At the regular press conference of the Ministry of Finance for the third quarter of 2025, Mr. Mai Son - Deputy Director of the Tax Department said that the Tax sector is focusing on implementing many tasks of reforming and modernizing tax management.

Firstly, for the private economic sector, the tax authority has developed a separate action program, aiming to promote modern tax management, associated with digital transformation. This plan is implemented uniformly throughout the industry, to create maximum convenience for taxpayers.

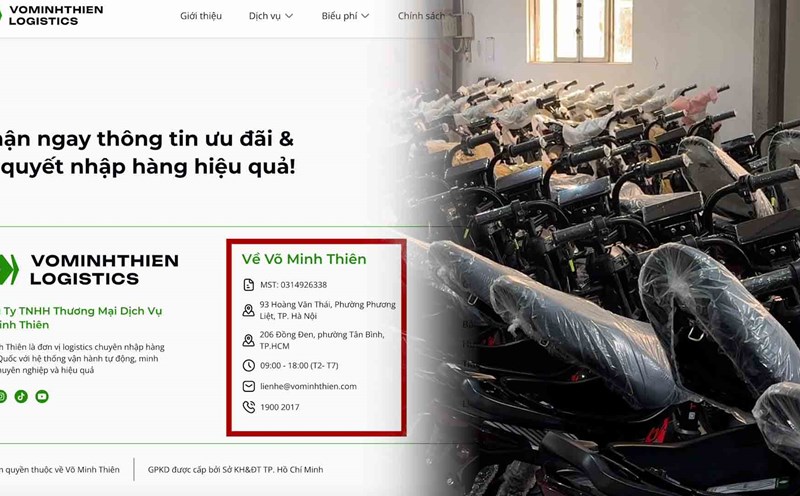

Second, the tax authority is developing a project to convert business households to enterprises. This project is associated with the application of electronic invoices from cash registers and accounting support solutions, helping business households gradually get acquainted and convert in accordance with legal regulations. The goal is that by January 1, 2026, all converted business households will comply with regulations and ensure fairness in tax obligations.

The Tax sector is focusing on connecting and sharing data between state management agencies, thereby supporting businesses to fulfill their tax obligations in the most practical and simplest way.

In the first 9 months of 2025, 18,000 business households have switched from the contract tax method to declaration, and more than 2,500 households have switched from declaration to enterprise. To facilitate, the tax authority has built a simple, easy-to-intague accounting regime and is implementing shared software for business households, integrated directly on the tax management system.

At the same time, the Tax sector has stepped up propaganda and support through many channels, including close coordination with tax agents, technology solution providers, and the press and media. In the fourth quarter of 2025, the tax authority will continue to organize dialogue programs, directly answering problems, helping businesses feel secure in fulfilling their tax obligations.

"We persevere in the spirit of accompanying and supporting business households, removing difficulties, creating fairness and transparency in production and business activities. All implementation plans have been carefully prepared, ensuring that business households can implement the regulations smoothly and conveniently, Mr. Mai Son emphasized.

Adding the opinion of the Tax Department, Deputy Minister of Finance Nguyen Duc Chi emphasized: "The Tax Department will prepare all necessary options to support business households in the most convenient and smooth transition."