20,400 secondary transactions recorded in Hanoi in the second quarter of 2025

In the second quarter of 2025, the Hanoi high-rise real estate market recorded a clear shift when the newly opened mid-range supply was absent for the fifth consecutive quarter, causing demand for buying to shift strongly to the secondary market.

According to Mr. Tran Minh Tien - Director of One Mount Group Market Research & Customer Insight Center, this is a sign that the market is entering a new phase of balance between primary and secondary.

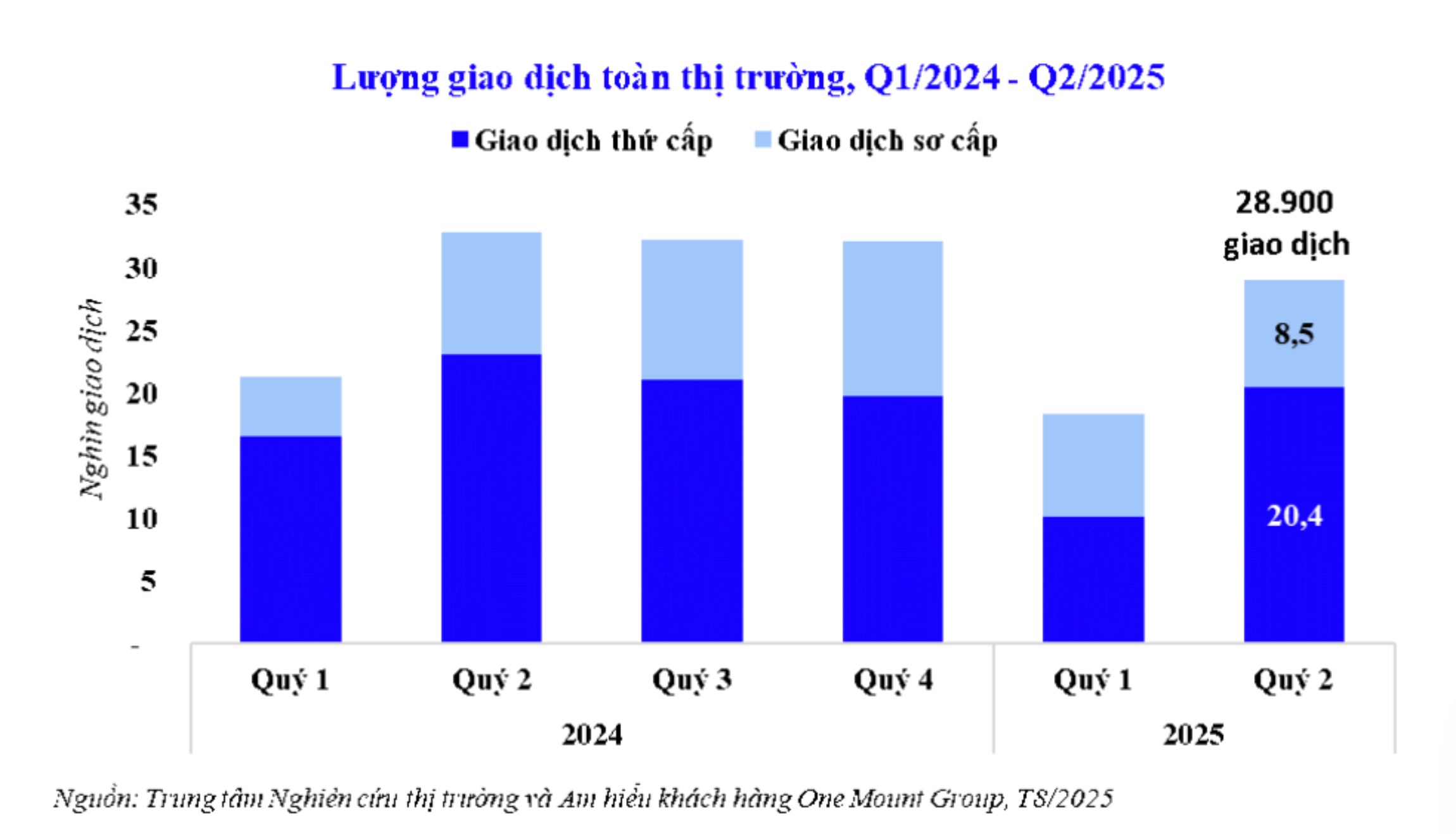

According to data from the One Mount Group Market Research & Customer Insight Center, Hanoi recorded about 28,900 real estate transactions in the second quarter of 2025, an increase of 56% compared to the previous quarter. Of which, secondary transactions account for 20,400 apartments, 2.4 times higher than primary (8,500 apartments).

High-rise apartments continue to be the most vibrant segment, with more than 17,100 apartments for sale (including both primary and secondary), an increase of 107% compared to the previous quarter. While the newly opened primary supply decreased, secondary transactions increased by 8% compared to the same period in 2024 and increased by 84% compared to the previous quarter, reaching 9,400 units thanks to an abundant transfer fund, diverse selling prices and better suited to the ability to pay of many real buyers.

This shift is the result of many contributing factors - from the absence of mid-range and affordable projects, high primary prices, to more cautious psychology of buyers - Mr. Tran Minh Tien commented.

According to Mr. Tran Minh Tien, the shift to the secondary market in the second quarter of 2025 is not only a temporary response to the shortage of new mid-range supply but also shows the increasingly important role of the transfer market in maintaining liquidity.

Accordingly, it can be seen that secondary schools are becoming a "vault" to help balance the market in the context of shifting primary supply. With a strong recovery momentum in the second quarter and a large number of apartments expected to be handed over in the second half of the year, secondary transactions are expected to continue to play a key role, keeping the rhythm of the Hanoi real estate market throughout 2025.

primary apartment prices increase, people with a salary of 50 million VND/month will find it difficult to buy

Recent research data from the Vietnam Association of Realtors (VARS) shows that in the first half of 2025, 60% of the supply of newly opened apartments will be products priced at over 80 million VND/m2. Some apartment projects in the provinces on the outskirts of Hanoi also have prices starting from 55 million VND/m2.

The current price is not only far beyond the affordability of low-income people but also beyond the reach of those in the upper middle-income group. According to feedback from real estate brokers who are members of VARS, many young customers, even with good incomes, at 40-50 million VND/month, still do not "d like" to buy a house without financial support from their family.

The pressure to repay loans is too great, especially when interest rates "float" after a period of strong increases, becoming a significant psychological barrier for young people - those who focus on quality of life, living experience and flexibility in consumption rather than deciding to borrow long-term for decades to own a small apartment.

VARS believes that in the short term, apartment prices in Hanoi will continue to increase due to high input costs and investors' profit expectations are still high. A large number of investors are currently not under significant financial pressure, including pressure from loan costs, so there is no motivation to adjust down selling prices.