Interest Rate hits new high

According to Lao Dong, on October 28, Bac A Commercial Joint Stock Bank (Bac A Bank) issued a new interest rate schedule, recording an increase of 0.15-0.35 percentage points for all terms.

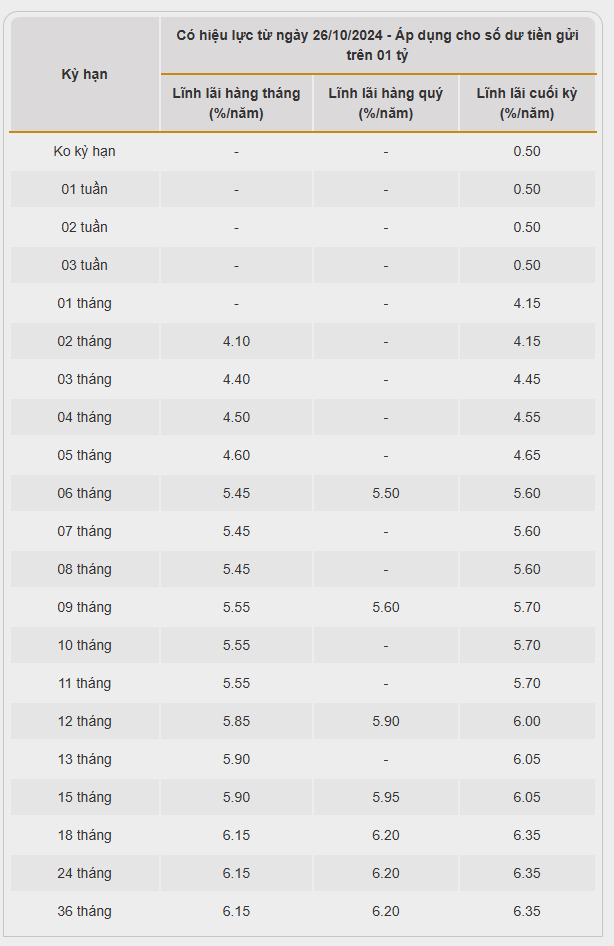

The interest rate table for deposits with balances over 1 billion VND is currently listed by Bac A Bank as follows:

1-month Interest Rate increased by 0.15 percentage points to 4.15%/year.

The 3-month Interest Rate increased by 0.15 percentage points to 4.45%/year.

Interest Rate for 6-month term increased by 0.15 percentage points, to 5.6%/year.

Interest Rate for 9-month term increased by 0.15 percentage points, to 5.7%/year.

12-month Interest Rate increased by 0.1 percentage point to 6.0%/year.

Interest Rate for 18-36 month term increased by 0.3 percentage points, to 6.35%/year.

