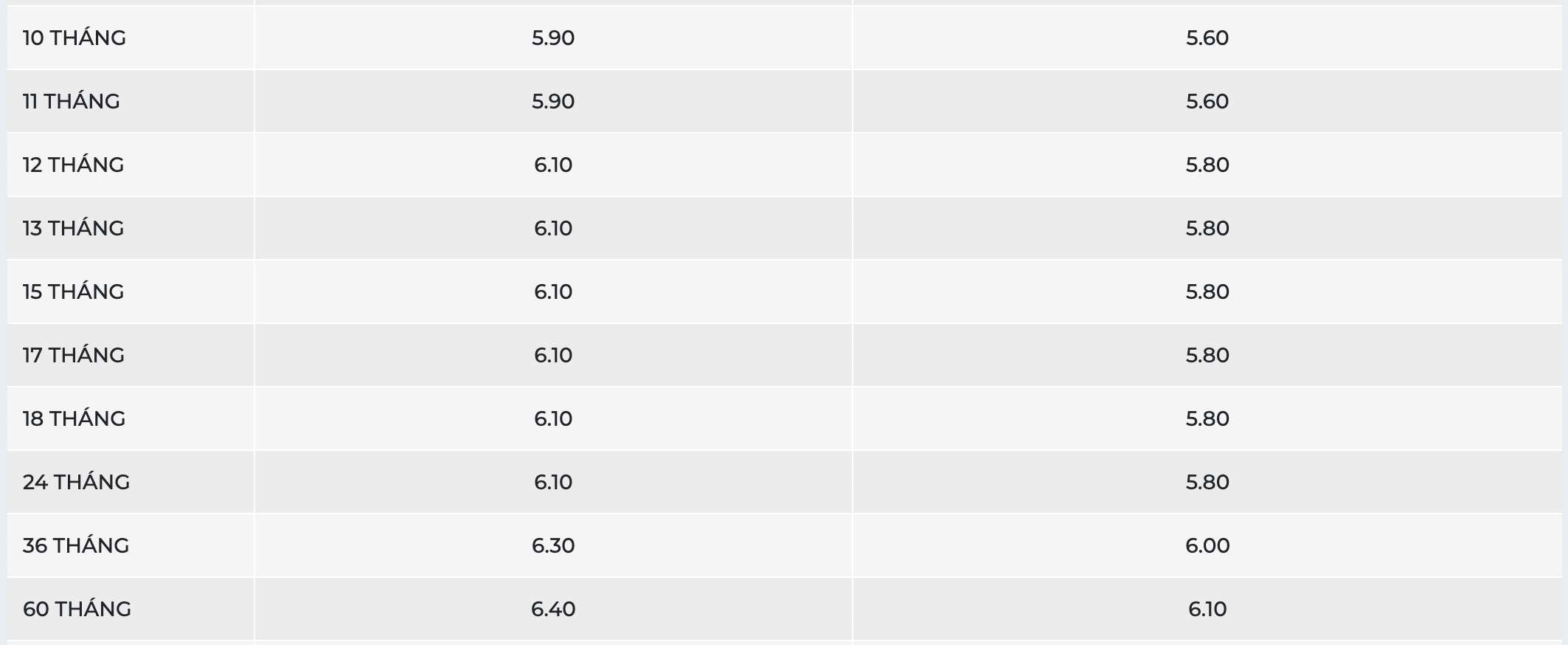

The GPBank is listing the highest interest rate of 12 months at 6.05%/year for customers to deposit Mobile Savings. Currently, the highest interest rate on this bank is 6.15% of the term 13 - 36 months.

