The 2024 Social Insurance Law stipulates that voluntary social insurance participants can pay money in the following methods: 3 months, 6 months, 12 months at once or pay at one time for many years in the future.

According to Decree No. 159/2025 detailing and guiding the implementation of a number of articles of the Law on Social Insurance on voluntary social insurance, voluntary social insurance participants who have paid according to the above methods and during that time fall into one of the following cases will be partially refunded the amount paid:

- Belonging to the list of subjects participating in compulsory social insurance.

- Receive one-time social insurance according to the provisions of Article 102 of the Law on Social Insurance.

- Death or being declared dead by the Court.

- meet the conditions and propose to be settled for pension according to the provisions of Article 98 or Clause 9, Article 141 of the Law on Social Insurance.

The refund amount is determined by the total amount paid corresponding to the remaining period of the payment method that the voluntary social insurance participant has paid and does not include the State's payment support (if any).

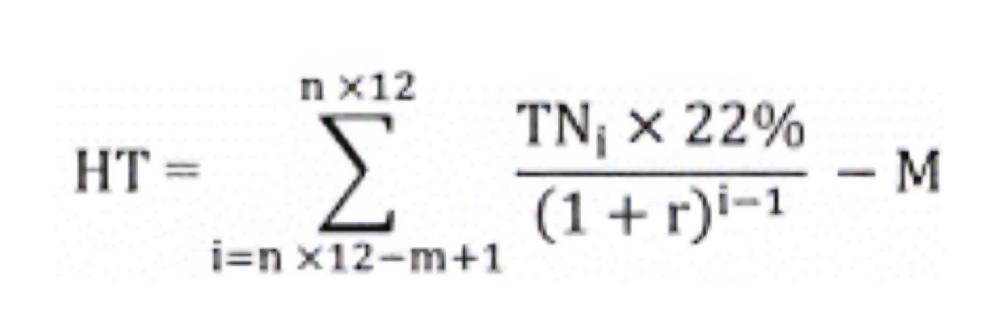

In case the voluntary social insurance participant has paid the one-time payment method for many years in the future (no more than once every 60 months) according to Article 6 of the above Decree, the refund amount is determined according to the following formula:

In which:

HT: Refund amount (FF);

Ex: The income level used as the basis for voluntary social insurance contributions is chosen by the voluntary social insurance participant at the time of contribution (even/month);

M: Ample amount of voluntary social insurance payment support from the State (if any);

r: Average monthly investment interest rate of the previous year adjacent to the payment year announced by Vietnam Social Insurance (%/month);

n: The number of years of advance payment is voluntarily selected by the social insurance participant, receiving one of the values from 2 to 5,

m: Number of months remaining of the payment method that the voluntary social insurance participant has paid;

i: Natural integers with values from (n x 12 - m +1) to (n x 12).