According to Lao Dong, savings interest rates are on the rise, especially in the last months of 2024. Many banks have adjusted deposit interest rates to attract deposits from customers.

For example, Agribank has increased interest rates for short terms under 12 months, especially online, by 0.5-1%. This increase makes Agribank one of the banks with the highest interest rates in the Big 4 group, ranging from 2.4% to 3.7% for terms under 12 months and 4.8% for terms of 12 months or more (online deposits).

According to Vietcombank Securities Company (VCBS), the current mobilization interest rate level is about 0.5% higher than the bottom level set in the second quarter, but still lower than the COVID-19 period.

VCBS forecasts that savings interest rates will remain flat in 2025, with expectations that exchange rate pressure will cool down to support system liquidity and the State Bank will continue its loose monetary policy.

As for whether or not to put your money in savings at this time, the decision depends on your financial goals and return expectations. If customers are looking for safety and stability, saving is still a reasonable choice, especially when interest rates are trending up. However, savers should also consider other factors such as inflation, personal liquidity needs and other investment opportunities before making a decision.

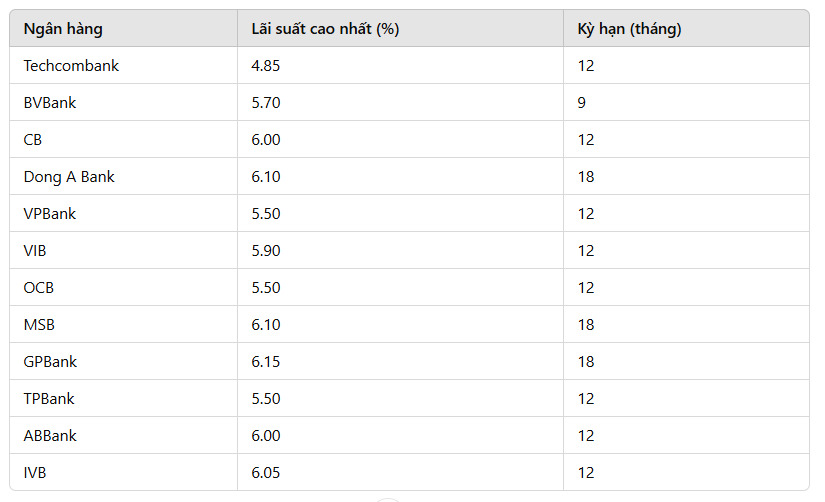

According to statistics, 12 banks have increased deposit interest rates since the beginning of December, including: Techcombank, BVBank, CB, Dong A Bank, VPBank, VIB, OCB, MSB, GPBank, TPBank, ABBank and IVB.

A series of banks compete to pay deposit interest from 7%/year?

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.5%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.5%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed an interest rate of 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of initial interest or periodic interest.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

MSB currently offers a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

In addition, lower savings rates, from 7.0%/year, are also listed at many banks.

See more daily bank interest rate updates HERE.