Interest rate level in October recorded 8 banks increasing interest rates including: NCB, Agribank, MSB, LPBank, Eximbank, Techcombank, ABBank and Bac A Bank.

On the contrary, Agribank reduced 0.1%/year deposit interest rates for terms of 6-11 months and Techcombank reduced 0.1%/year interest rates for terms of 1-36 months, NCB reduced from 0.1-0.35% interest rates for terms of 13-60 months, while VPBank reduced 0.2%/year interest rates for terms of 6-36 months.

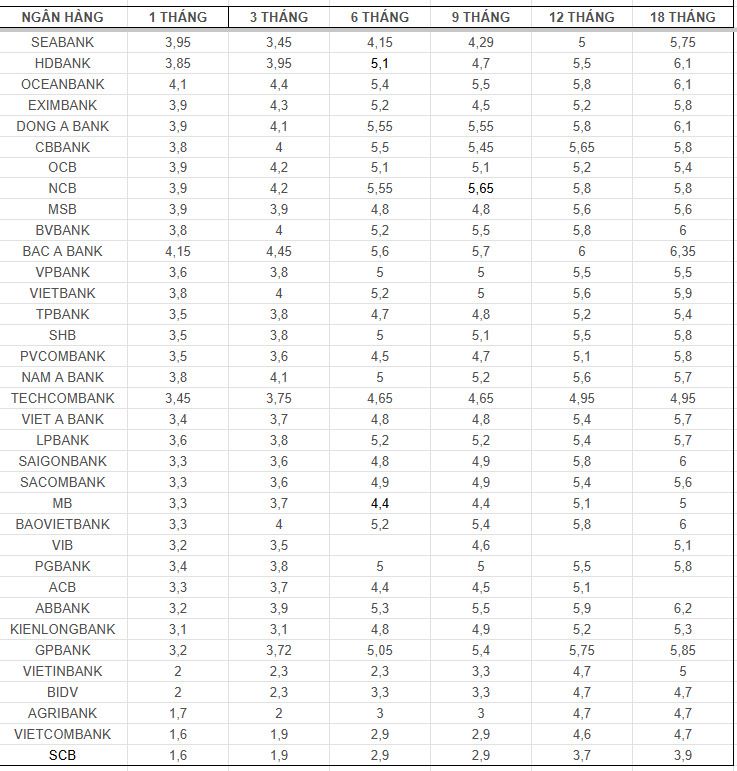

A series of banks pay interest rates above 6.0%/year

According to Lao Dong, the market currently has up to 8 banks listing interest rates above 6.0%/year and not requiring deposit conditions.

At 24-month term, ABBank leads with interest rate of 6.3%/year.

At the 18-36 month term, Bac A Bank recently took the leading position with an interest rate of 6.35%/year for deposits of over 1 billion VND and an interest rate of 6.15%/year for deposits of less than 1 billion VND.

HDBank, OceanBank, Dong A Bank follow with interest rates of 6.1%/year for terms of 18-36 months.

Finally, banks listed interest rates of 6.0%/year for similar terms, including BVBank, BaovietBank; Saigonbank currently listed interest rates of 6.0%/year for 18-month terms and 6.1%/year for 36-month terms; SHB also currently listed interest rates of 6.1%/year for 36-month terms.

Meanwhile, Vietnam Export Import Commercial Joint Stock Bank (Eximbank) also listed an interest rate of 6.3%/year but with more complicated deposit conditions.

Accordingly, the interest rate for "Online deposits" on weekends, Saturdays and Sundays of October and November; the days in October include October 26 and 27, 2024; the days in November include November 2, 3, 9, 10, 16, 17, 23, 24, 2024; customers will enjoy an interest rate of 6.3%/year for terms of 18-24-36 months.

(See the highest interest rates HERE)

Details of deposit interest rates at banks, updated on October 29, 2024