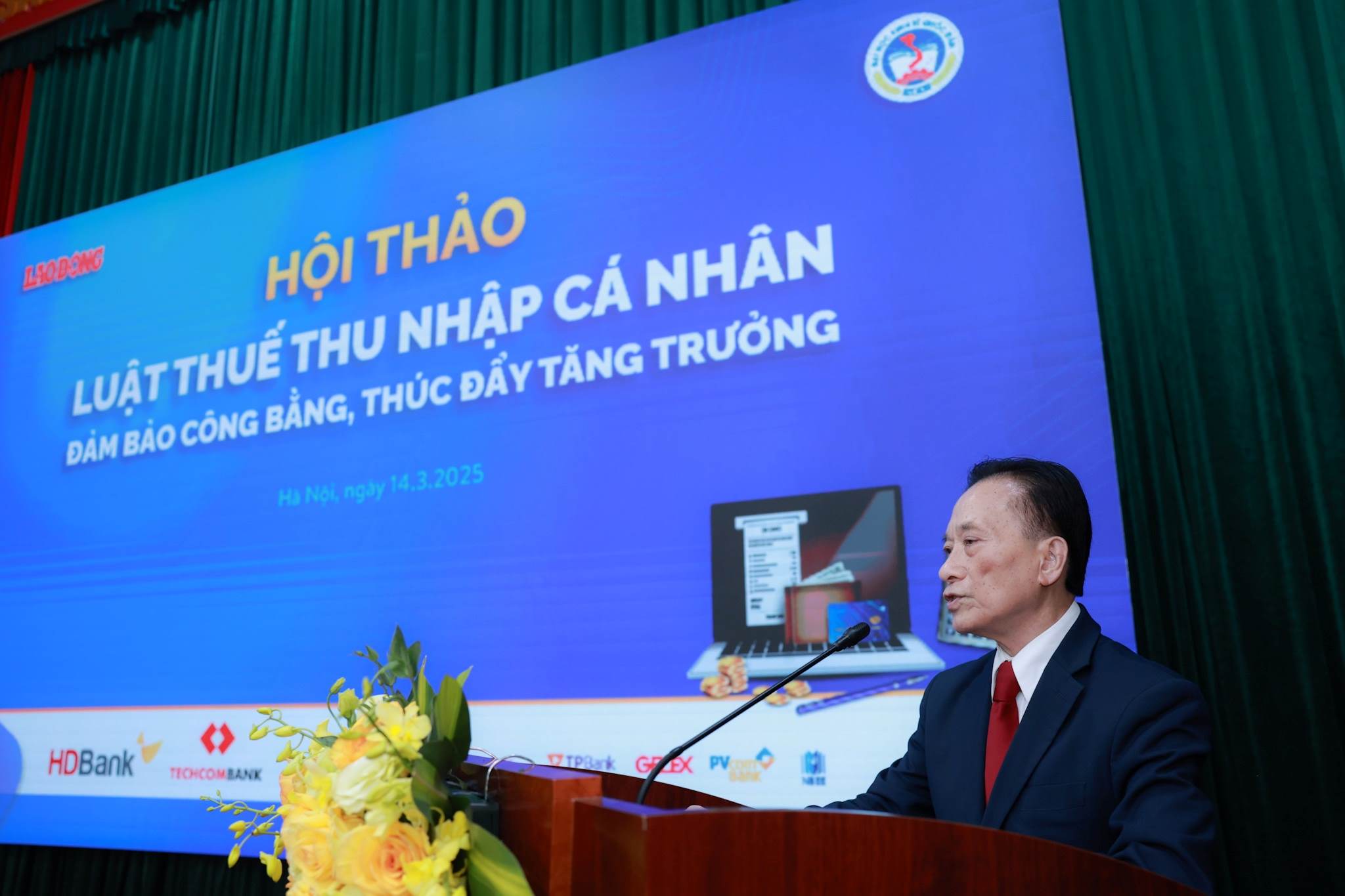

The family deduction level needs to be adjusted according to economic fluctuations

At the workshop " individual Income Tax Law - Ensuring fairness, promoting growth", Associate Professor, Dr. Phan Huu Nghi - Deputy Director of the Institute of Banking and Finance, National Economics University - commented that the current family deduction level does not accurately reflect the actual income level of the people. "Average income per capita is about 4,600 USD/year, but common income can be up to 8,500 - 10,000 USD. Therefore, there needs to be accurate statistics to determine a reasonable tax rate, instead of applying fixed levels of 11 million, 18 million or 25 million VND/month," he said.

Sharing this view, Ms. Nguyen Thi Cuc - President of the Tax Consulting Association - said that the family deduction level should be adjusted according to the consumer price index (CPI). "If the CPI increases by 20%, the deduction level also needs to increase accordingly to ensure that workers are able to cover their living expenses after tax," she analyzed. However, she also emphasized that the adjustment needs to be implemented synchronously with other factors of the tax system to ensure fairness for all income groups.

