Over the past month, commercial banks have continuously borrowed capital from the State Bank of Vietnam (SBV) through the OMO channel.

In the trading session on November 26, the State Bank of Vietnam offered VND20,000 billion with a term of 7 days, interest rate of 4%/year, and the entire amount was absorbed by 15 commercial banks.

The total OMO volume circulating on the mortgage channel increased to nearly VND78,000 billion at the end of the session on November 26, while the amount of circulating treasury bills decreased to VND17,450 billion. Thus, the SBV is in a state of net pumping nearly VND60,550 billion into the banking system.

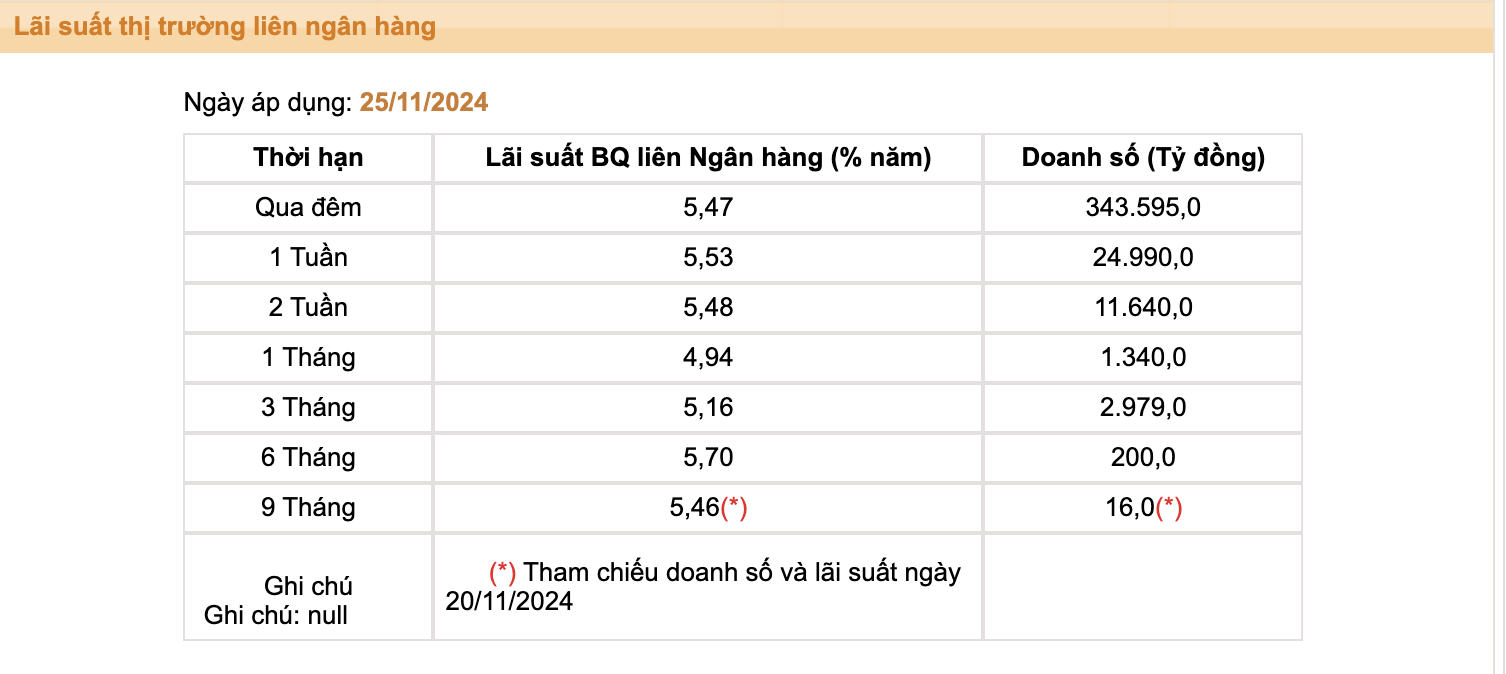

According to Dragon Capital Securities (VDSC), the number of members participating in the OMO channel is always high, showing that the liquidity of the banking system is showing signs of widespread stress. The average overnight lending rate in the first 20 days of November was 5.17%/year, 1.55 percentage points higher than the previous month.

In the mobilization market, the interest rates of commercial banks have been adjusted to increase sharply, especially in short terms from 1-3 months. Agribank has increased interest rates continuously in the past 4 months, becoming the state-owned joint stock commercial bank with the highest mobilization interest rate, with a term of 1 month at 2.4%/year, 3 months at 2.9%/year, 6 months at 3.6%/year and 12 months at 4.8%/year.

Exchange rate pressure continued to increase in November, however, according to VDSC, the SBV did not have to sell foreign currency like last month, possibly because the demand for foreign currency was not too large. Therefore, the reason for the tight liquidity of the system in November was still largely due to capital demand in the final period of the year.

MB Securities (MBS) said that the high interbank interest rates have signaled a liquidity shortage. The issuance of treasury bills by the State Bank of Vietnam and the withdrawal of more than 4.5 billion USD from three major banks by the State Treasury in the third quarter of 2024 are factors that have increased liquidity pressure.

Despite the SBV’s strong intervention measures such as pumping money through the OMO channel, overnight interest rates remain above 5%, indicating significant pressure in the system. This development is a contributing factor to banks continuing to adjust deposit interest rates upward to attract new capital, thereby helping to ensure liquidity.