Vietnam National Petroleum Group has sent a petition to the Tax Department about the difficulty when the time of issuance of invoices does not match the time of recording revenue.

Meanwhile, at point c, clause 7, point b, clause 6, Article 1 of Decree No. 70/2025/ND-CP dated March 20, 2025 of the Government, the time of recording revenue is the time of transferring ownership of goods. The time of issuing the invoice is the time to complete the data comparison between the parties, but no later than 07 days of the month following the arising month and the latest time to sign the number is the next working day of the invoice issuance time.

This leads to invoices being issued differently from the sales period, leading to a difference between the time of invoice and the time of revenue recording.

Responding to this issue, the Tax Department has sent a document to the Vietnam National Petroleum Group, specifically as follows:

Pursuant to Point a, Clause 1, Article 8 of the Law on VAT No. 48/2024/QH15 dated November 26, 2025, stipulates the time of determining VAT on goods. The time of transferring ownership or use of goods to the buyer or the time of issuing the invoice, regardless of whether the money has been collected or not.

At Point a, Clause 6, Article 1 of Decree No. 70/2025/ND-CP dated March 20, 2025, amending and supplementing Clause 1, Article 9 of Decree No. 123/2020/ND-CP dated October 19, 2020, it is stipulated that:

Amend and supplement Clause 1, Clause 2, Point a, Point e, Point l, Point m, Point n Clause 4, Article 9 and add Point p, Point Q, Point r to Clause 4, Article as follows:

The time to prepare invoices to exchange for sales of goods (including sales, transfers of public assets and sales of national reserve goods) is the time to transfer ownership or use of goods to buyers, regardless of whether they have collected money or not.

Exchanging for goods (including export processing), the time of issuing e-commerce invoices, electronic value-added invoices or electronic goods invoices is determined by the seller but no later than the next working day from the date the goods are cleared according to customs law.

At point b, clause 6, Article 1 of Decree No. 70/2025/ND-CP dated March 20, 2025, amending and supplementing Point a, Clause 4, Article 9 of Decree No. 123/2020/ND-CP dated October 19, 2020, it is stipulated that:

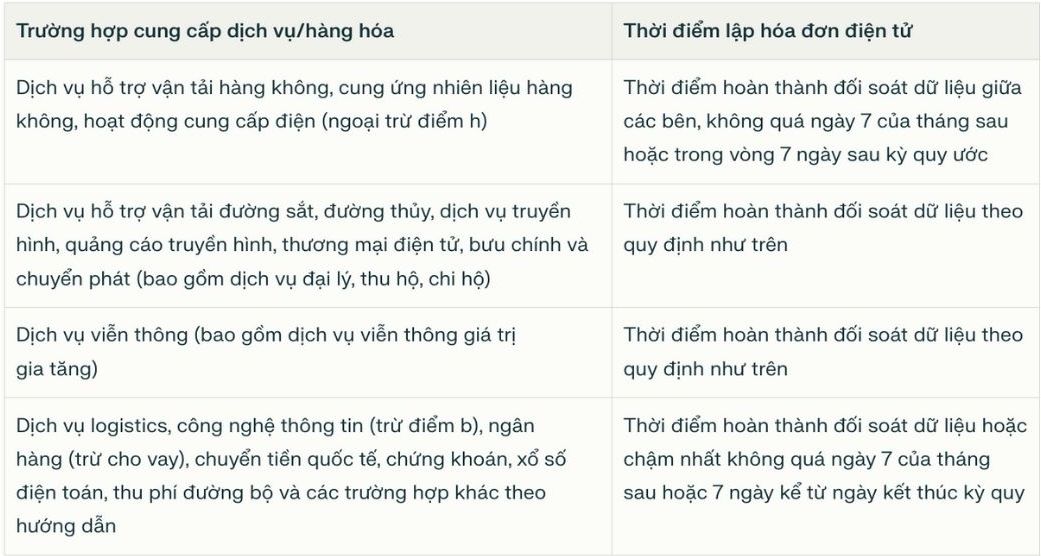

In cases of selling goods and providing services in large quantities, which arise frequently, it is necessary to have time to review data between goods selling and providing services and customers and partners, including:

The seller declares tax according to the time of making the invoice; the time of tax declaration for the buyer is the time of receiving the invoice to ensure correctness and completeness in form and content as prescribed in Article 10 of this Decree.

Article 15 and Article 16 of Decree No. 181/2025/ND-CP dated July 1, 2025 detailing the time to determine VAT is appropriate for the time of issuing invoices according to the provisions of the law on invoices.

Based on the above regulations, the time of determining VAT is regulated to be the same as the time of making the invoice.