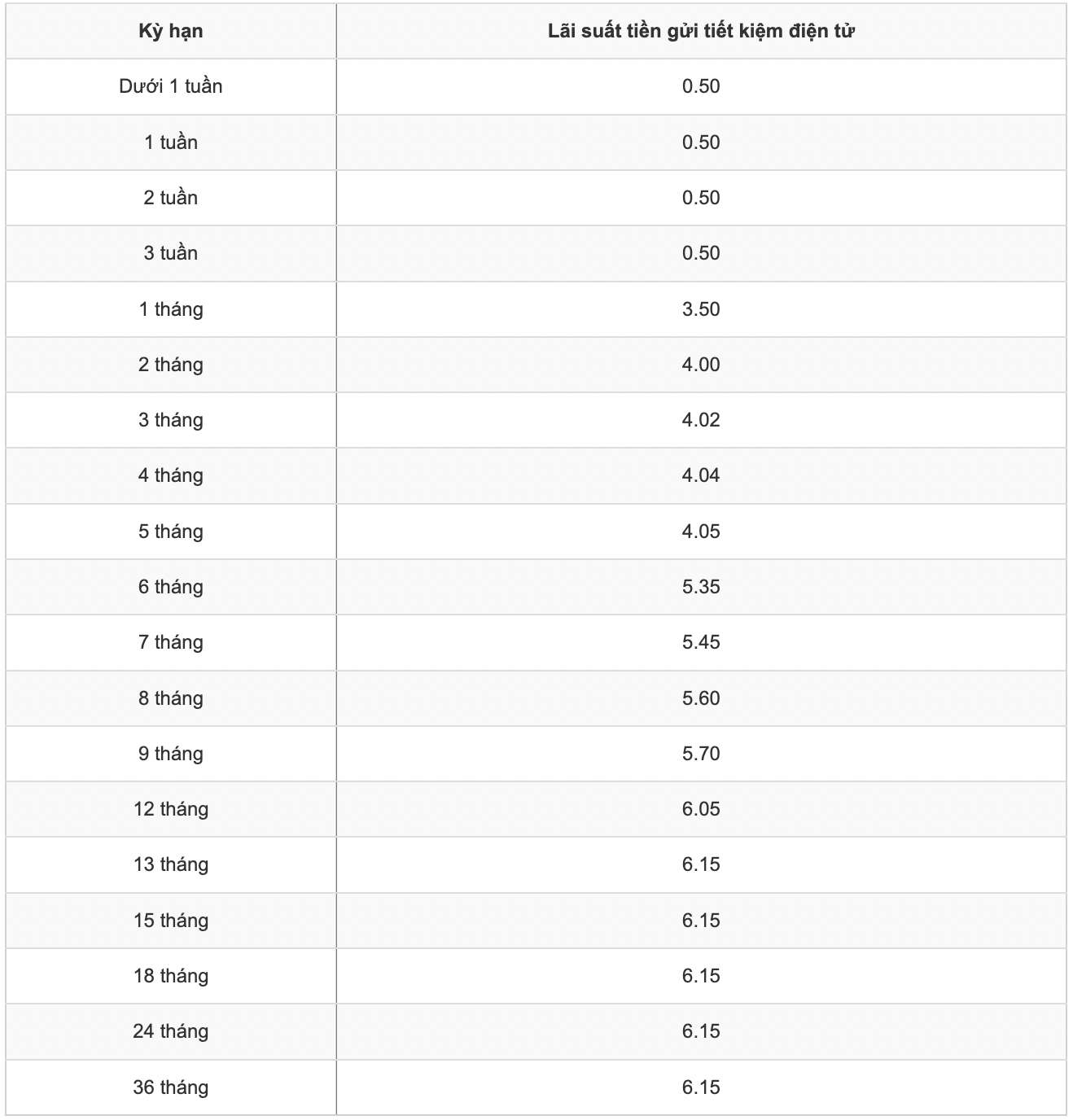

Cake by VPBank is listing the highest interest rate of 12 months at 6%/year when customers receive interest at the end of the period. In other terms Cake by VPBank listed interest rates from 4.28 - 6.3%/year.