Associate Professor, Dr. Le Xuan Truong - Head of the Tax Department, Academy of Finance - proposed to determine the family deduction level based on the principle of ensuring that the remaining income of employees after tax is enough to maintain an average living standard."If there is no family deduction, a single person with an income of 16 million VND/month will have to pay many times higher tax than at present," Mr. Truong cited.

Many countries in the world have had flexible adjustment policies on family deduction levels."In Indonesia, the family deduction is equivalent to 0.7 times GDP per capita, while in the UK it is 0.3 times.Vietnam can refer to it to determine a reasonable deduction level," said Associate Professor, Dr. Le Xuan Truong.

The progressive tax structure needs to be considered

In addition to the family deduction, the personal income tax declaration is also an issue that receives much attention. Currently, Vietnam applies a progressive tax rate of 7 levels, from 5% to 35%. According to experts, this highest tax rate is higher than corporate income tax (20%), which can create certain impacts on the high-income labor group.

Ms. Nguyen Thi Cuc commented: "Redesigning tax plans, especially extending the gap between tax levels, will help reduce tax pressure for people with average and high incomes". According to Ms. Cuc, many countries have adjusted the number of tax rates and lowered the highest tax rate to 25-30% to ensure competition and attract highly skilled workers.

Associate Professor, Dr. Phan Huu Nghi also said that the trend of tax reform in many countries is aiming to "reduc the tax burden for workers, expand the tax base to adapt to digital transformation and globalization". According to Mr. Nghi, in Vietnam, the current rate of increase in personal income tax revenue is higher than the actual rate of increase in people's income, which shows that there needs to be appropriate adjustment to ensure the reasonableness of tax rates.

Reforming personal income tax to create development momentum

Experts have made a number of specific proposals to adjust tax policies to better suit reality.

Associate Professor, Dr. Le Xuan Truong said that it is necessary to "adjust the family deduction level flexibly, associated with CPI or GDP per capita to accurately reflect the actual living standards of workers". He emphasized that this will help ensure that workers' after-tax income is still enough to maintain a suitable standard of living.

Ms. Nguyen Thi Cuc proposed "reducing the number of tax rates and adjusting the highest tax rates", because according to her, having too many tax rates makes income regulation not really reasonable. "The highest tax rate of 35% is also higher than corporate income tax, there needs to be adjustment to ensure fairness and attract highly qualified workers," said Ms. Cuc.

Emphasizing the need to "improve the tax system", Associate Professor, Dr. Phan Huu Nghi said that it helps taxpayers easily fulfill their obligations without encountering difficulties in administrative procedures. According to him, applying technology to tax management will help increase transparency, limiting errors in tax declaration and settlement.

Some experts also propose further research on other tax policies. "It is necessary to review inheritance tax and real estate tax to expand the tax base, ensuring a stable source of revenue for the State budget", Associate Professor, Dr. Le Xuan Truong suggested. He said that reasonable taxation on certain types of assets can help reduce pressure on personal income tax, creating more fairness in the tax system.

Second real estate tax: Consider benefits and impacts

The second real estate tax has caused a lot of controversy. Experts say that it is necessary to consider carefully to ensure fairness, avoid speculation and impact the economy.

In the context of public discussions on property tax, especially "heritage tax" and "second estate tax", scientists have given different perspectives on the reasonableness and feasibility of this policy.

Ms. Nguyen Thi Cuc - President of the Tax Consulting Association - commented that taxing a second home is not really reasonable, because "the area and value of each person's house are different". Instead of focusing only on real estate, she proposed a comprehensive asset tax policy, applicable to even large-value assets such as boats and air tickets, while excluding depreciated assets. She also emphasized that "saving deposit interest rates should not be applied at the present time".

Regarding inheritance and gift tax, Associate Professor, Dr. Le Xuan Truong - Head of the Tax Department, Academy of Finance - proposed to exempt tax for transactions between parents, spouses and children, and at the same time set the taxable threshold of 5 billion, 10 billion VND or higher to ensure fairness. He also mentioned international experience such as first-time real estate registration tax or annual tax. In the UK, second real estate owners have to pay an additional 30% of tax when registering, he cited.

Dr. Nguyen Tri Hieu added a perspective from the US, where real estate tax is collected annually based on market value. "If the value of the property increases, the tax rate will also be adjusted accordingly," said Mr. Hieu. According to him, in Vietnam, the imposition of a second real estate tax is necessary to create social justice and limit speculation. Many home buyers do not have to live but to huge up waiting for prices to increase, causing market imbalance, Dr. Hieu emphasized.

The above opinions show that a second property and real estate tax can help increase budget revenue, create social justice and limit speculation. However, the implementation needs to be carefully considered, setting an appropriate threshold so as not to affect people with real housing needs, while avoiding negative impacts on the real estate market and the economy. Tax policies need to have a reasonable roadmap, referring to international experience to ensure effectiveness and feasibility in practice.