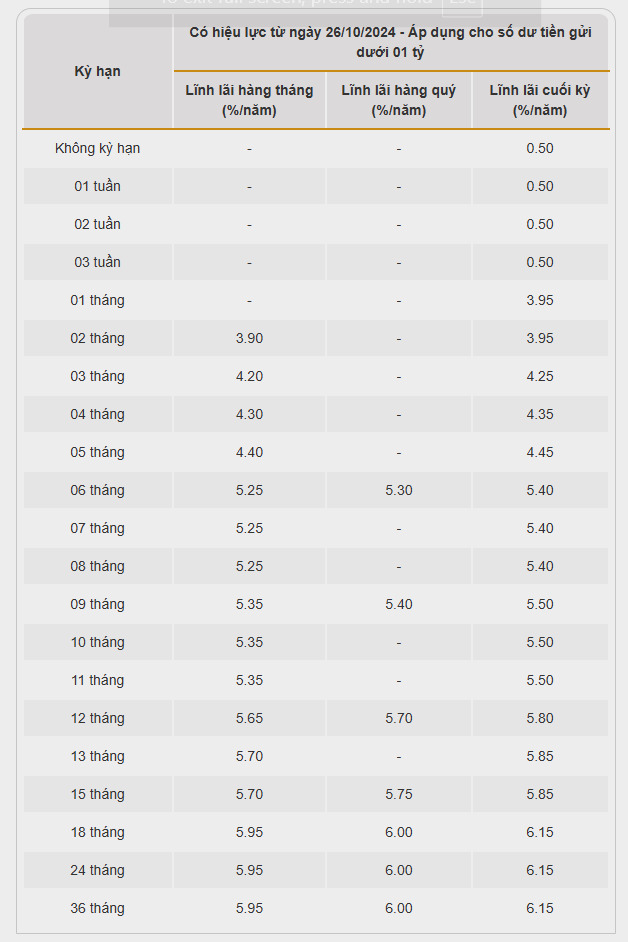

The deposit interest rate table with balance under 1 billion VND is currently listed by Bac A Bank as follows:

Interest Rate for 1 month term is 3.95%/year.

Interest Rate for 3-month term is 4.25%/year.

Interest Rate for 6-month term is 5.4%/year.

Interest Rate for 9-month term is 5.5%/year.

Interest Rate for 12-month term is 5.8%/year.

Interest Rate for 18-36 month term is 6.15%/year.

Notably, Bac A Bank just raised interest rates once in early October. After raising interest rates, Bac A Bank suddenly increased interest rates a second time, rising to the top position in the ranking of banks with the highest interest rates on the market.

According to October interest rate statistics, 6 banks increased interest rates including: NCB, Agribank, MSB, LPBank, Eximbank, and Bac A Bank.

On the contrary, Agribank reduced 0.1%/year deposit interest rates for terms of 6-11 months and Techcombank reduced 0.1%/year interest rates for terms of 1-36 months, NCB reduced from 0.1-0.35% interest rates for terms of 13-60 months, while VPBank reduced 0.2%/year interest rates for terms of 6-36 months.

(See the highest interest rates HERE)

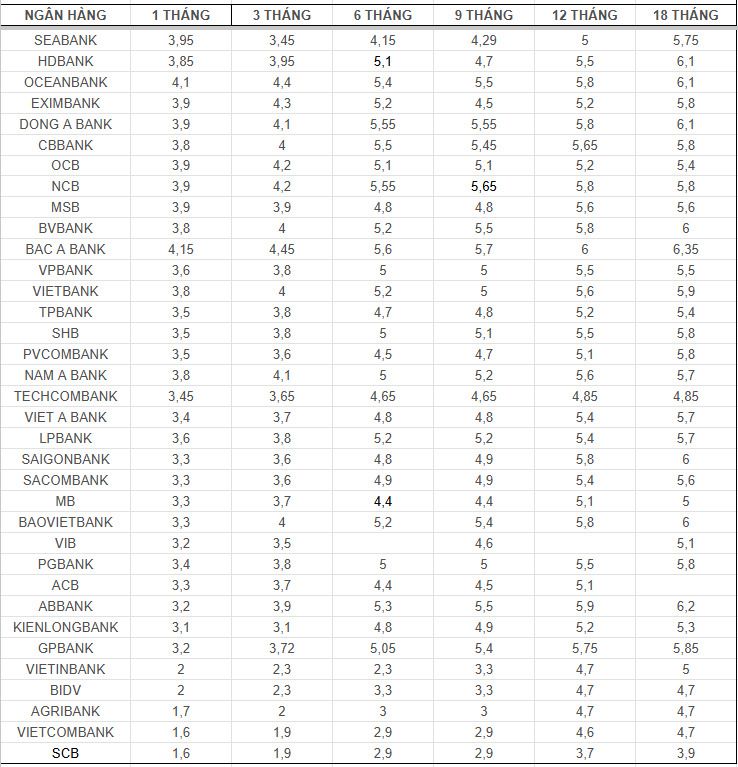

Details of deposit interest rates at banks, updated on October 28, 2024