Domestic coffee prices decrease for the second consecutive session

The domestic coffee market continued to decrease by 500 VND/kg compared to yesterday, marking two consecutive days of plummeting prices. Since the beginning of the week, coffee prices have lost a total of 2,000 VND/kg.

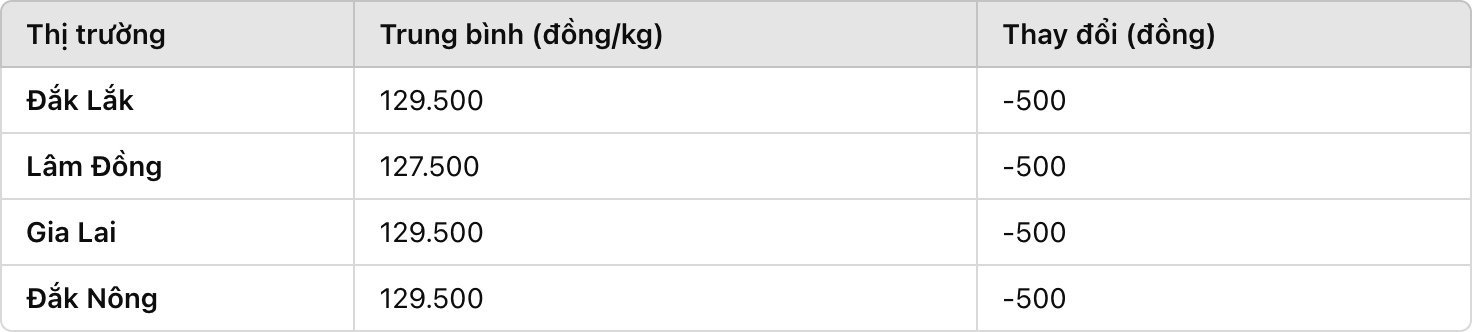

Currently, coffee prices in key areas such as Dak Lak, Gia Lai, Dak Nong are at 129,500 VND/kg, down 500 VND compared to yesterday. Lam Dong has the lowest price, reaching 127,500 VND/kg.

World coffee prices continue to plummet

On the London Stock Exchange, Robusta coffee prices fell nearly 1% when the May delivery contract decreased by 46 USD/ton. Meanwhile, Arabica on the New York exchange only fluctuated slightly but was still in the general downtrend.

The market has not shown any signs of recovery

Coffee prices have continuously decreased in the past week due to many factors. First of all, abundant supply from Brazil and Vietnam continues to put pressure on prices. In addition, consumer demand shows signs of slowing down, causing transactions to become quiet.

Data from ICE shows that Arabica coffee inventories are increasing, which has limited investment funds' purchases. Meanwhile, the Robusta market is also under great pressure as exporters are selling strongly because they are worried that prices may decrease further.

The weather situation in the main growing areas has not had a strong impact on the supply. Rainfall in Minas Gerais (Brazil) is lower than the historical average, but not enough to affect upcoming crop yields. Therefore, there is no factor to support coffee prices to increase again in the short term.

Coffee price forecast

According to experts' analysis, coffee prices may continue to decrease slightly in the short term due to the large supply pressure. The latest forecast shows that Robusta prices may decrease by about 100-150 USD/ton if buying pressure does not return soon.

In the medium term, the market could recover in April as Brazil enters a new harvest. This is often the time when coffee prices have adjusted slightly up due to increased demand from roasters.

However, the market still has many potential risks, especially in the context of an unstable global economy. According to a Reuters survey, Arabica coffee prices could fall by about 30% by the end of 2025, down to $6,200/ton.