According to Section b6.2, Point b, Clause 4, Article 13 of Circular 40/2021/TT-BTC, there is a regulation that when a contract household (business household paying tax under a contract method) changes to the declaration method, the contract household declares to adjust and supplement the Contract Tax Declaration according to form No. 01/CNKD issued with Circular 40/2021/TT-BTC.

The tax authority shall base on the Declaration to adjust and supplement to adjust and reduce the tax rate contracted for the conversion period.

If the contracting household changes to the declaration method in the year, the deadline for submitting the tax declaration of the contracting household is no later than the 10th day from the date of conversion of the tax calculation method.

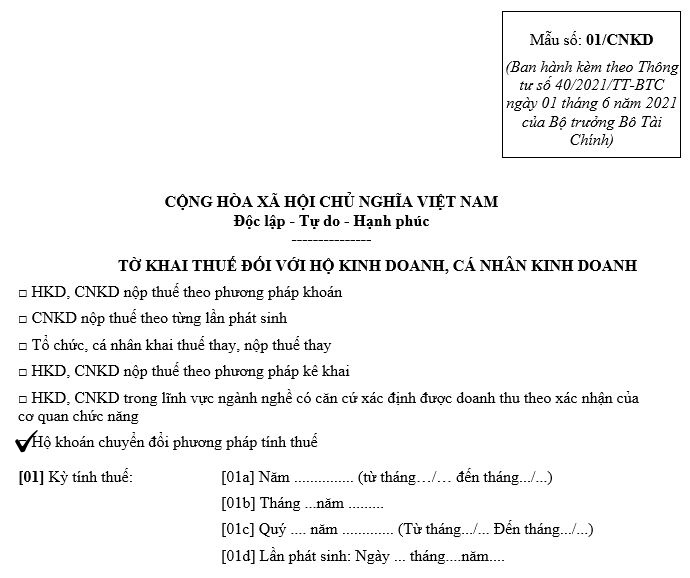

The form of the adjusted and supplemented Declaration - form No. 01/CNKD is as follows:

The method of completing the tax declaration for contracted households transferred to declaration households is as follows:

- marked X in the box "Contractors converting tax calculation methods"

- chiary [01] Tax calculation period is applied as follows:

+ chi duong [01a] only declares for business households (HKD), (business individuals) that employees pay taxes under the contract method.

+ chi duong [01b] or [01c] only declare for HKDs and CNKDs that pay taxes according to the declaration method or organizations and individuals that declare taxes on behalf of, pay taxes on behalf of tax monthly or quarterly.

+ chi dinh [01d] declared for HKD, CNKD paying tax at each occurrence.

- Index [08a] only marks when the information in the index [08] has changed compared to the previous declaration.

- Index [12a] only marks when the information in index [12b], [12c], [12d], [12d] has changed compared to the previous declaration.

- In the revenue and output indicator: If it is a contract, the expected revenue and output will be declared on average for 1 month in a year; If it is a business individual who pays tax on each arising revenue and output, it will be declared on each arising revenue and output. If it is a HKD or a CNKD that pays tax according to the declaration method or organizes tax declaration on behalf of or pays tax on behalf of, it must declare monthly or quarterly revenue and output corresponding to the monthly or quarterly period.

- HKDs and CNKDs in the form of business cooperation with organizations shall declare instead with Declaration 01/CNKD Appendix to the Detailed List of business households and individuals according to form 01-1/BK-CNKD and do not have to declare targets from [04] to [18].

- Business households and individuals paying taxes according to the declaration method shall declare by individuals with declaration 01/CPD Appendix to the business performance statement for the period of business households and individuals doing business according to form 01-2/BK-HDKD, except for cases where HKD and CNKD in the field of industry have a basis to determine revenue according to confirmation from the competent authority.

- Part C only applies to individuals licensed to exploit mineral resources.