The income of Ms. Nguyen Thi Han (28 years old, Nam Dinh) - a garment worker in Nam Dinh - is calculated based on the output. Therefore, there are months when her salary exceeds the personal income tax exemption threshold, making her feel worried.

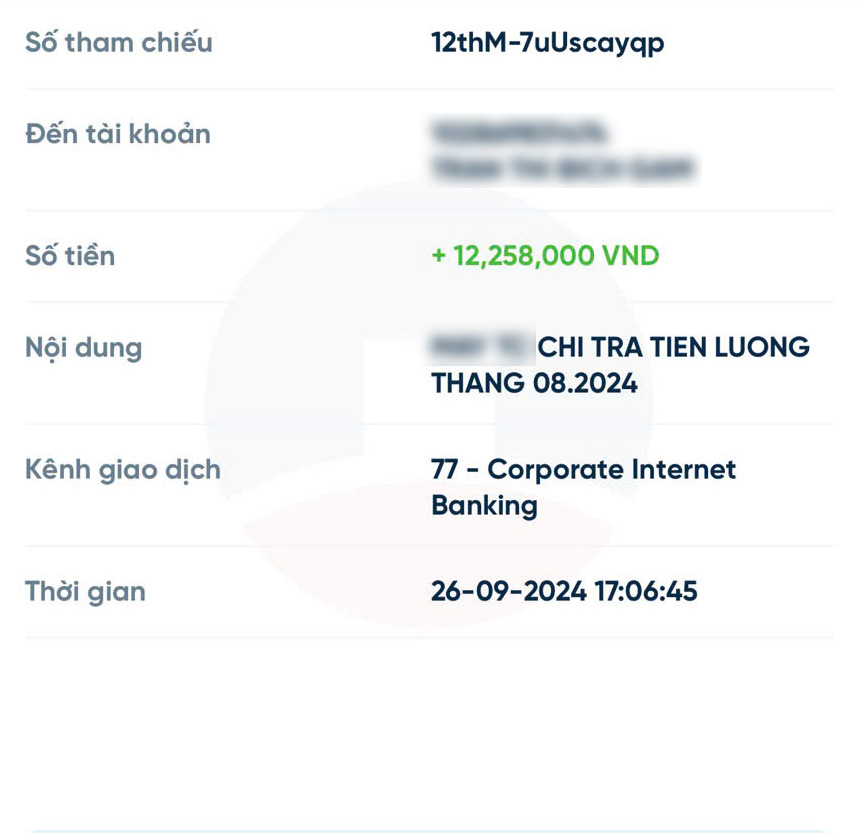

“My average income is 10 to 11 million VND/month, some months it reaches 12 or even 13 million VND. The amount of money deducted from personal income tax is all the result of hard work,” said Ms. Han.

Speaking further, Ms. Han said that if her monthly income reaches 12 million VND or more, she will definitely work 30 minutes of overtime every day. To earn an extra 1 million VND each month, female workers have to come home late, get more tired, and have less time for their families.

With no dependents, Ms. Han has to pay personal income tax with a salary of over 11 million VND. The female worker said that this family deduction is still quite low because there are many expenses in life.

Ms. Han wants to adjust the family deduction to at least 13 million VND/month. Because market prices have increased a lot compared to the most recent adjustment (11 million VND - from 2020), affecting income and expenses.

In addition, the female worker shared that increasing the family deduction level also makes workers not feel deprived of their hard work. Because it is sweat and health, not an unexpected income that is superior to other industries.

After nearly 10 years of working as a factory worker, Ms. Pham Thi Mai (43 years old, Nam Dinh) said that since the increase in regional minimum wage, allowances and overtime on Sundays, her income has exceeded the personal income tax exemption level.

“Behind the income of 12 million VND is a lot of hardship, only those in the profession can understand. Working overtime one day on Sunday, rotating two weeks of days, two weeks of nights, accepting to work in a department with toxic odors, greatly affecting health” - Ms. Mai said.

The female worker said that every month she spends nearly 1 million VND to buy eye supplements, brain tonics and to strengthen bones and joints.

Sharing about dependents, Ms. Mai said that her children are all grown up and her husband is still healthy so she cannot register for deduction.

For the above reasons, according to female workers, the income level for calculating personal income tax should be increased to over 12 million VND or personal income tax should be exempted for direct production workers.

The current family deduction level is implemented according to Resolution 954/2020/UBTVQH14: The deduction level for taxpayers is 11 million VND/month (132 million VND/year); The deduction level for each dependent is 4.4 million VND/month.

The Ministry of Finance is conducting a comprehensive review and assessment of the Personal Income Tax Law, including the issue of family deductions, to report to the Government, the National Assembly Standing Committee and the National Assembly for consideration of amendments and supplements.