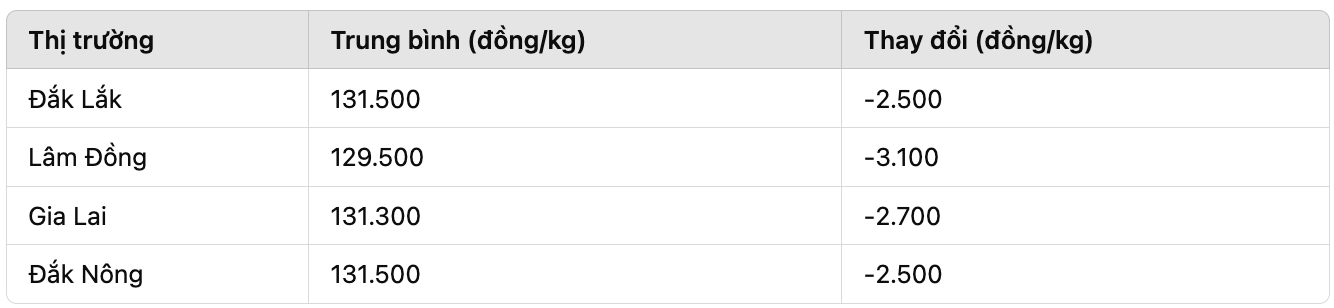

Domestic coffee prices

The domestic coffee market today continues to decline sharply, losing 2,500 - 3,100 VND/kg compared to yesterday. Lam Dong was the area with the biggest decrease with a decrease of VND 3,100/kg, pushing the price down to VND 129,500/kg. Other provinces such as Dak Lak, Gia Lai, Dak Nong also recorded a sharp decrease, bringing the average price to 131,300 - 131,500 VND/kg.

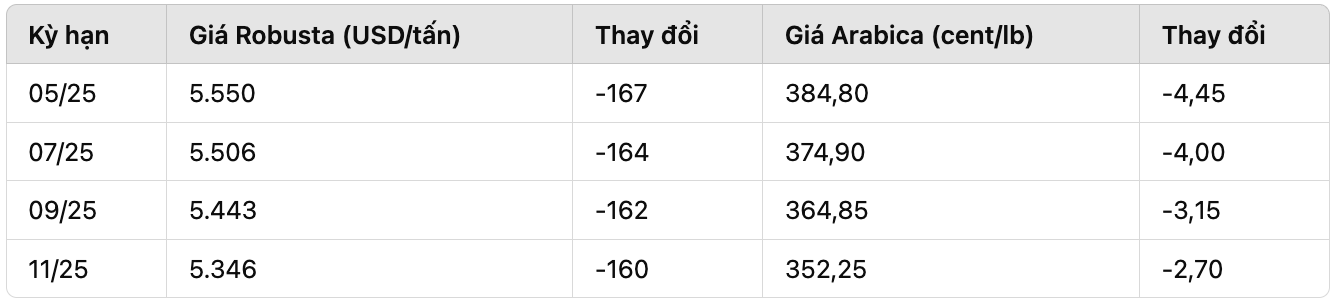

World coffee prices

On the London Stock Exchange, Robusta coffee prices fell more than 2.9%%, the contract for the May 2025 term lost 167 USD, down to 5,550 USD/ton. The contract for July 2025 also decreased by 164 USD, to 5,506 USD/ton.

On the New York Stock Exchange, Arabica coffee prices fell sharply when the contract in May 2025 lost 4.45 cents/lb, to 384.80 cents/lb. The July 2025 contract also decreased by 4 cents/lb, closing at 374.90 cents/lb.

Market analysis

Coffee prices fell sharply due to pressure from many factors. In the world market, the sell-off continues as investors worry about a recovery in coffee inventories, while consumption demand shows signs of slowing down.

According to Somar Meteorologia, rainfall in Minas Gerais - Brazil's largest Arabica growing area - reached only 11.4 mm last week, 76% lower than the historical average. However, this is not enough to support prices, because the market is still under pressure from abundant supply.

In Uganda, coffee exports in January increased sharply by 14.43% in volume and up to 83.4% in turnover value compared to the same period last year, reaching 550,341 bags. Notably, Robusta exports increased by 20.64%, while Arabica decreased by 17.6% due to the 2-year cycle of Arabica coffee in this country.

The domestic market also witnessed a sharp decrease in prices. Purchasing demand weakens as businesses have completed export orders in the short term. On the other hand, the supply of the new crop is still being brought to the market, causing coffee prices to not recover.

trend forecast

targets: Coffee prices may continue to correct in the next few sessions, due to profit-taking pressure and fluctuations in the USD.

Medium term: Coffee supply in Vietnam and Brazil will be an important factor affecting prices. If actual output in Brazil does not decrease as strongly as expected, the market will continue to be under downward pressure.

ahead of schedule: As Brazil enters the new harvest season, coffee prices could face further downward pressure. However, unfavorable weather factors may cause supply to decline, creating opportunities for coffee prices to recover in the second quarter of 2025.