Updated SJC gold price

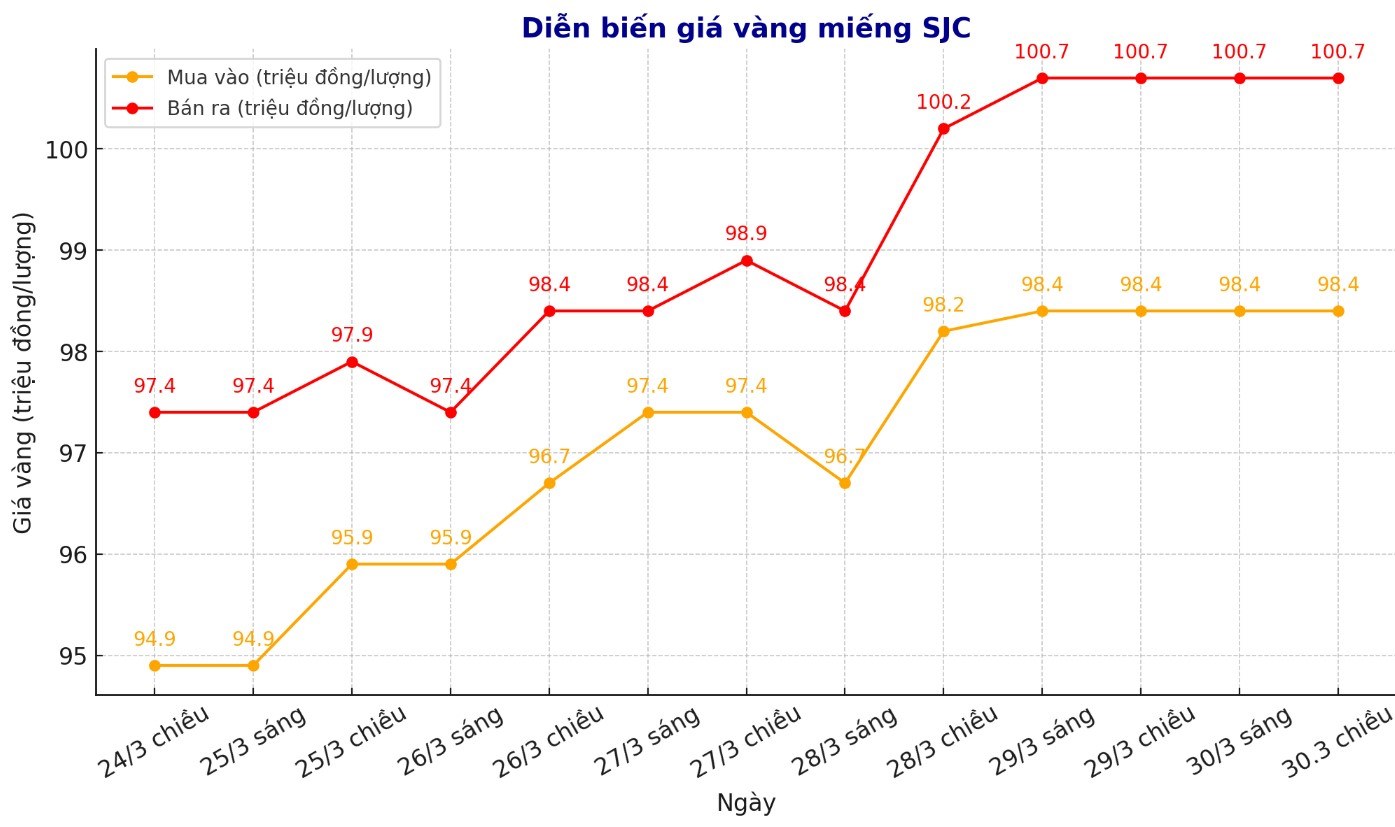

As of 5:15 p.m., the price of SJC gold bars was listed by DOJI Group at 98.4-100.7 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 23, 2025), the price of SJC gold bars at DOJI increased by VND4 million/tael for buying and VND3.3 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2.3 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 98.4-100.7 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session (March 23, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by VND4 million/tael for buying and VND3.3 million/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of March 23 and selling it in today's session (March 30), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both make a profit of 1 million VND/tael.

