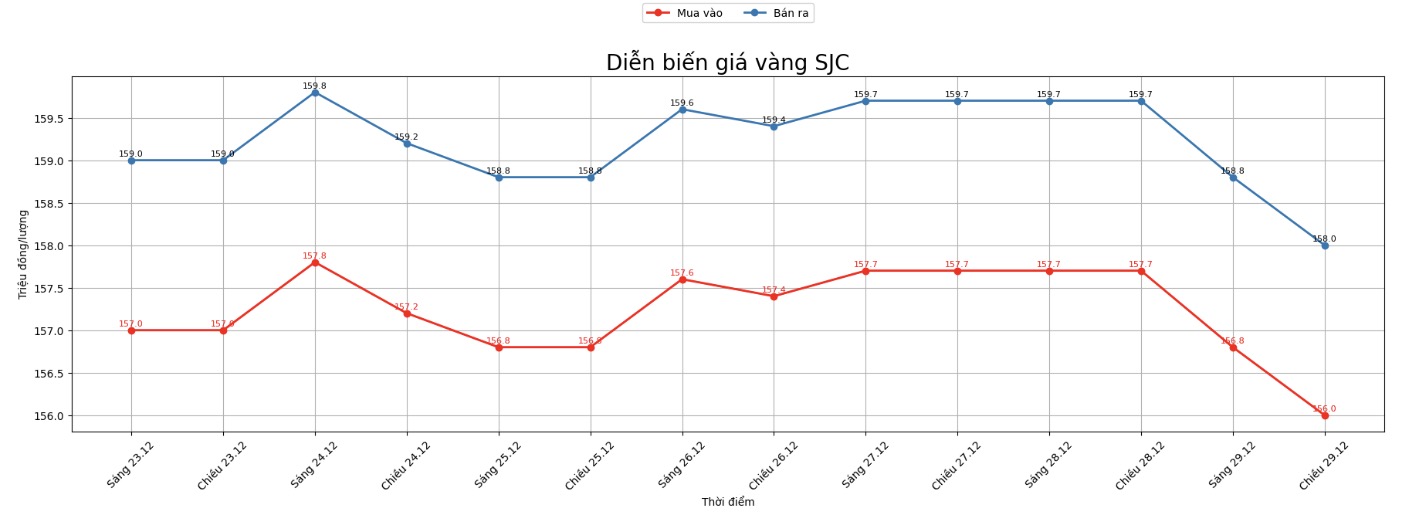

SJC gold price update

As of 10:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 152.2-154.2 million VND/tael (buying - selling), down 4.6 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 151.2-154.2 million VND/tael (buying - selling), down 4.6 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at the threshold of 152.2-154.2 million VND/tael (buying - selling), down 4.6 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

