Increasing taxes and tobacco prices is an important solution

Research by the World Health Organization WHO, increasing taxes and tobacco prices is an important solution, contributing about 60% to the effectiveness of reducing tobacco use. WHO estimates that increasing taxes to increase prices by 10% will reduce consumption by about 4% -5%. In particular, it can be reduced by up to 10% or more in children and the poor.

At the same time, according to the World Bank's estimate, when tobacco taxes increase by 10%, tobacco tax revenue can increase by 7%.

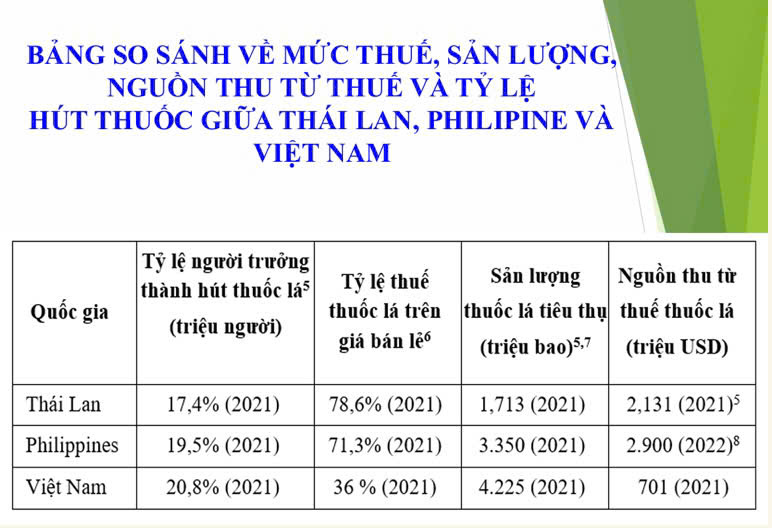

According to international experience, tobacco output cannot decrease rapidly in a short time: For example, Thailand: since 1993-2017, tobacco taxes have increased 11 times. As a result, the attraction rate increased from 32% to 19.1%, budget revenue increased 4 times (500 million USD → 2.3 billion USD), but the consumption output still remained approximately 2 billion bags per year.

In the Philippines, which has applied absolute tax and implemented special consumption tax reform since 2012, the tax will increase annually to 65 peso/bag (~1 USD/bag) in 2023. The result was an increase in tax revenue from 680 million USD2) to 2.9 billion USD (2022). The smoking rate has decreased from 27% (2009) to 19.5% (2021).

In Vietnam, tobacco use causes 85,500 deaths each year. Pass away smoking causes 18,800 deaths. A total of 104,300 deaths/year from diseases related to tobacco.

According to the preliminary estimate of the Vietnam Health Economics Association in 2022, the total cost related to medical examination and treatment, illness and premature death due to diseases related to tobacco use is 108 trillion VND per year (equivalent to 1.14% of GDP in 2022). This figure is 5 times larger than the contribution of tobacco tax revenue to the national budget.

The impact of tax on retail prices is too low

There are up to 40 cigarette brands on the market with retail prices under 10,000 VND/pack of 20 cigarettes, many brands have prices only from 7 thousand VND to 8 thousand VND/pack of 20 cigarettes.

With such a low retail price, cigarettes are very accessible to low-income people and new smokers, including children and adolescents.

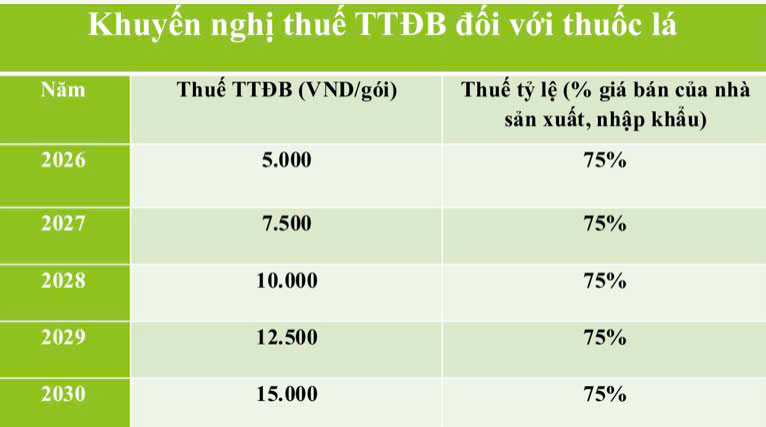

According to WHO's recommendation, to achieve the goals of the National Strategy on Tobacco Harm Prevention and Control by 2030, Vietnam needs to apply a tax increase plan stronger than the plans of the Ministry of Finance.

WHO and the Ministry of Health propose applying an absolute tax according to the roadmap to reach 15 thousand VND/bag by 2030 and maintain the tax rate at 75%.

At the workshop to share information on tobacco harm prevention activities organized by the Tobacco Harm Prevention Fund (Ministry of Health) on May 8, MSc. Phan Thi Hai - Director of the Fund said that for each retail price package of 10,000 VND, the factory price is only about 3.9 thousand VND.

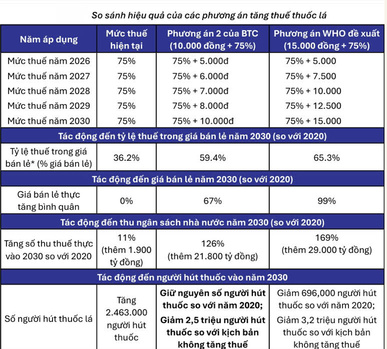

Increasing the tax from 70% to 75% of the factory price only increased the price by 220 VND. Retailers can increase prices together and will only increase prices by about 300 VND = 3%. However, average inflation is 4% and average income growth is 5%. Therefore, the tax increase has an impact, but very little on consumption in those years.

If following this plan, by 2030, the smoking rate among men will decrease to below 36% and among women to below 1.0%, meeting the national strategic target. Reduced 3.2 million smokers compared to the scenario of no tax increase. This reduction is higher than the current Ministry of Finance's plan of 1 million smokers.

In particular, this option will help increase real tax revenue (adjusted according to inflation) to 169%, increasing from 17.4 trillion VND in 2020 to 46.4 trillion VND in 2030 (an increase of 29 trillion VND). This increase is higher than the increase according to the Ministry of Finance's plan of nearly 10 trillion VND, helping to increase the State budget.