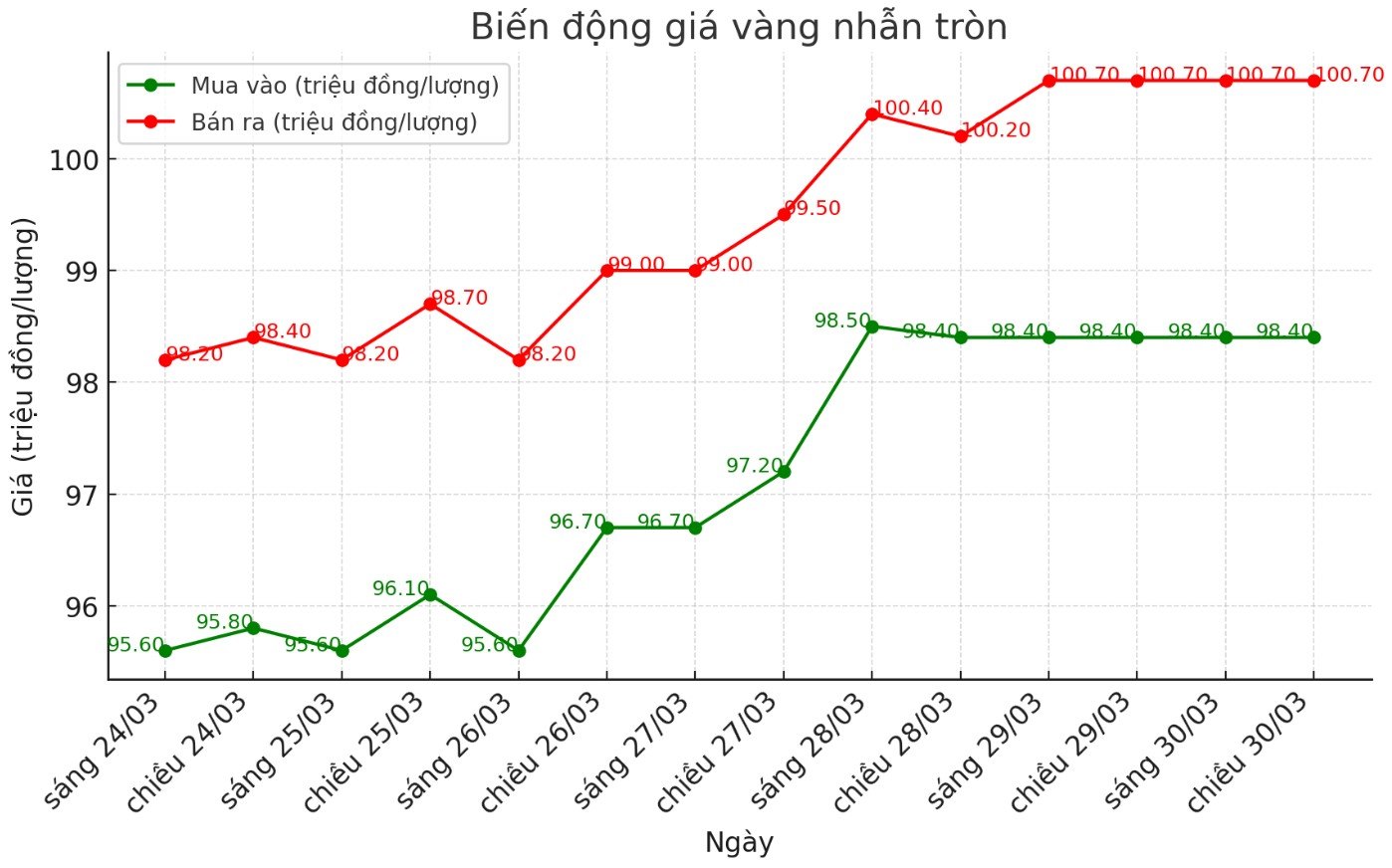

9999 round gold ring price

As of 5:15 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.4-100.7 million VND/tael (buy - sell); an increase of 2.8 million VND/tael for buying and an increase of 2.5 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 2.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.9-100.9 million VND/tael (buy - sell); an increase of 2.8 million VND/tael for buying and an increase of 2.3 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 2 million VND/tael.

If buying gold rings in the session of March 23 and selling in today's session (March 30), buyers at DOJI will make a profit of VND 200,000/tael, while buyers at Bao Tin Minh Chau will make a profit of VND 300,000/tael.

High price difference, risks for investors

Although gold prices have continuously hit new peaks, the gap between buying and selling prices is currently high, directly affecting investors' profits. In the context of strong market fluctuations, buying gold at a large price difference can put investors at risk, especially when prices are adjusted.

The high price difference forces investors to wait for prices to increase more strongly to make a significant profit. For example, if an investor buys SJC gold at a selling price of VND100.7 million/tael and immediately wants to resell it at a buying price of VND98.4 million/tael, they will lose VND2.3 million/tael due to a large price difference.

To make a profit, gold prices need to increase by at least 2.3 million VND/tael, which must exceed 100.7 million VND/tael. This increases the risk of investment. Therefore, the large price difference range creates a disadvantage for those who intend to short-term surfing. When buying at a high level, if prices do not continue to increase sharply or there is an adjustment, investors will take more time to make a profit. This is a factor that needs to be carefully considered before deciding to invest in gold in the current period.