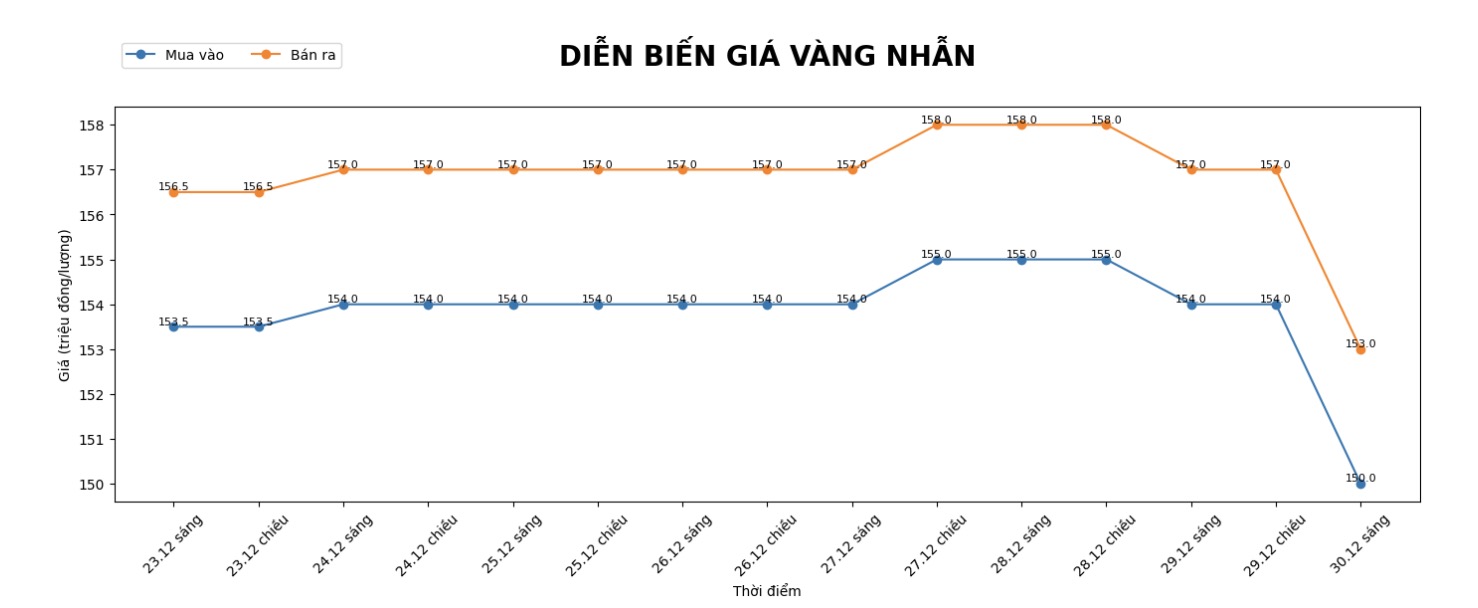

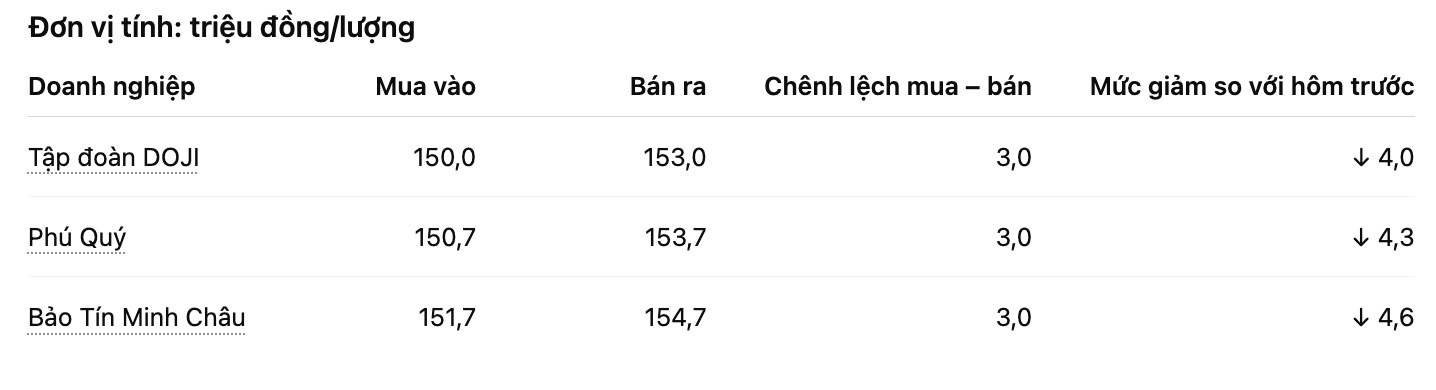

Price of 9999 round gold ring

As of 10:05 am, DOJI Group listed the price of gold rings at 150-153 million VND/tael (buying - selling), down 4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 150.7-153.7 million VND/tael (buying - selling), down 4.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.7-154.7 million VND/tael (buying - selling), down 4.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The buying-selling gap is high, causing risks for individual investors to increase. Individual investors, especially those with "surfing" psychology, need to consider carefully before spending money.

