According to the separate financial statements for the fourth quarter and the whole year 2025 just announced by SSI Securities Joint Stock Company (HoSE: SSI), the enterprise recorded the highest revenue and pre-tax profit since its establishment.

Accordingly, SSI's total revenue and pre-tax profit (LNTT) alone reached 3,566 billion VND and 916 billion VND respectively.

Estimated consolidated, Q4 revenue reached VND 3,723 billion, LNTT reached VND 1,005 billion. Accumulated for the whole year 2025, SSI's revenue and LNTT reached VND 13,160 billion and VND 5,085 billion, completing 135.7% and 119.6% of the plan approved by the General Meeting of Shareholders respectively.

As of December 31, 2025, the parent company has total assets of VND 92,975 billion and owner's equity of VND 31,054 billion, an increase of 28.2% and 19.6% respectively compared to the end of 2024. Accumulated for the last 4 quarters, the profit margin on owner's equity (ROE) reached 13.5% and on total assets (ROA) reached 4.2%.

SSI said that this result simultaneously reflects the favorable market context after the upgrade and the company's ability to exploit opportunities on the foundation of strong capital, diverse products and operating discipline.

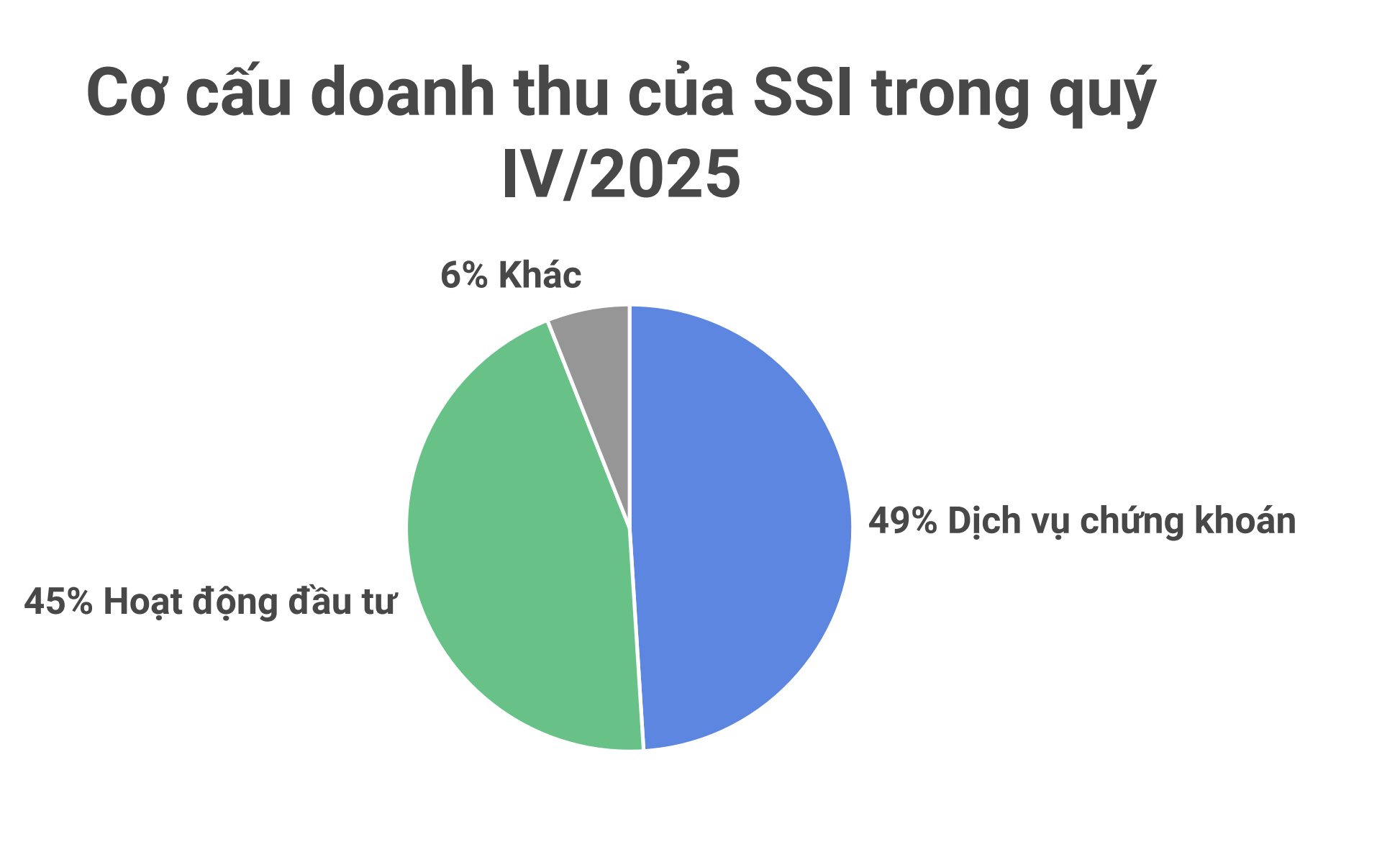

In the fourth quarter of 2025, the securities service segment recorded revenue of 1,751 billion VND, accounting for about 49% of total revenue. Brokerage, depository, and investment consulting services had their 5th consecutive quarter of market share growth. The market share of brokerage of shares, fund certificates and secured warrants on HOSE reached 12.50% in the fourth quarter of 2025 - the highest level in 22 quarters; for the whole year 2025, market share reached 11.53%, the highest in the past 5 years.

In parallel with the underlying market, the derivative brokerage segment was promoted when the market share for the whole year reached 5.09%, a sharp increase compared to 3.58% in 2024. Improvements in products, consulting services and user experience are considered the main driving force for growth in both segments. In the fourth quarter alone, this segment achieved revenue of 653 billion VND, an increase of 96% compared to the same period in 2024.

Margin lending and advance payment of sales reached revenue of nearly 1,098 billion VND, an increase of 9% compared to the previous quarter. Margin and advance loan balance reached more than 38,940 billion VND, an increase of 77% compared to the beginning of the year. SSI said that in the context of strong market fluctuations, the company maintains a strict risk management policy, no bad debts arise despite the rapid increase in outstanding loans and market liquidity.

Revenue from investment activities reached 1,593 billion VND, an increase of 53% compared to the same period in 2024 and contributing about 45% of total operating revenue. The investment portfolio continues to focus on fixed income assets issued by credit institutions, and is adjusted in scale to suit macroeconomic policy developments and interest rate levels.

Revenue from capital source activities and financial business recorded 206 billion VND, an increase of 53% compared to the previous quarter. Notably, in the fourth quarter of 2025, SSI successfully arranged a 300 million USD syndicated loan - considered the largest syndicated loan ever of the Vietnamese securities company group, thereby expanding medium and long-term capital space for core business activities.

In the investment banking service segment, SSI achieved revenue of 16 billion VND. In the fourth quarter, the company played a consulting and distribution role in a number of large-scale capital mobilization transactions in the market, including transactions such as the IPO of VPS Securities Joint Stock Company and the issuance of green bonds of Vietcombank.

The revenue structure continues to diversify between business segments, showing that SSI is expanding its scale on the basis of capital, market share and operating capacity, while maintaining the focus on risk management, transparency and efficiency in capital use - factors considered the foundation for the new market period after upgrades.