The US dollar (USD) is struggling to gain ground on the final trading day of the third quarter, September 30, according to FXStreet. This morning, investors will closely monitor consumer price index (CPI) data from Germany. Later in the US session, Federal Reserve Chairman Jerome Powell and several other officials will deliver important speeches.

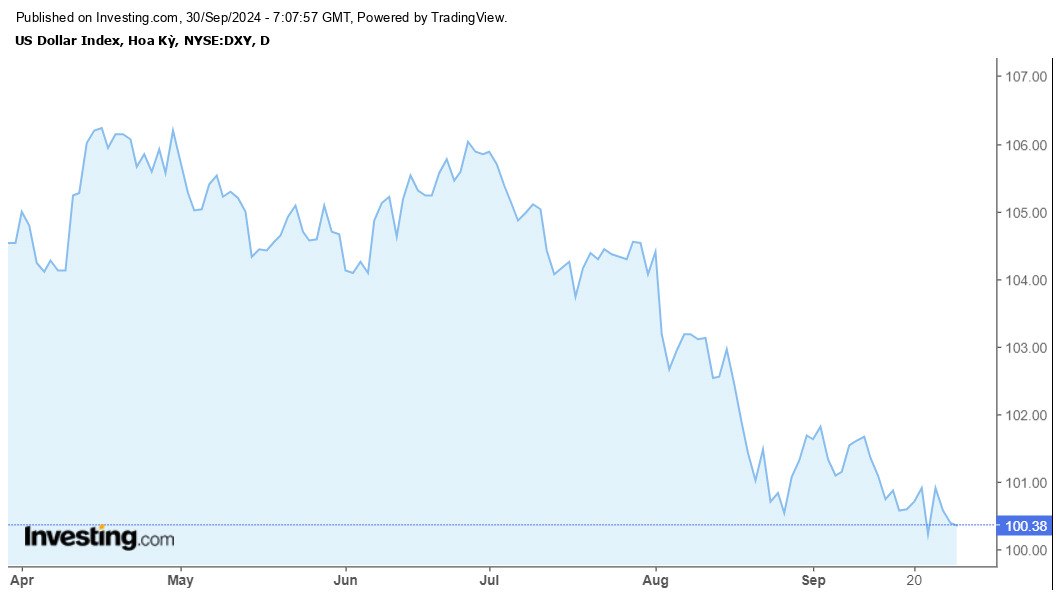

The dollar index fell to a more than one-year low of 100.15 on Friday (September 27, 2024), before making a slight correction over the weekend. New data from the US Bureau of Economic Analysis showed that the core personal consumption expenditures (PCE) price index rose 0.1% in August, below market expectations of 0.2%.

The dollar index remained below 100.50 on Monday morning. Powell will also participate in a panel discussion at the National Association for Business Economics' annual conference in Nashville, starting at 17:00 GMT. Fed Governor Michelle Bowman will also speak at the same time. US stocks traded slightly lower.

In Australia, the business confidence index improved from 50.6 in August to 60.9 in September, helping the AUD/USD pair rise to its highest level since February 2023, surpassing the 0.6900 threshold.

In the UK, the Office for National Statistics announced a downward revision of second-quarter GDP growth to 0.7% from the previously reported 0.9%.

After a sharp decline on Friday, the USD/JPY pair continued to decline on Monday morning, approaching the 142.00 level.

The EUR/USD pair is quite stable during the European trading session, hovering above 1.1150.

According to Lao Dong, on September 30, the DXY index - measuring the strength of the greenback - is currently fluctuating around 100.31-100.48.