On December 10, 2025, the National Assembly passed the Law on Personal Income Tax (amended) with 4 Chapters, 30 Articles. In which, raising the non-taxable revenue threshold to 500 million VND/year and deducting this level before calculating tax according to the ratio on revenue. At the same time, adjusting the corresponding value-added tax non-taxable revenue level to 500 million VND.

Thus, in 2026, business households and individuals with annual revenue of less than 500 million VND/year will not be subject to value-added tax (VAT) and will not pay personal income tax (PIT).

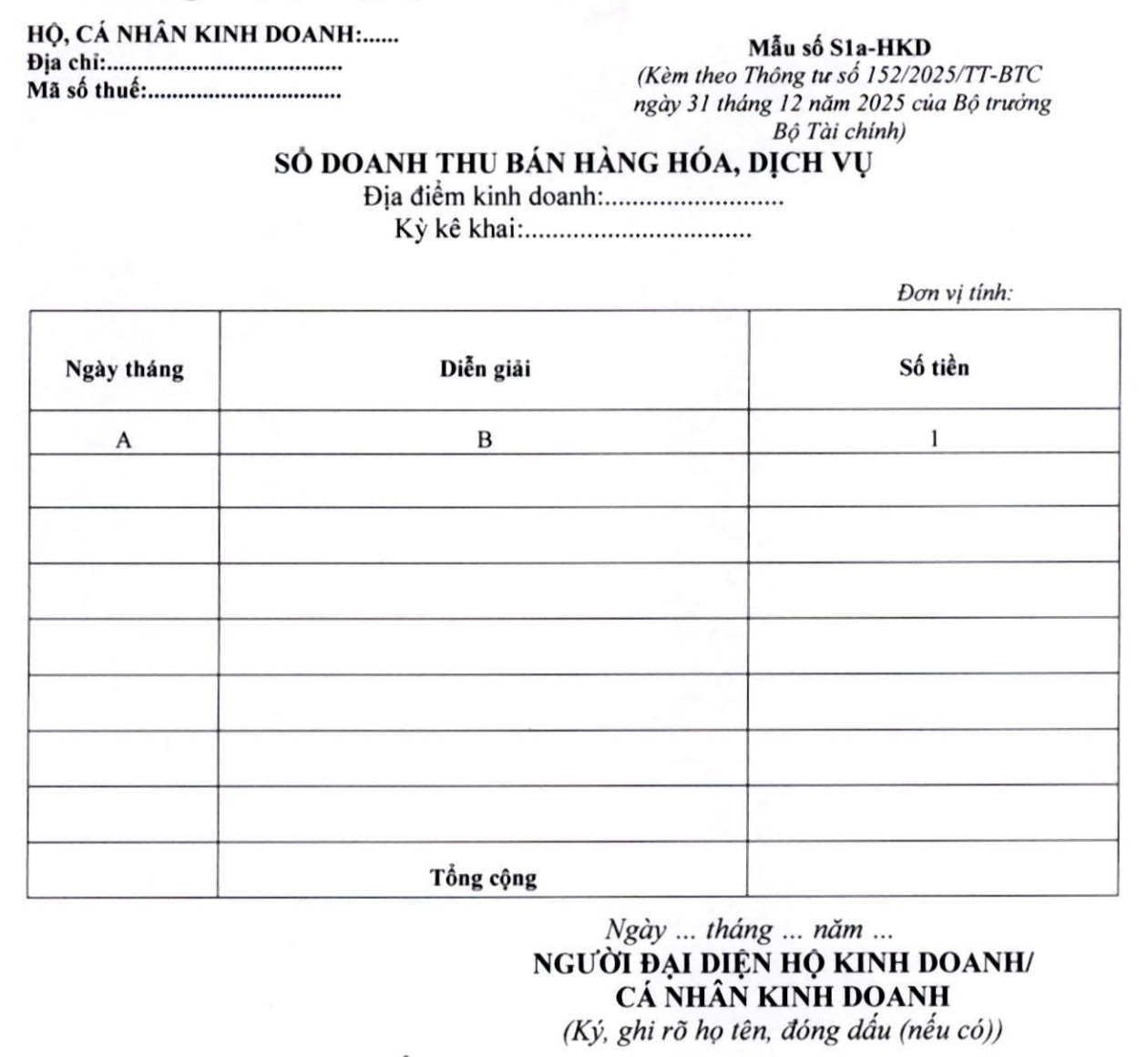

Based on Article 4 of Circular 152/2025/TT-BTС stipulating accounting guidance for business households and individuals with revenue of less than 500 million VND/year as follows:

[1] In case business households and individual businesses are not subject to value-added tax and do not have to pay personal income tax, they shall use Book 3 of sales revenue of goods and services (model number S1a-HKD) below to record sales revenue of goods and services:

[2] Bookkeeping method:

(i) This book is opened to record revenue from selling goods and services as a basis for declaring and determining whether business households and individuals are subject to VAT and pay PIT according to the provisions of tax law. In case business households and individuals declare revenue according to the provisions of tax law, business households and individuals can use this book to monitor and compare data with tax authorities.

(ii) Bookkeeping method:

- Column A: Record the date and month recorded in the book.

- Column B: Recording the revenue from selling goods and services. Business households and individuals can record according to each arising business or periodically.

- Column 1: Record the amount of money from selling goods and services.