ACB increases interest rates

According to Lao Dong's record on September 18, Asia Commercial Joint Stock Bank (ACB) issued a new interest rate schedule, increasing an average of 0.1 percentage points for all terms.

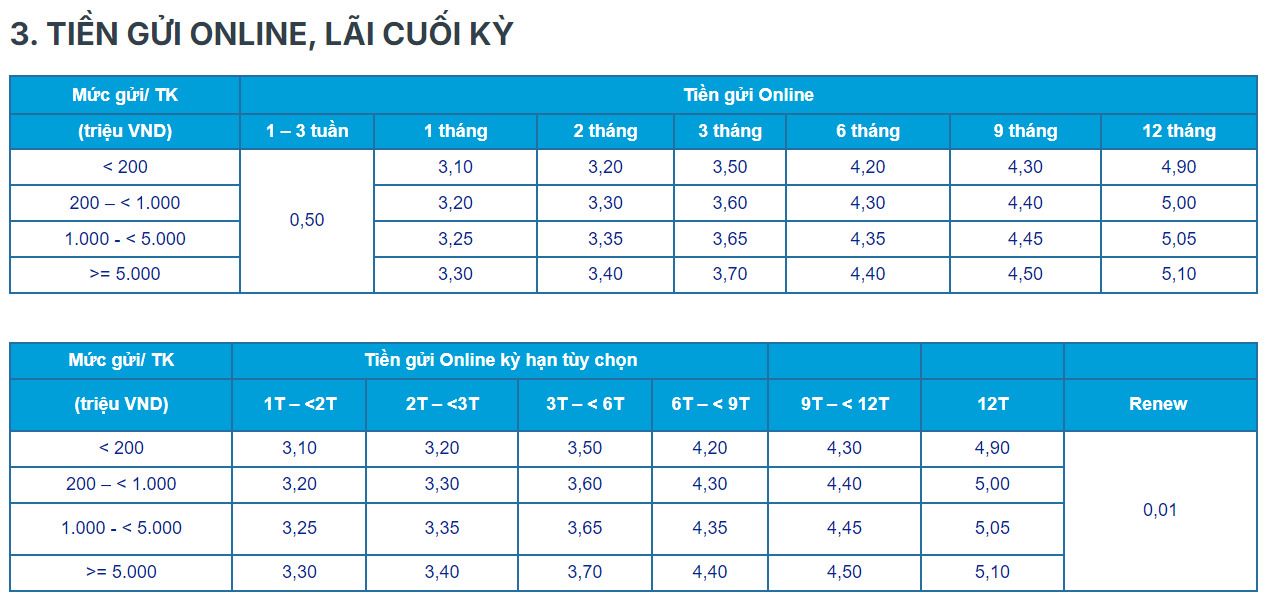

ACB's online deposit interest rates are currently listed as follows:

Interest Rate for 1-month term increased by 0.1 percentage point, to 3.1-3.3%/year.

Interest Rate for 3-month term increased by 0.1 percentage point, to 3.5-3.7%/year.

Interest Rate for 6-month term increased by 0.05 percentage points, to 4.2-4.4%/year.

Interest Rate for 9-month term increased by 0.1 percentage point, to 4.3-4.5%/year.

12-month Interest Rate increased by 0.1 percentage point, to 4.9-5.1%/year.

