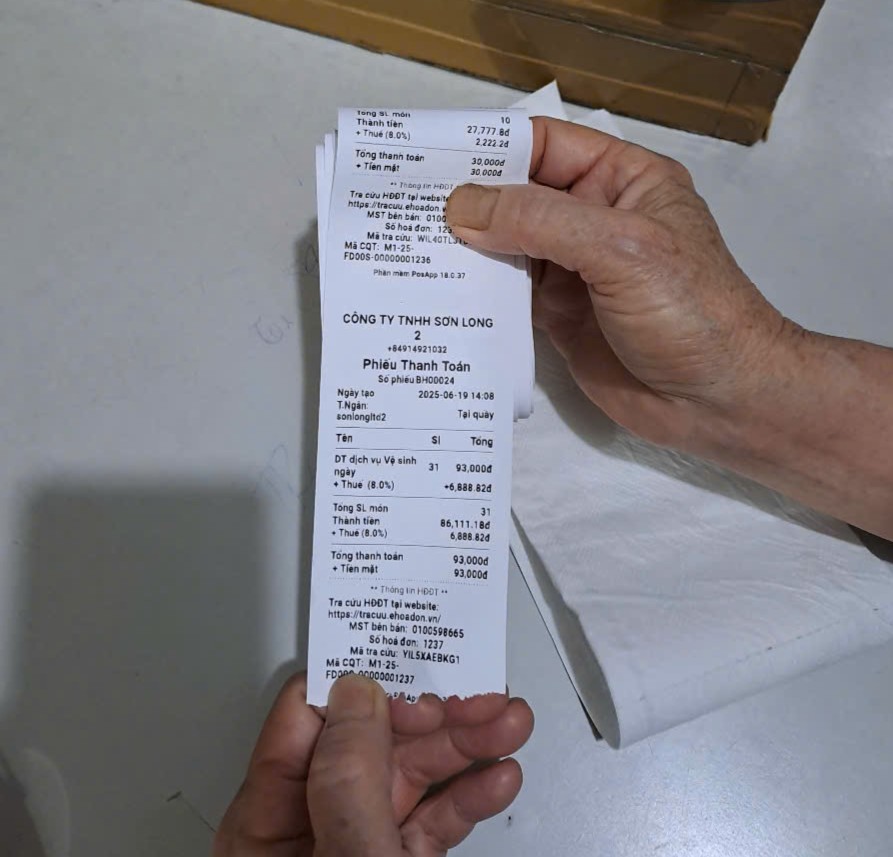

In recent days, many social networking sites have spread information that a toilet in Hanoi pays value-added tax (VAT) bills to customers who buy the user. The person who posted this information shared that the toilet collects a fee of 6,000 VND for 2 uses, including an 8% VAT.

The invoice issued on June 6, 2025, clear information and full tax payment even though the service is provided at a price considered " insignificant", has caused the online community to discuss. The invoice creator is Son Long Company Limited in Long Bien District, Hanoi (Son Long Company).

Sharing her views on this, Ms. Ha Thi Lien - a trader (Gia Lam, Hanoi) - said that the service fee is too small to issue invoices, while others are worried that the management unit will collect more money from customers to cover expenses.

Mr. Anh Tuan - a trader at Ninh Hiep market - is worried that many export invoices may be thrown by customers, causing pollution.

The opposite view is like that, but according to the reporter's records, the incident also received a lot of support for the transparent business action and full tax payment of the market management unit.

Talking to Lao Dong reporter, Son Long Company's accountant confirmed that the above invoice was created by the company. Accordingly, the rice paper that is causing a stir was paid by the company to customers using the toilet of Son Long market (Ninh Hiep commune, Gia Lam district, Hanoi) - a market invested by Son Long Company.

The accountant said that the price of all services the company is providing includes 8% VAT. The two lowest-priced services are toilets and parking are no exception.

"We charge a fee of VND3,000/guest to use the restroom, of which VAT is VND240. Similar to the parking fee of 10,000 VND/trip, the VAT of 800 VND is included.

The company has paid VAT for the two services for many years, but only issued a pair of invoices at the end of the day. From June 1, we have switched to issuing invoices to comply with the new regulations. Although costs arise, the service price remains unchanged, said the accountant.

Ms. Nguyen Thi Yen, a construction worker in charge of the toilet at Son Long market, shared that the toilet is used by 200-300 customers every day. Having to issue retail invoices makes her work a little more complicated.

But there are basically no problems. Service prices remain unchanged, so customers are not affected, some people are surprised but no one says anything. Most customers will not get the bill, so I roll it up in one place to avoid causing environmental pollution," said Ms. Yen.

Commenting on the market issuing invoices for each toilet visit, Mr. Nguyen Van Quang - a person who came to buy goods - said that issuing invoices each time like that was not necessary. However, he still supports compliance with new regulations of the management unit, aiming for an increasingly transparent business environment.

Regarding the controversy over whether it is necessary to create invoices for very small value transactions, economic expert Dinh Trong Thinh said that the authorities need to carefully and in detail consider the above special cases, or transactions arising in disadvantaged areas that make issuing invoices inconvenient, thereby issuing reasonable and appropriate regulations.

Also related to the above issue, Ms. Ngo Thi Lua - Director of accounting services and tax agents Luka - said that for transactions with very small value, the seller of goods and services should send an official dispatch to the tax authority to be considered for application of the appropriate mechanism.