Have paid to buy but are not sure to have silver in hand

According to records, in the context of many gold and silver stores hanging signs "out of stock", "only accept pre-orders", many silver purchase transactions today are actually depositing money to maintain the right to receive silver in the future.

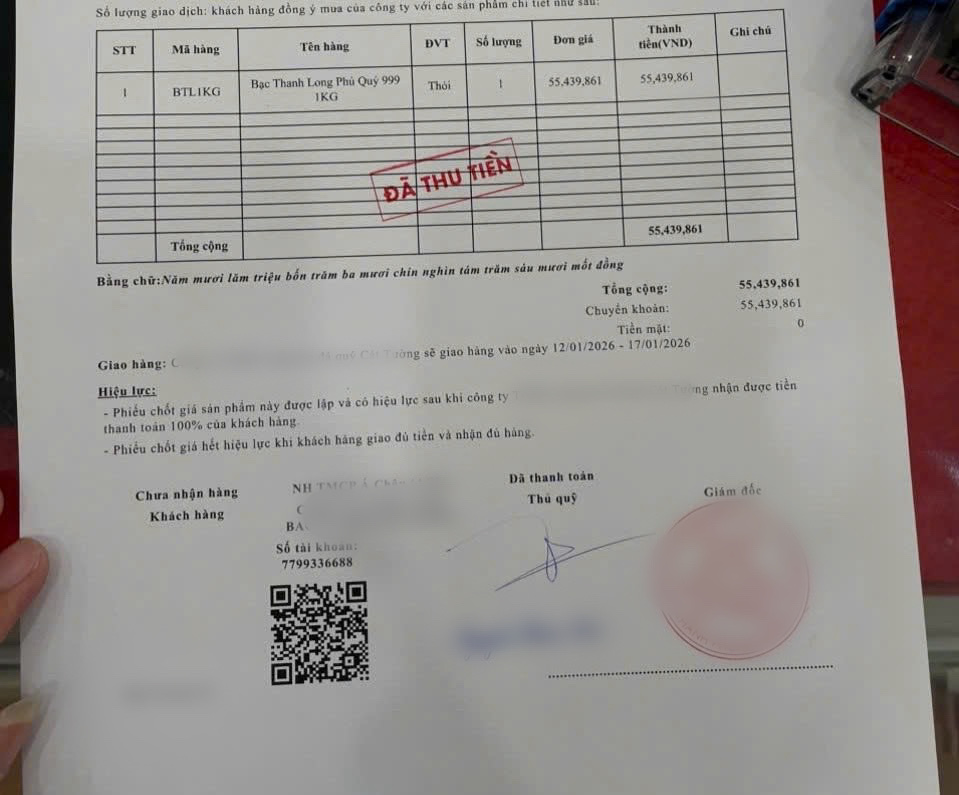

Buyers pay at the price at the time of transaction, in exchange for an appointment or purchase confirmation, and the time of receipt completely depends on the supply of the enterprise.

To put it bluntly, many people buy silver but do not have silver in hand yet. They only keep appointments, while market prices can change very quickly," said a gold and silver shop owner in Phu Tho.

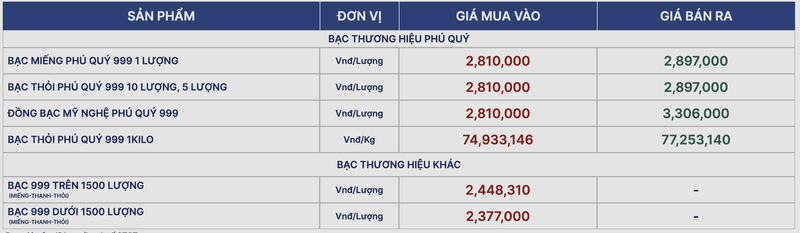

According to the update on December 30, the domestic silver price level continues to be maintained at a high level, in which the difference between buying and selling prices is quite large.

Phu Quy brand silver with Phu Quy 999 silver bars of 1 tael is currently bought at 2.806 million VND/tael, sold at 2.893 million VND/tael. Phu Quy 999 silver bar products of 5-10 taels are also listed at the same price.

Notably, Phu Quy 999 silver bars of 1kg type currently have a buying price of about 74.83 million VND/kg, while the selling price is up to 77.15 million VND/kg, a difference of more than 2.3 million VND/kg.

In other branded silver groups, 999 silver of over 1,500 taels is bought at about 2.445 million VND/tael, type under 1,500 taels is about 2.374 million VND/tael, mainly not publicly listed selling prices, transactions depend on agreements.

The fact that the price is high while the difference is large shows that the risk of "loss on paper" for buyers is very clear, especially when many transactions only stop at the pre-booked level.

Official goods shortage, risks spreading to the underground market

When gold and silver shops are short of silver bars, the trend of buying and selling "hand in hand" on social networks and groups is booming.

In the role of a person who needs to buy silver bars and ready-made goods, reporters contacted a Zalo account named Minh Anh. This person said that they have 200 taels of silver available at a price of 3.35 million VND/tael, significantly higher than the listed price at official business enterprises.

When asked about the documents to ensure standard goods, this person said that there was an invoice for a total of 200 taels.

However, when reporters questioned the transparency of hand-to-hand transactions, as well as the mechanism to ensure the rights of buyers, this account did not answer.

Before concerns about selling prices being higher than the general level, this person only replied briefly: "Don't be greedy for cheap prices".

According to business circles, buying and selling silver through associations and groups poses many risks, difficulty in controlling the amount of silver, lack of invoices and documents according to each transaction, risk of disputes and especially risks when needing to resell.

Not everyone has enough experience to distinguish between standard silver and mixed silver. Transactions through strangers online, if risks occur, are very difficult to handle," said Mr. Nguyen Van Ha - owner of a gold and silver shop in Kim Boi commune, Phu Tho province.

Unlike gold, which usually fluctuates relatively stably – silver is considered a commodity with a large fluctuation range. Prices can increase rapidly, but can also decrease deeply in a short time, putting buyers in high-price areas at high risk.

Talking to reporters, Assoc. Prof. Dr. Dinh Trong Thinh - Senior Lecturer of the Academy of Finance - said that in principle, gold and silver prices often move in parallel, but silver is not a popular investment and accumulation channel in Vietnam, so the level of stability is lower.

The rapid increase in silver prices, narrowing the gap with gold, is a sign that needs to be considered cautiously.

According to Mr. Thinh, the "silver paper" form poses many risks because buyers spend money but do not receive goods immediately, while market prices may fluctuate sharply during the waiting time.

Reality shows that silver is not an absolute safe haven. In the context of the market being led by crowd psychology and supply scarcity, buyers need to carefully consider before spending money, avoid chasing short-term price increases and especially should not gather all their savings to "ride the wave" of silver.