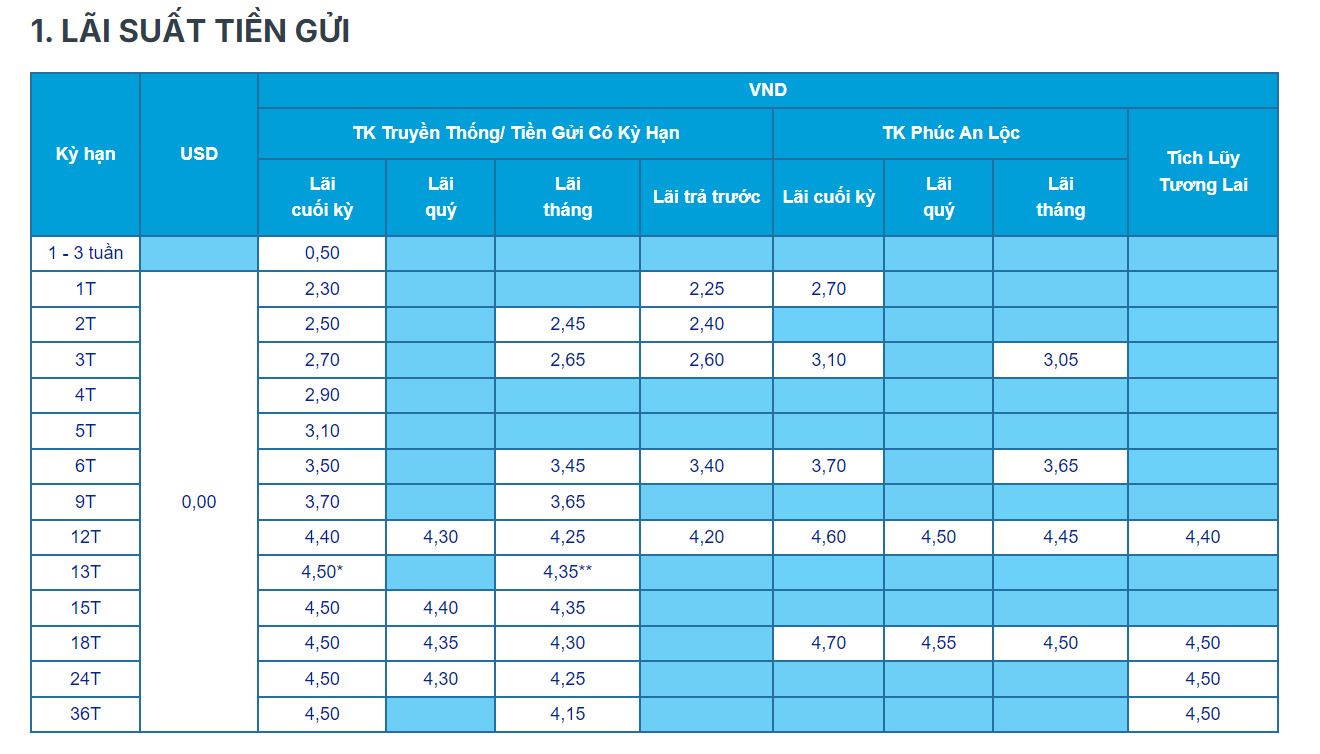

ACB's counter deposit interest rates and term-end interest payment method are currently listed as follows:

Interest Rate for 1 month term is 2.3%/year.

Interest Rate for 3-month term is 2.7%/year.

Interest Rate for 6-month term is 3.5%/year.

Interest Rate for 9-month term is 3.7%/year.

Interest Rate for 12-month term is 4.5%/year.

Series of 10 banks increase interest rates

According to Lao Dong, since the beginning of September, 10 banks have increased interest rates, including Dong A Bank, OceanBank, VietBank, GPBank, Agribank, Bac A Bank, NCB, OCB and BVBank; with the increasing trend mainly in short terms.

However, the interest rate market also recorded a downward trend in interest rates from a bank that used to lead the market with the highest interest rate, ABBank. The alternating up and down trends at banks created a significant change in the ranking of the top highest interest rates in the market.

In the latest report of the research team of Bao Viet Securities Joint Stock Company (BVSC), it was stated that by the beginning of September 2024, the average 12-month deposit interest rate reached 5.14%, an increase of 1 basis point (bps) compared to the previous month and an increase of 58 bps compared to the lowest level in early April. However, the interest rate is still down 64 bps compared to the same period in 2023 and 12 bps compared to the end of 2023. Currently, the deposit interest rate is still at the lowest level ever, much lower than the Covid-19 pandemic period (5.77%).

Also according to the latest report of DSC Securities Corporation, the research team commented that mobilization pressure will return in the final period of the year, along with the time when credit is boosted; and reserved the opinion that the average interest rate of the whole system will increase slightly, to about 5-5.2% by the end of 2024.

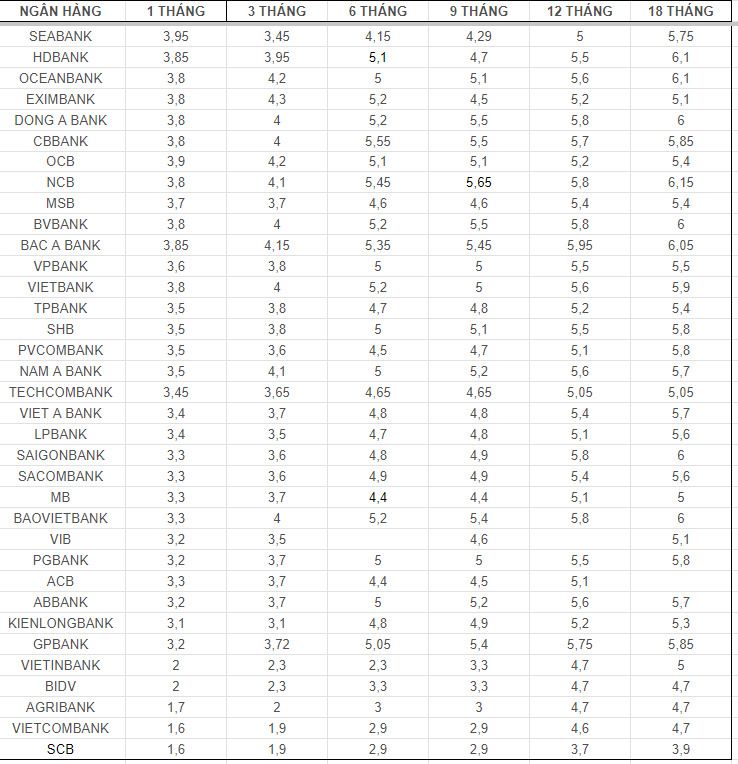

Details of deposit interest rates at banks, updated on September 18, 2024