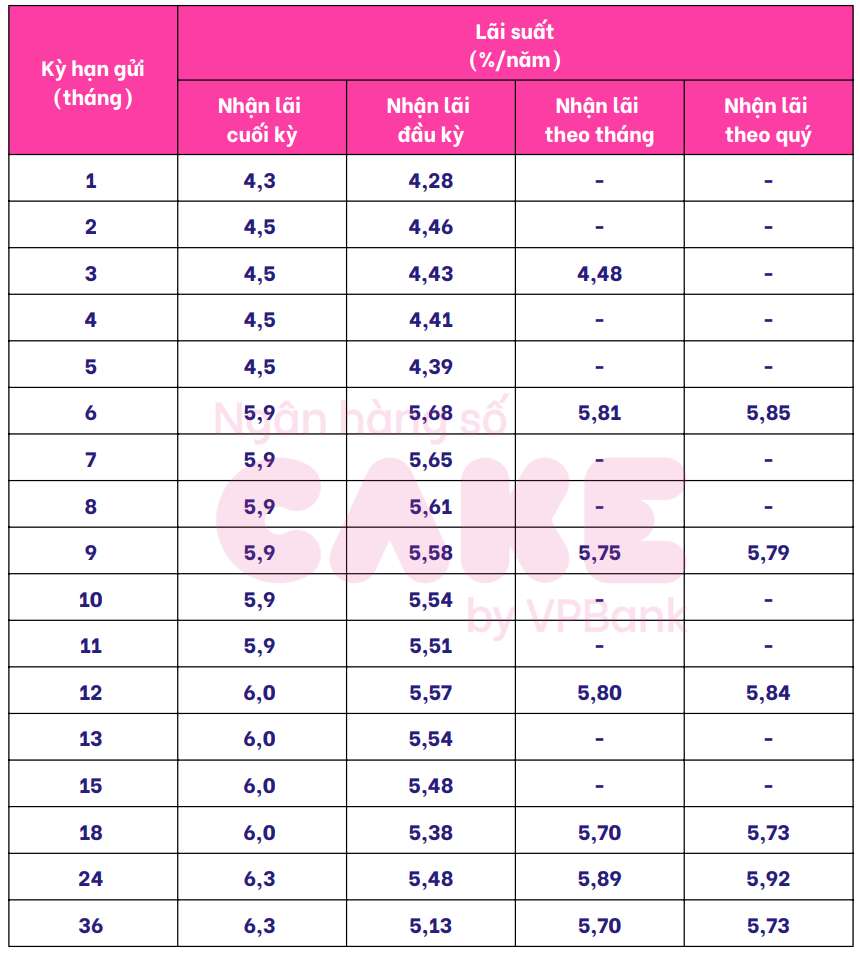

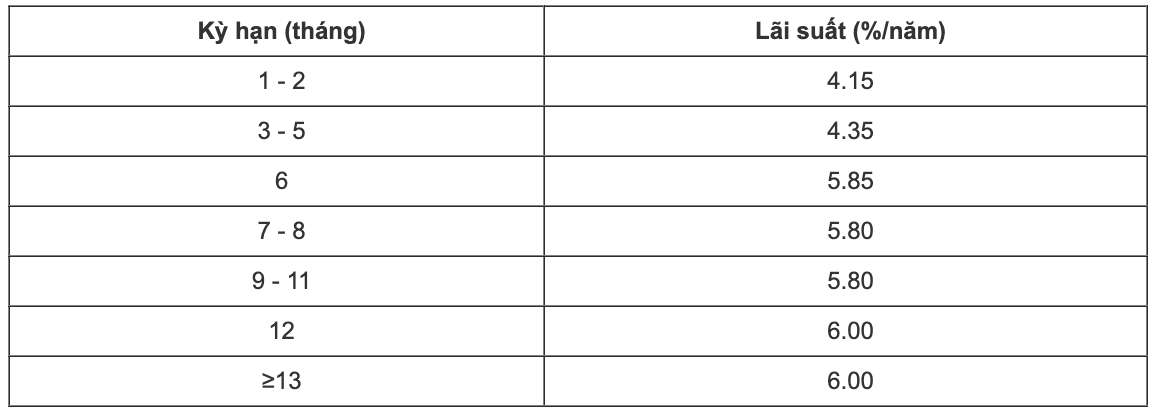

CBBank is listing the highest 12 -month interest rate at 6% when customers send money online. This bank is listing interest rates ranging from 4.1-6%/year.

Save 2 billion dong 12 months how much interest?

You can refer to how to calculate the interest to know how much interest is received after deposit. To calculate the interest, you can apply the formula:

Interest = deposit x interest rate/12 x number of months deposit

For example, you deposit 2 billion dong to Bank A, 12 -month term and interest rate of 6.1%/year, the amount received as follows:

2 billion x 6.1%/12 x 12 = 122 million.

* Information about interest rates is for reference only and can change in each period. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to the interest rate information here.