World gold prices rose again in Tuesday's trading session, after plummeting sharply in the previous session. Thin liquidity at the end of the year made price fluctuations stronger, while investors still expect the underlying factors to continue pushing precious metals to new highs in 2026.

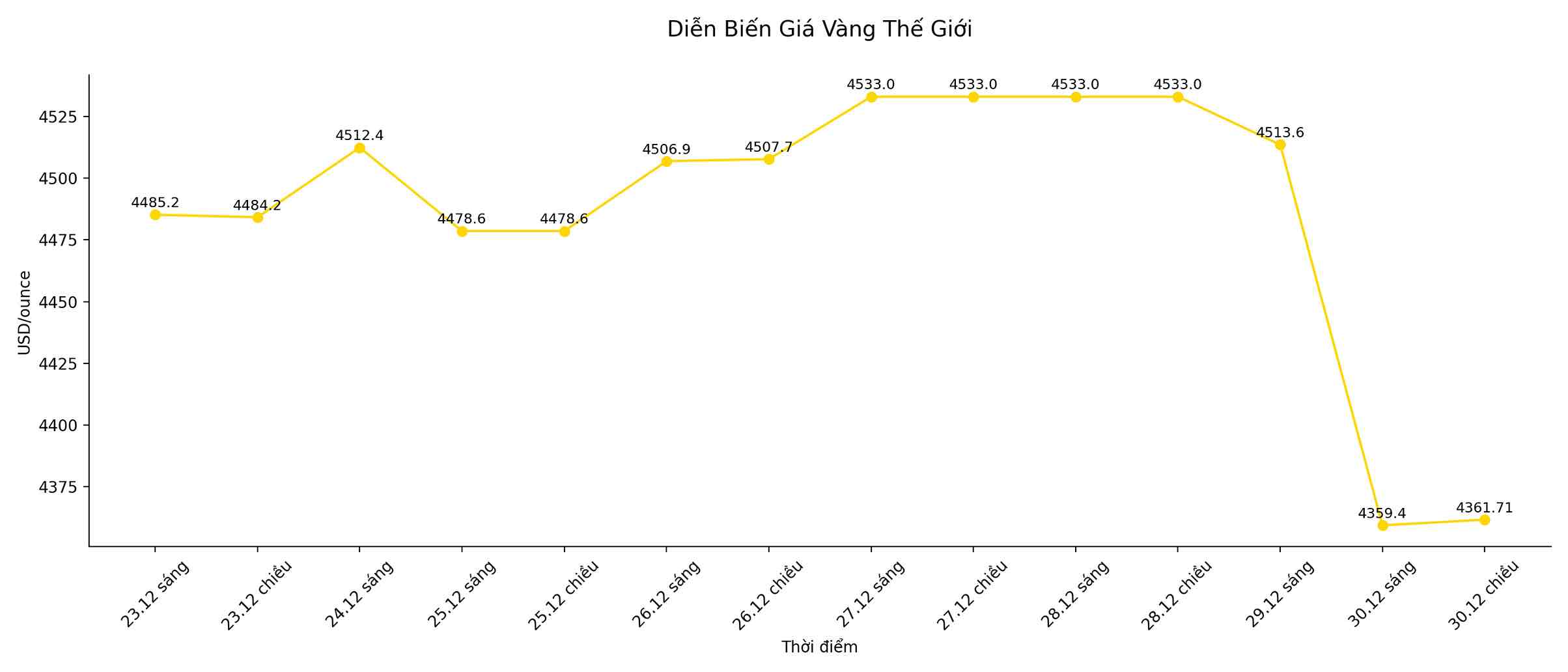

As of this afternoon's trading session, spot gold prices increased by 0.7%, to 4,361.71 USD/ounce, after hitting a record level of 4,549.71 USD/ounce last Friday. Previously, in Monday's session, gold fell to its lowest level since December 17, recording the strongest decrease in the day since October 21.

Gold futures for February delivery in the US also increased by 0.8%, to 4,377.20 USD/ounce.

Mr. Kyle Rodda, senior analyst at Capital.com, said that the recent strong fluctuation clearly reflects the thin trading characteristics during the holiday: "The sharp drop in gold prices right from the beginning of the week shows a very large level of fluctuation, partly amplified by low liquidity at the end of the year.

Technical indicators also show a technical correction momentum, as the RSI of both gold and silver has left the overbought zone in the first session of the week.

Despite short-term corrections, gold prices still recorded an impressive 66% increase from the beginning of 2025, thanks to a series of supporting factors such as expectations of the US Federal Reserve (Fed) reducing interest rates, prolonged geopolitical tensions, strong buying pressure from central banks and capital flows into gold ETF funds.

The market currently expects the Fed to cut interest rates at least twice next year, an environment that is considered favorable for non-profit assets such as gold.

Meanwhile, spot silver prices rose 3.1% to 74.49 USD/ounce, after hitting a record 83.62 USD/ounce in the previous session. However, the metal also recorded its strongest decline since August 2020 on Monday.

Since the beginning of the year, silver prices have increased by 158%, far exceeding gold's increase. The upward momentum was driven by the fact that silver was included in the US strategic mineral list, along with tighter supply and increased industrial demand.

Mr. Kelvin Wong, senior market analyst at OANDA, said: "I expect the long-term upward trend of both gold and silver to continue. In the next 6 months, gold prices may reach about 5,010 USD/ounce, and silver may reach 90.90 USD/ounce".

In other precious metals, platinum prices rose 1.8% to $2,146.81/ounce, after experiencing the sharpest decline in history on Monday, when this metal had just set a record high of $2,478.50/ounce.