Experts recommend that when deciding to invest in gold, investors should not only pay attention to the upward trend but also consider the difference between buying and selling prices to optimize profits and limit risks. In the context of strong fluctuations in gold prices, choosing a reasonable buying and selling time and closely monitoring market developments is very important.

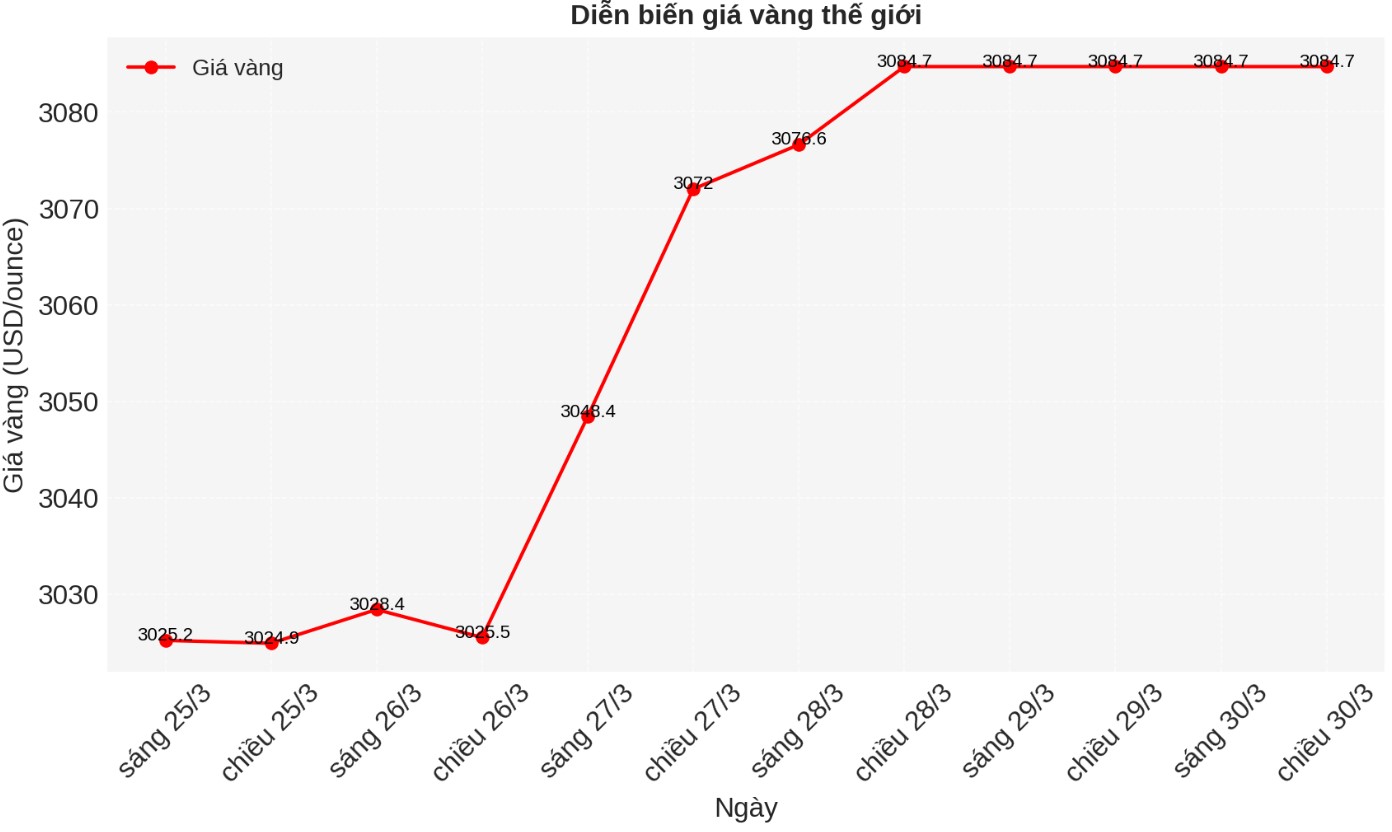

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,084.7 USD/ounce, up 61.3 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices at the end of the weekend session received support when the USD decreased. Recorded at 5:15 p.m. on March 30, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.710 points (down 0.27%).

According to Kitco News' weekly survey, industry experts show strong optimism about gold's upside potential. Meanwhile, retail investors are only modestly increasing expectations.

This week, 20 analysts participated in the survey of Kitco News. After last week with a balanced mentality, the buyers on Wall Street almost took complete control. There are 15 experts (accounting for 85%) predicting that gold prices will continue to increase next week. Only 1 expert (5%) predicted that gold would fall, while the remaining 2 (10%) predicted that gold would move sideways and continue to accumulate.

Meanwhile, Kitco's online poll recorded 202 votes. 129 investors (64%) expect gold prices to continue to rise next week, 39 (19%) predict gold will fall and the remaining 34 (17%) expect gold prices to move sideways.

See more news related to gold prices HERE...