According to the latest data from the US National Association of Realtors (NAR), the home price index in the US in November increased by 3.3% compared to the previous month, more than three times higher than analysts' forecast of 1.0%. This is considered a positive sign, showing that potential home buyers are returning to the market more strongly than expected.

Notably, October data was also adjusted up to 2.4%, instead of the initial announced level. By region, on-premises sales all recorded increases in all four major regions of the US including Northeast, Midwest, South and West.

Year-on-year, standby house sales increased by 2.6%, completely opposite to the forecast of a decrease of 0.6% and reversed compared to the decrease of 0.4% in October. Compared to the same period last year, buying and selling activities also increased in all regions, further strengthening expectations that the US housing market is gradually stabilizing after a prolonged period of weakening.

Mr. Lawrence Yun – Chief Economist of NAR – said that home buying momentum is clearly improving. According to him, reduced mortgage interest rates, faster wage increases than house prices and richer supply than last year are helping buyers feel more confident when returning to the market.

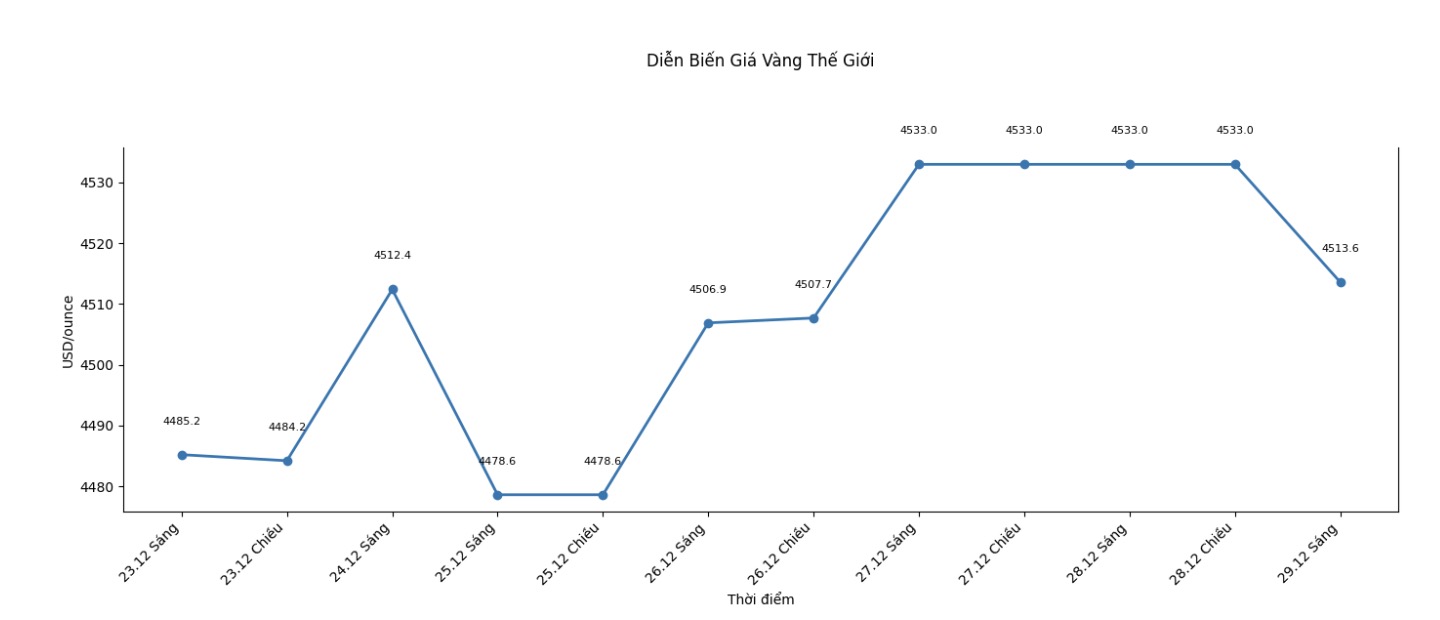

Immediately after housing data was announced, spot gold prices were under strong downward pressure and hit the bottom of the session. At the time of writing the article (1:06 AM on December 30 - Vietnam time), world gold prices were listed at 4,330.3 USD/ounce, down 202.7 USD/ounce.

Meanwhile, Jim Wyckoff - senior analyst at Kitco - said that the gold and silver market is experiencing one of the strongest declining sessions ever, mainly due to massive profit-taking and short-term investors clearing their buying positions on the futures contract market.

Previously, silver once set a record high of 82.67 USD/ounce in the night session, while February gold futures reached a historical high of 4,584 USD/ounce at the end of last week. Currently, February gold futures are down more than 70 USD, while March silver futures are also losing more than 2 USD per ounce.

According to Mr. Wyckoff, the current downward trend is technically adjusted in the upward trend is still maintained. Although the price charts of gold and silver are somewhat damaged in the short term, the level is not too serious. However, if selling pressure continues to increase sharply in the coming sessions, the market may send a clearer signal of creating a short-term peak.

Conversely, if the price of precious metals recovers soon in the next few days, today's low price range could become a new correction bottom in the current upward trend. Trading dien bien in the next two days will be particularly important, deciding the direction of gold and silver prices in the following weeks" - Mr. Wyckoff emphasized.

In related markets, the USD index increased slightly, crude oil prices edged up around 59.25 USD/barrel, while the yield of US 10-year government bonds was at 4.118%. These factors continue to create more short-term pressure on gold prices.

Analysts believe that, besides the impact from positive US economic data, gold prices are entering a correction phase after a prolonged hot streak, making the market more sensitive to short-term economic information and technical signals.