What is Agribank's average lending interest rate ?

Implementing the direction of the Government and the State Bank, Agribank's short-term loan interest rate for a number of priority industries and fields is 4.0%/year.

Agribank's short-term loan interest rate is normally at least 5%/year; The average interest rate for medium and long-term loans is usually at least 5.5%/year.

If people borrow for consumption via credit cards, the interest rate is 13%/year.

Announced in August 2024, Agribank's average lending interest rate is currently at 7.03%/year.

Agribank said that the average capital cost does not include the capital cost required for credit risk, and the cost of credit risk provisions is 5.54%/year.

In particular, the average deposit interest rate is 3.74%/year, other costs (including mandatory reserves, liquidity reserves, deposit insurance, operating costs) are 1.8%/year. year.

With the above average lending and mobilization interest rates, the current interest rate difference between lending and mobilization at Agribank is 1.49%/year.

However, it is necessary to know the specific loan interest rate according to the term, target audience and Agribank's customer policies. The average capital cost does not include the capital cost required for credit risk and credit risk provision costs.

Details of Agribank's latest loan interest rate table

Interest rates for consumer loans (buying houses, land, cars, motorbikes,...) at Agribank

Preferential interest rate: loan interest rate is maximum 2.5%/year lower than the floor interest rate for loans serving life needs (such as loans to buy houses, land, cars, motorbikes, televisions). , fridge,...):

- Interest rates are only from 4.0%/year for loans with terms of 3 months or less

- Interest rates are only from 4.5%/year for loans over 3 months to 6 months

- Interest rates are only from 5.0%/year for loans over 6 months to 12 months.

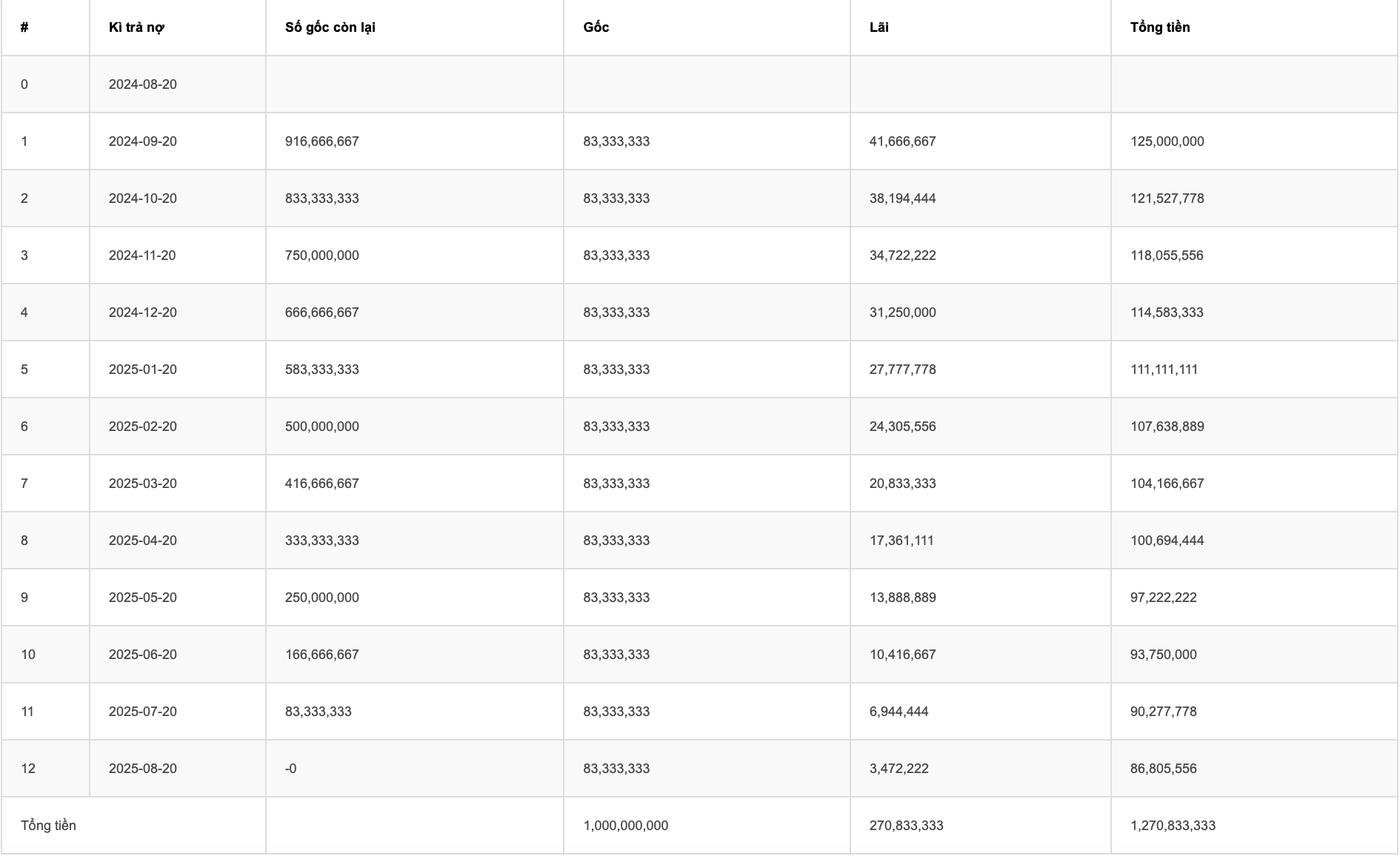

For example: Loan amount is 1 billion VND, interest rate is 5.0%/year with a term of 12 months. The amount of interest and principal that customers must pay each month is as follows:

In addition, Agribank's home loan interest rates are being applied as follows:

- Fixed for the first 6 months: 6%/year

- Fixed for the first 12 months: 6.5%/year (applicable to loans with a minimum term of 3 years)

- Fixed for the first 24 months at 7%/year (applicable to loans with a minimum term of 5 years).

Production and business loan interest rates at Agribank

Recorded on August 20, Agribank granted individual customers medium and long-term loans to invest in production and business with the following interest rates:

Loan interest rates from 6%/year for loans of 12 months or more.

One-time loan method.

Applies to disbursements arising from August 1, 2024 to October 31, 2024 or until the Program scale is reached.

As for short-term loan customers, Agribank offers loans at a maximum interest rate of 2%/year lower than the floor interest rate for loans serving production and business corresponding to each term according to Agribank's regulations from time to time. period:

- From 3.0%/year with loan term up to 3 months

- From 3.5%/year for loans over 3 to 6 months

- From 4.0%/year for loans over 6 to 12 months

Loan method: One-time loan, limit loan, overdraft limit loan on payment account.

Applicable to disbursements arising from March 20, 2024 until reaching the Program scale.

How to calculate the most standard Agribank loan interest rate

Based on the amount, term, interest rate and loan type to calculate interest. Agribank proposes 2 ways to calculate bank loan interest rates as follows:

- How to calculate loan interest rate based on decreasing balance:

Monthly principal = Loan amount/Loan term

First month's interest = Loan amount x Monthly loan interest rate/Loan term

Interest in the following months = Remaining principal x Monthly loan interest rate/Loan term

- How to calculate interest rate based on initial debt balance:

Interest = Principal balance x Loan interest rate/Loan term