Pursuant to Clause 25, Article 5 and Article 17 of the Law on Value Added Tax 2024, from January 1, 2026, business households and individuals with annual revenue of over VND 200 million or more are subject to VAT and personal income tax.

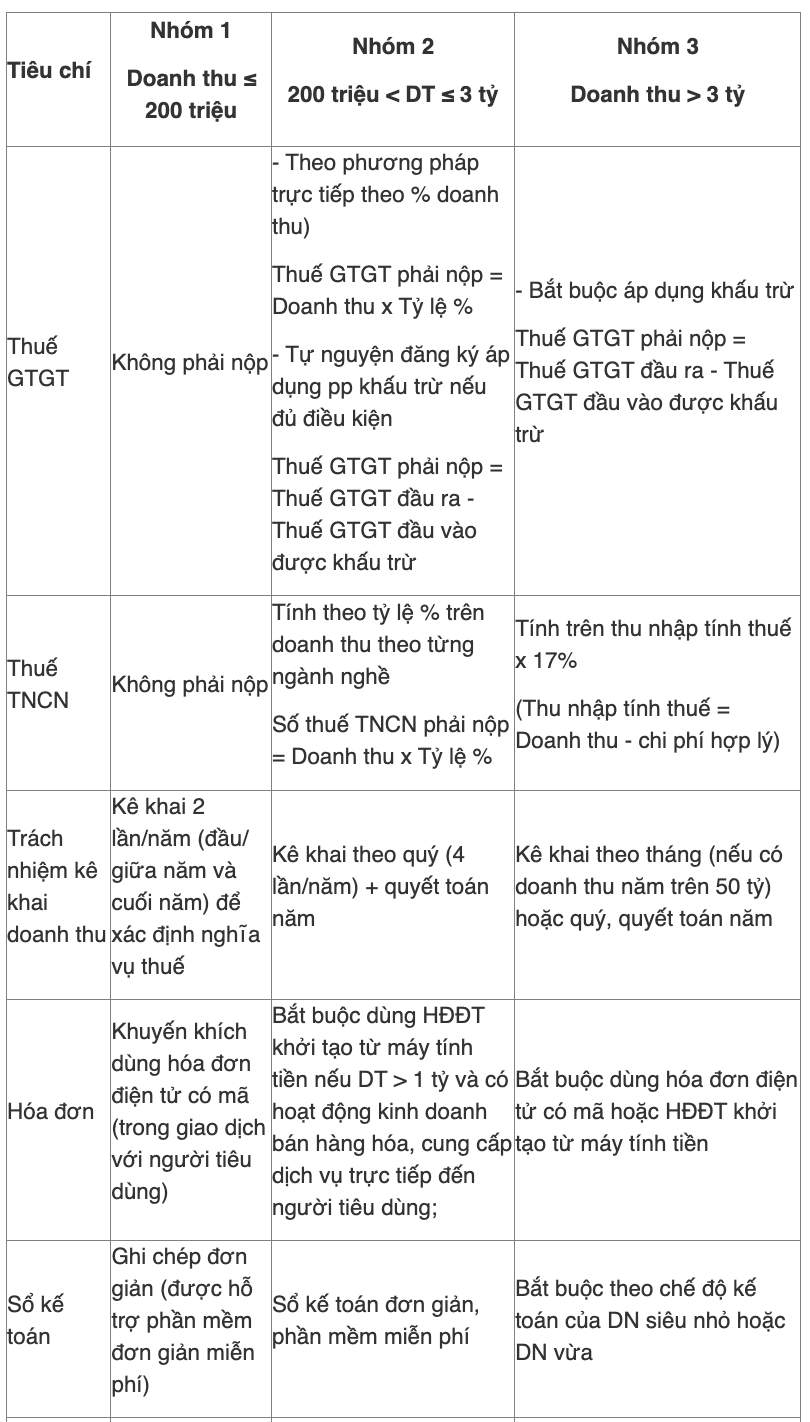

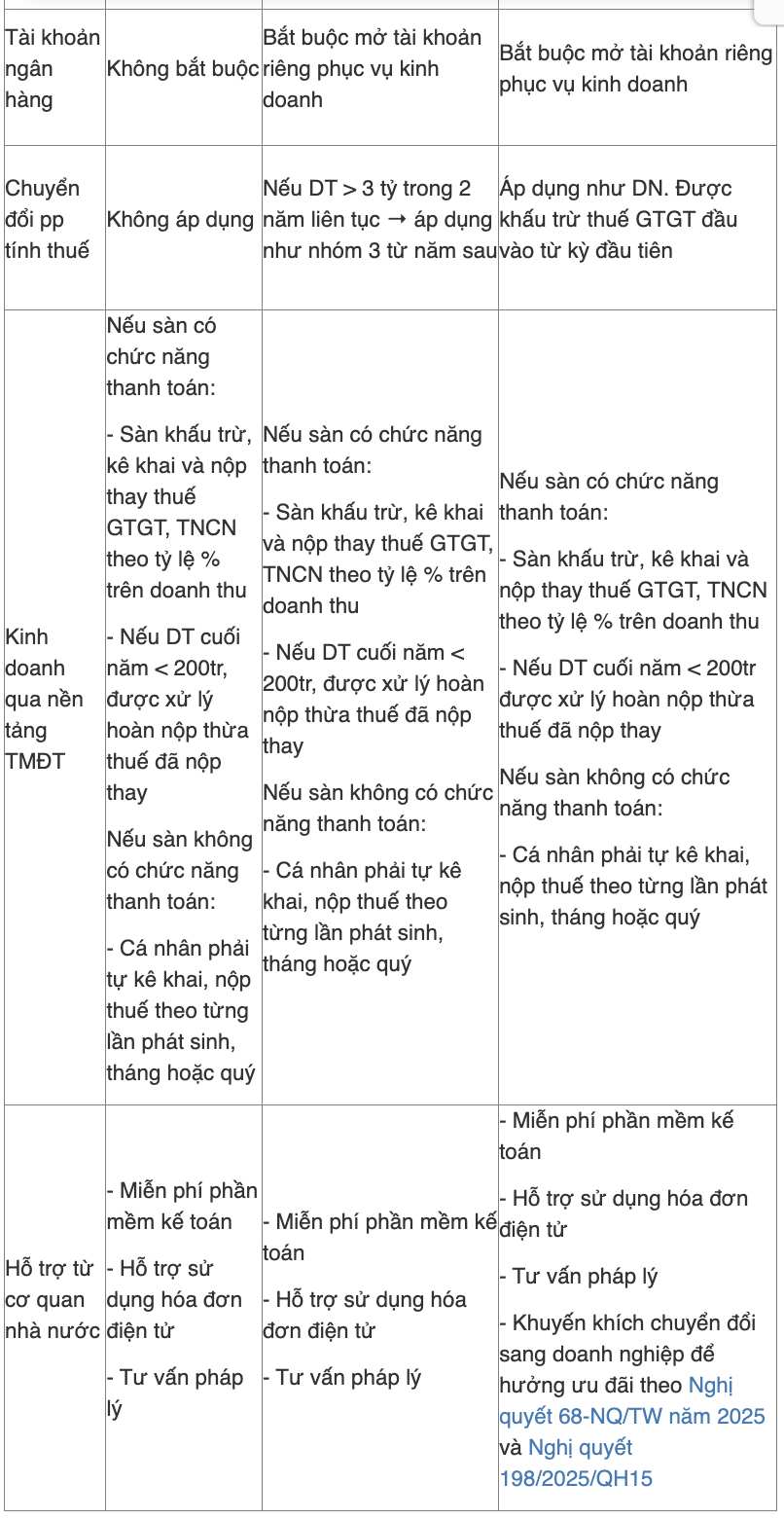

Accordingly, in Table 2 of the list of tables issued with Decision 3389/QD-BTC in 2025, which stipulates the tax management model for households and individuals doing business, there are regulations on tax payment revenue along with calculation of tax on business households when withdrawing corporate tax as follows: