From January 1, 2026, the fixed tax mechanism for business households was officially abolished, replaced by the form of declaration and tax payment based on actual revenue. This is considered a turning point in tax management, towards greater transparency and fairness.

As the application time is approaching, many business households are still wondering: What types of taxes will be paid, what obligations and what risks if they do not comply with regulations?

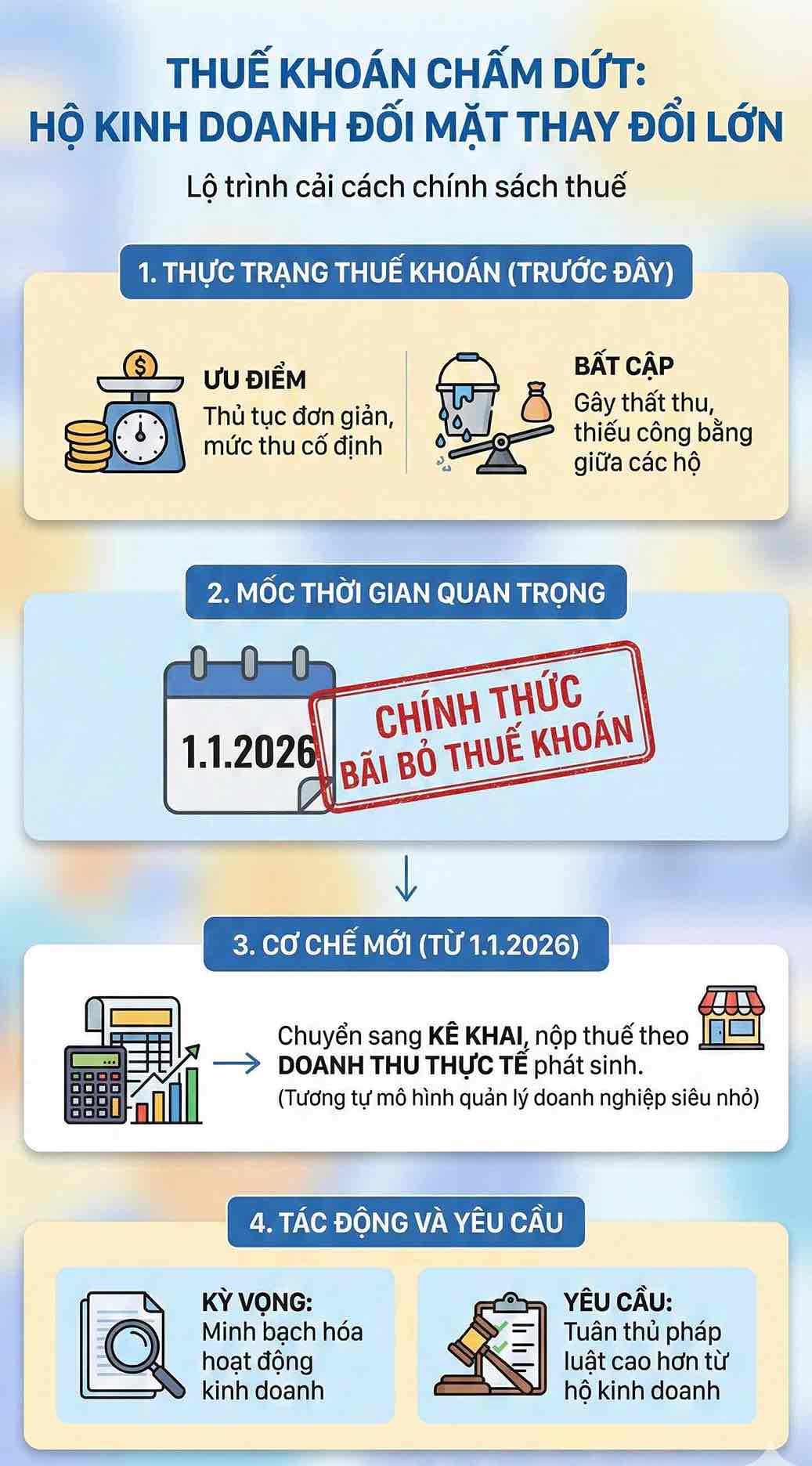

Contract tax ends, a shift in household business management

For many years, fixed tax has been applied to simplify procedures for small business households. However, this mechanism reveals many limitations such as difficulty reflecting actual revenue, lack of transparency and easy occurrence of budget revenue loss.

According to the tax system reform orientation approved by the National Assembly, from January 1, 2026, the fixed tax mechanism will no longer be applied. Instead, business households will declare and pay taxes according to actual generated revenue, similar to the management method for small-scale enterprises.

This change aims to ensure fairness in the performance of tax obligations, while improving transparency in business operations.

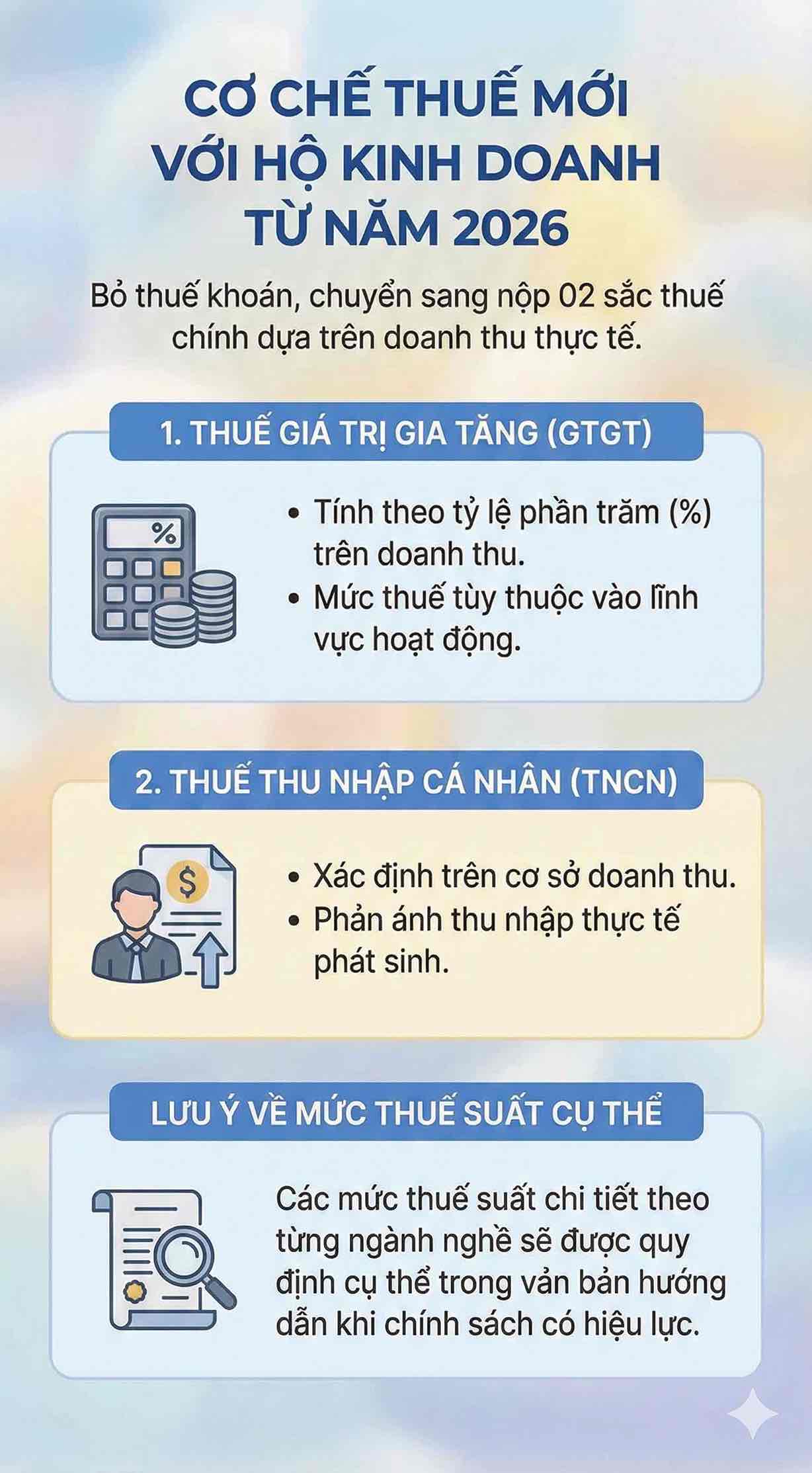

New tax mechanism for business households from 2026

According to current regulations and policy orientations being implemented, when contract tax is abolished, business households will fulfill tax obligations for two main taxes:

Value-added tax (VAT) is calculated as a percentage of revenue, depending on the field of operation of the business household. The application of specific tax rates will be based on detailed regulations in decrees and guiding circulars issued by competent authorities.

Personal income tax (PIT) for business households is determined based on revenue, reflecting actual income arising during the business process.

Specific tax rates for each industry will continue to be detailed in the guidance document when the policy officially takes effect.

Revenue threshold and tax obligations

According to current regulations, business households with revenue of less than 500 million VND/year are exempt from VAT and PIT. From this threshold and above, business households must:

- Implement tax declaration according to regulations

- Pay all arising taxes

- Comply with the invoice and document regime according to the guidance of the tax authority.

This is a fundamental difference compared to the previous fixed tax mechanism, when the tax rate was mainly fixed annually.

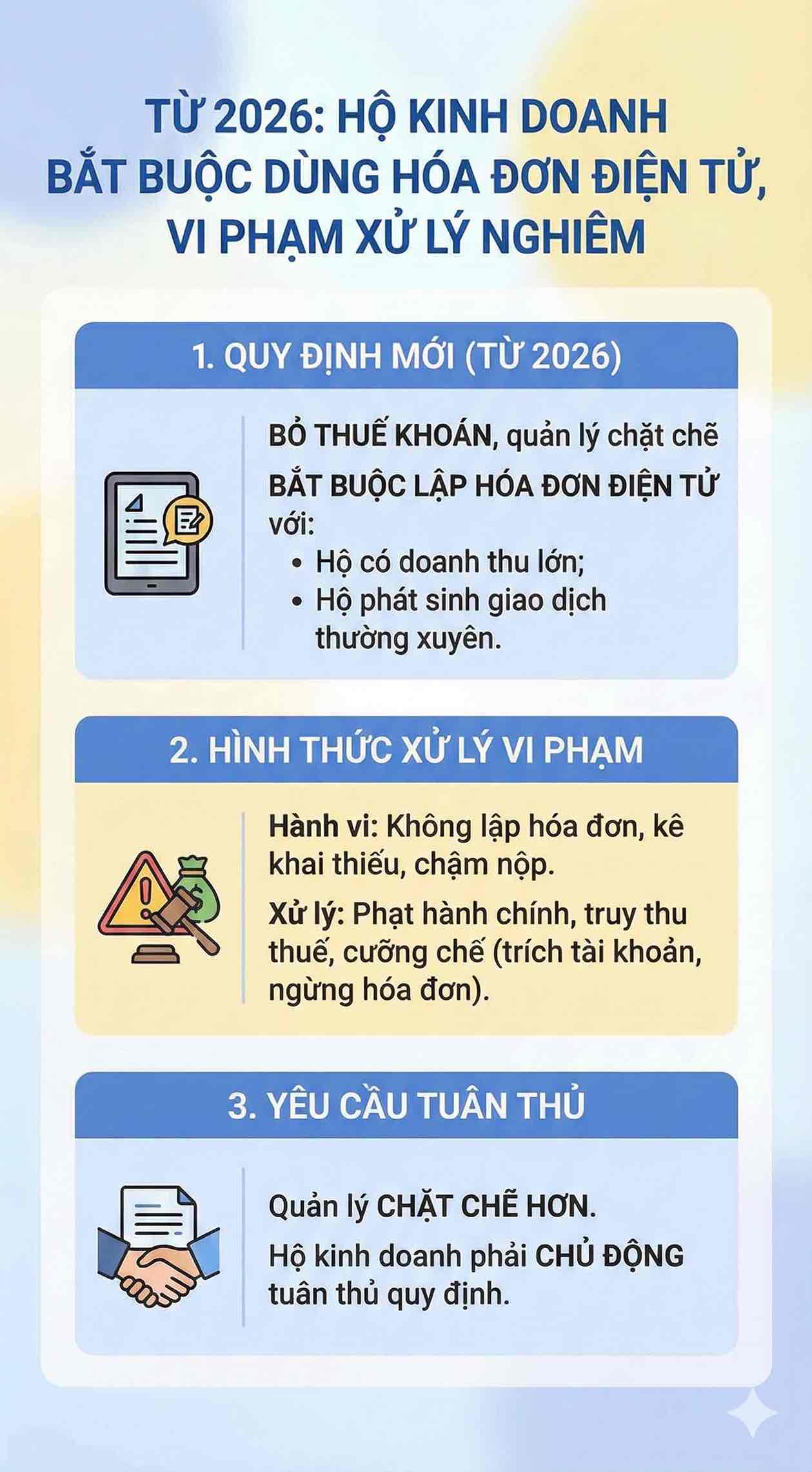

Not issuing electronic invoices, business households may be heavily fined

Along with the abolition of fixed tax, the use of electronic invoices will be managed more strictly. According to regulations, business households with large revenue or regular transactions are required to make invoices when selling goods and providing services.

In case of not issuing invoices, declaring insufficient revenue or late payment of tax dossiers, taxpayers may be administratively sanctioned, recover the remaining tax arrears, and even apply coercive measures such as deducting money from accounts, and stopping using invoices.

Compared to the previous period, tax management from 2026 is assessed as stricter, requiring business households to proactively comply with regulations instead of relying on the fixed tax mechanism as before.

Business households are prone to risks when abolishing fixed tax if they do not prepare early

According to the recommendations of specialized agencies, right from this time, business households should proactively review revenue, practice recording books, and learn about regulations on electronic invoices and tax declaration obligations.

Early preparation not only helps avoid the risk of being penalized when the policy takes effect, but also helps business operations become more transparent, stable and sustainable in the long term.

The abolition of fixed tax from 2026 is an important step in tax policy reform, towards more transparent and fair management. However, along with that is a greater responsibility for business households in declaring and paying taxes in accordance with regulations.

Understanding regulations, understanding obligations correctly and proactively adapting will be decisive factors for business households not to fall into a passive position when the new policy officially takes effect.