Gold prices edged up in the first session of the week, supported by the weakening of the USD as investors were almost certain that the US Federal Reserve (Fed) would cut interest rates at the policy meeting taking place this week.

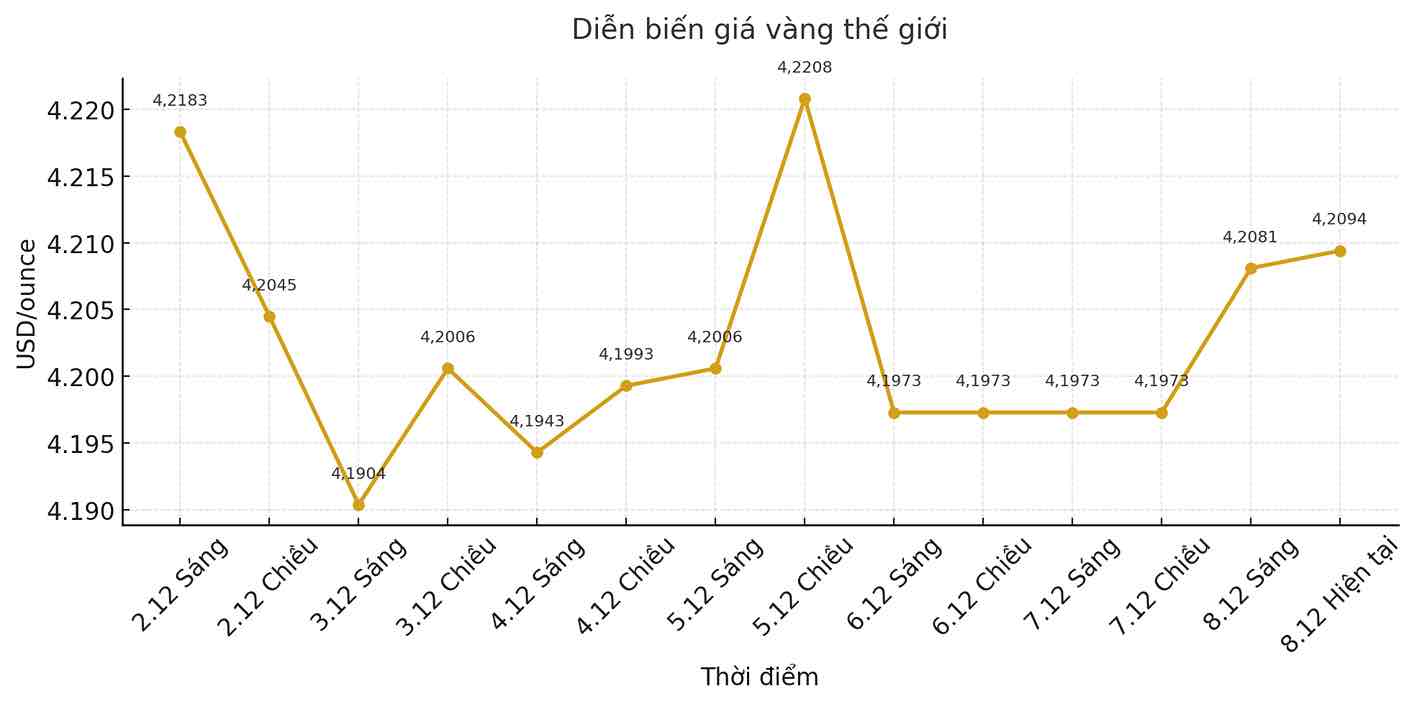

According to data, spot gold prices increased by 0.5%, to 4,215.69 USD/ounce, while December gold futures on COMEX were stable at 4,244.80 USD/ounce.

The US dollar fell slightly, hovering around a month's low as of December 4, making gold, which is priced in greenback, more attractive to foreign buyers.

Mr. Tim Waterer, chief market analyst at KCM Trade, said: The release of core PCE data did not create a big surprise, thereby maintaining expectations that the Fed will cut interest rates this week. The prospect of a loose monetary policy continues to be the main driver for gold to move up.

According to Mr. Waterer, expectations of the Fed cutting interest rates soon have slowed down the USD's increase, thereby creating a "space" for gold prices to continue to break out in the short term.

On the other hand, the US economy is sending signs of slowing down. consumer spending in September only increased slightly after three consecutive months of strong growth, while the labor market showed signs of stagnation and escalating living costs, weakening demand. Recent private sector employment data also recorded the sharpest decline in more than two and a half years.

The puppet statements from Fed officials have made investors more confident that the loose policy will soon be implemented. According to CME FedWatch, the market is currently pricing in an 88% chance that the Fed will cut interest rates by another 25 basis points at this week's meeting. Lower interest rates are often a supporting factor for non-yielding assets such as gold.

Not only gold, silver also continued to maintain its upward momentum. Silver prices rose 0.1%, to $28.35 an ounce, after hitting a record $29.32 in the closing session last weekend. Since the beginning of the year, silver has more than doubled in value.

According to Mr. Waterer, silver is still undervalued against gold, and the strong increase in 2025 reflects growing industrial demand and expectations of a supply shortage lasting at least until 2026.