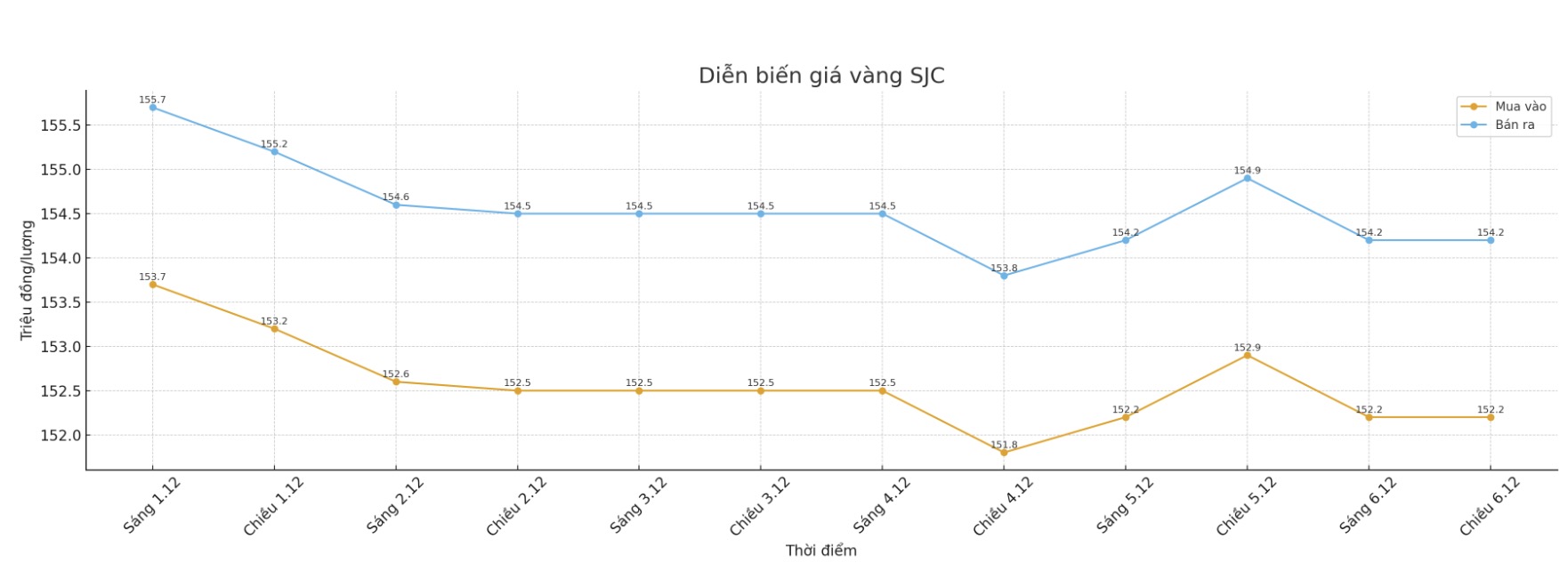

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND152.2-154.2 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.2-154.2 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