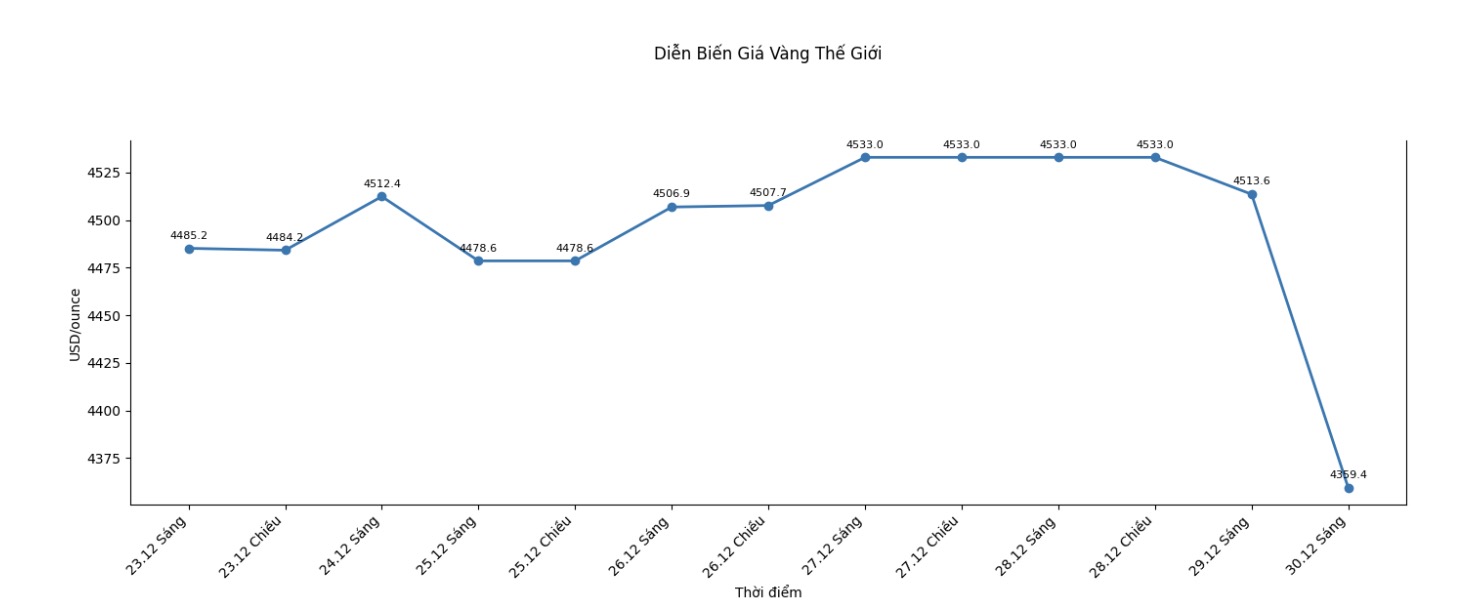

World gold price

At 10:09 am, world gold prices were listed around the threshold of 4,359.4 USD/ounce, down 154.2 USD compared to the previous day.

Gold price forecast

World gold prices fell sharply in the first session of the week, retreating to the lowest level of the day after US home data unexpectedly increased sharply.

According to the latest data from the US National Association of Realtors (NAR), the home price index in the US in November increased by 3.3% compared to the previous month, more than three times higher than analysts' forecast of 1.0%. This is considered a positive sign, showing that potential home buyers are returning to the market more strongly than expected.

Notably, October data was also adjusted up to 2.4%, instead of the initial announced level. By region, on-premises sales all recorded increases in all four major regions of the US including Northeast, Midwest, South and West.

Gold and silver markets fell sharply, recording one of the largest price drops ever due to strong profit-taking activities along with short-term futures traders completing their buying positions are prominent factors in today's session.

Silver hit a record high of 82.67 USD on the night, according to Comex futures in March. Meanwhile, February gold futures hit a historic peak of 4,584 USD on Friday. As of the nearest time, February gold fell 70.4 USD to 4,482.6 USD. March silver fell 2,331 USD, to 74.8 USD.

Up to now, today's price decreases are considered a correction in the upward trends that are still existing. Although some short-term technical damage appears on the charts of both metals, the level is not serious.

However, if strong selling pressure continues on Tuesday or Wednesday, this is likely to cause clearer technical damage, thereby showing that short-term peaks may have formed.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...