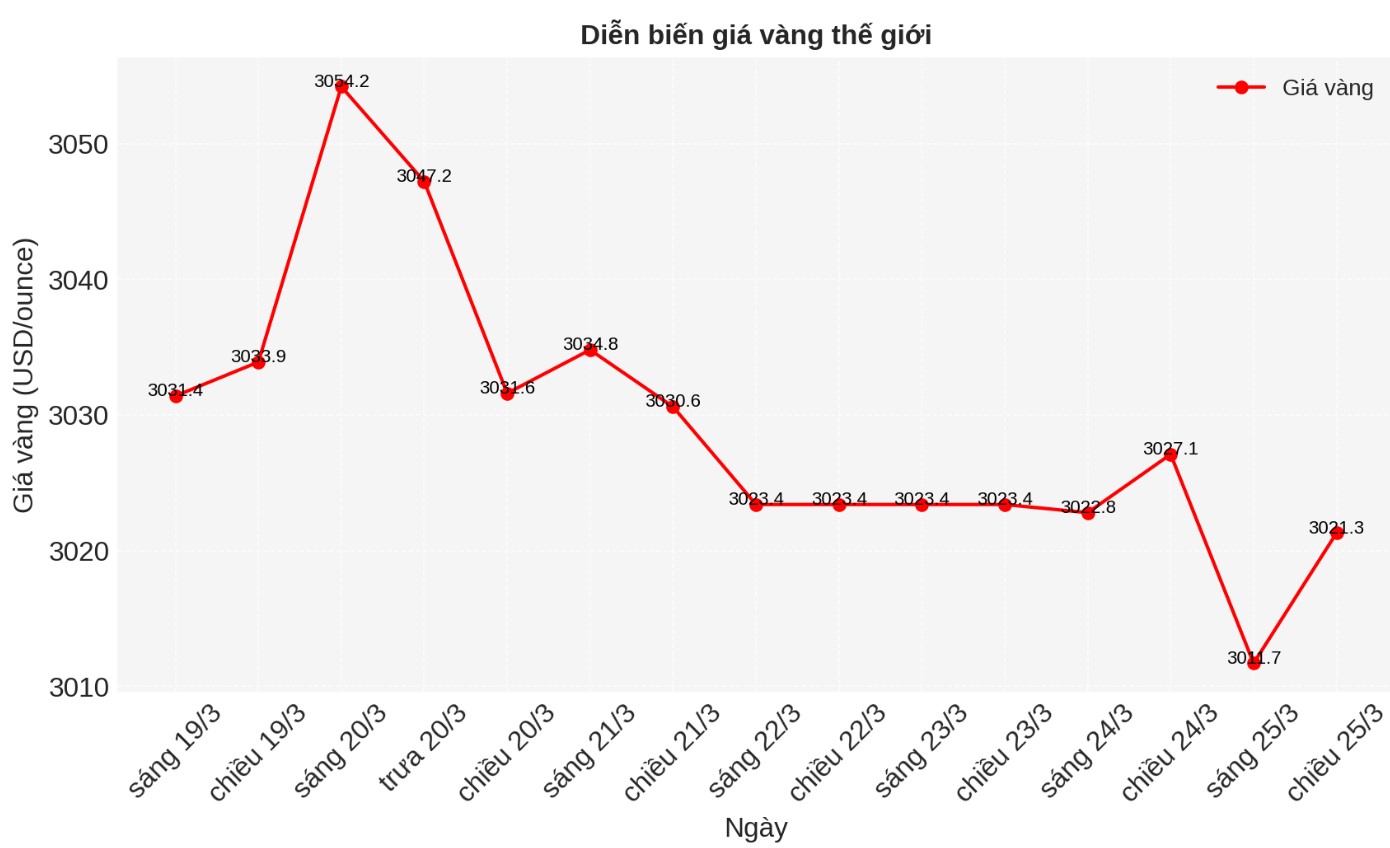

According to Reuters, gold prices increased slightly on Tuesday as uncertainty about US tariffs next week continued to boost demand for safe havens amid concerns about the US economic downturn and rising inflation. At 6:44 a.m. GMT, US gold futures also increased by 0.1%, reaching $3,019.70/ounce.

There is still much uncertainty about the scope and extent of US countervailing tariffs in the coming period. Gold still found certain support as a hedge against potential surprises," IG market strategist Yeap Jun Rong said.

On Monday, US President Donald Trump announced that tariffs on cars will be imposed, pointing out that not all of the tariffs he had declared would be implemented on April 2, a move that Wall Street viewed as a sign of flexibility in the issue that has disrupted the market over the past week.

Donald Trump's tax policies are often expected to help slow economic growth, causing further trade tensions and pushing inflation higher.

Atlanta Federal Reserve Chairman Raphael Bostic said he expects inflation to slow in the coming months. Therefore, he believes that the US Federal Reserve (FED) will only cut the standard interest rate by a quarter of a percentage point by the end of 2025.

Gold, seen as a hedge against geopolitical and economic uncertainty, has thrived in a low-interest-rate environment.

Marc Chandler - CEO of Bannockburn Global Forexn commented that the threat of tariffs will continue to support gold prices at over 3,000 USD/ounce.

According to Adam Button - Head of currency strategy at Forexlive.com, profit-taking after gold's recent increase is normal. He said that gold's holding above $3,000/ounce is an important milestone.

Meanwhile, market analyst Everett Millman of Gainesville Coins also noted that the current pullback is a good development in the larger uptrend of gold.

The market is now waiting for the Fed's personal spending index and inflation index, due out on Friday, to assess the central bank's next steps.

Meanwhile, gold-backed funds in gold mining companies are set to attract their largest monthly net flows in more than a year in March, as gold prices hit record highs, improved the company's profit outlook and increased cash flow.

Spot silver prices rose 0.3% to $23.1/ounce, platinum rose 0.2% to $974.65 and palladium rose 0.2% to $953.53.

See more news related to gold prices HERE...