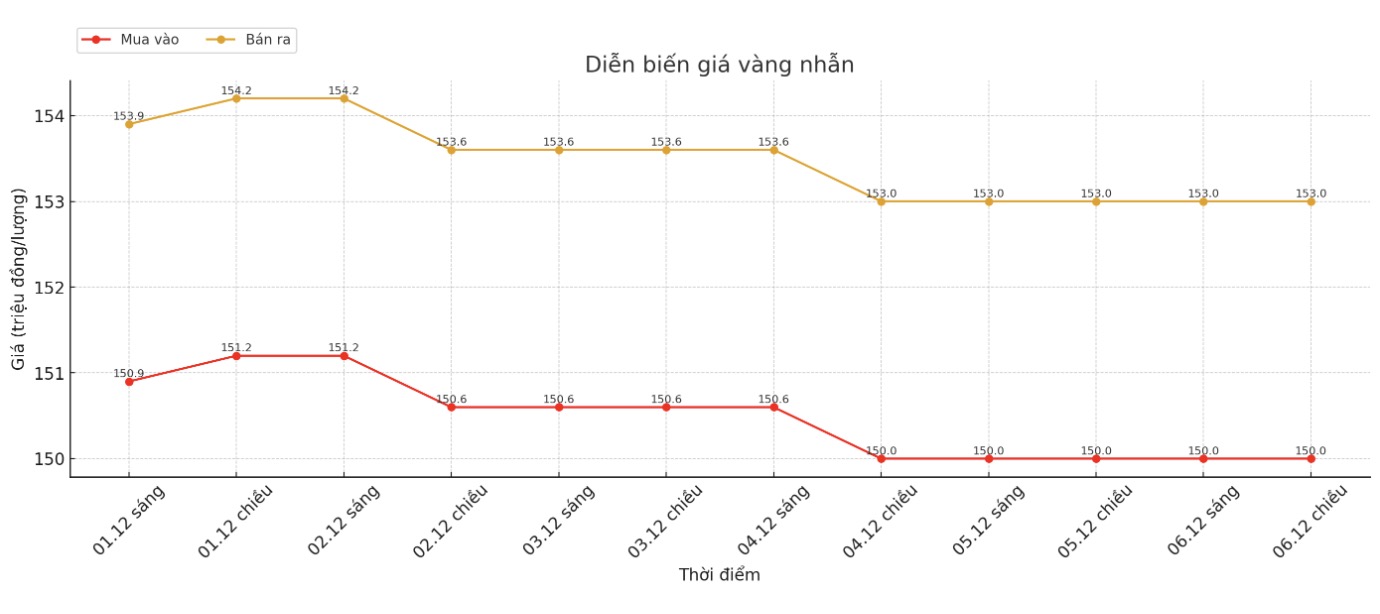

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

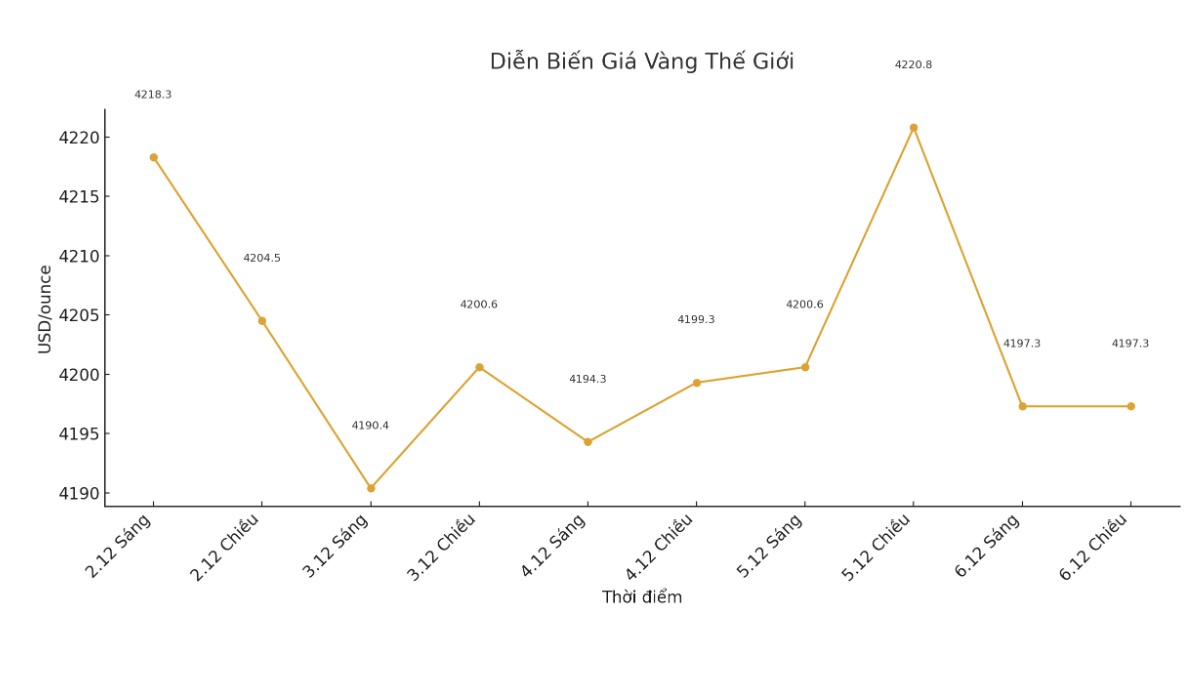

World gold price

The world gold price was listed at 5:45 p.m., at 4,197.3 USD/ounce, down 23.5 USD compared to a day ago.

Gold price forecast

Expectations for US interest rates have changed rapidly and strongly in the past six weeks. At the most recent monetary policy meeting, Federal Reserve Chairman Jerome Powell signaled a rather tailor-made signal when he said that a rate cut in December was not a certain thing. This statement immediately caused the market to sharply lower expectations of policy easing.

However, new developments in stable inflation and data showing a clear slowdown in the US labor market have quickly changed the situation. Less than a week before the meeting, the possibility of the Fed cutting interest rates was brought back into consideration by the market. According to CME's FedWatch tool, the probability of a rate cut at the end of 2025 is now back nearly 90%, after falling to about 30% after the FOMC meeting in November.

This constant change has caused the gold market to fluctuate strongly. Gold prices recovered from a bottom around $3,900/ounce to $4,200/ounce, but have yet to surpass last week's peak, showing cautious market sentiment.

Mr. Aaron Hill - Head of Market Analysis at FP Markets - said that the outlook for gold will depend largely on the Fed's policy orientation, economic growth and geopolitical risks. According to him, for gold to hit a new record high, the market needs a combination of more drastic interest rate cuts, a clear weakening of the USD and increased safe-haven demand. An economic shock or a more dovish signal from the Fed could be an important catalyst.

Meanwhile, Ms. Barbara Lambrecht - commodity analyst at Commerzbank - is particularly interested in the "dot plot" in the Fed's Economic Forecast Summary (SEP). Previously, the September SEP showed that the Fed expected only two interest rate cuts next year. However, new concerns about growth and economic pressures are raising the possibility of the Fed easing more strongly. If this scenario is clearly reflected in the dot plot, gold prices could be supported more positively.

From a technical perspective, Mr. Lukman Otunuga - an analyst at FXTM - said that gold will continue to fluctuate strongly due to uncertainties surrounding monetary policy. If it breaks above $4,240, prices could head toward $4,300 an ounce. Conversely, if it weakens below $4,200, gold could retreat to $4,180-4.160/ounce.

See more news related to gold prices HERE...