2025 personal income tax rate from wages

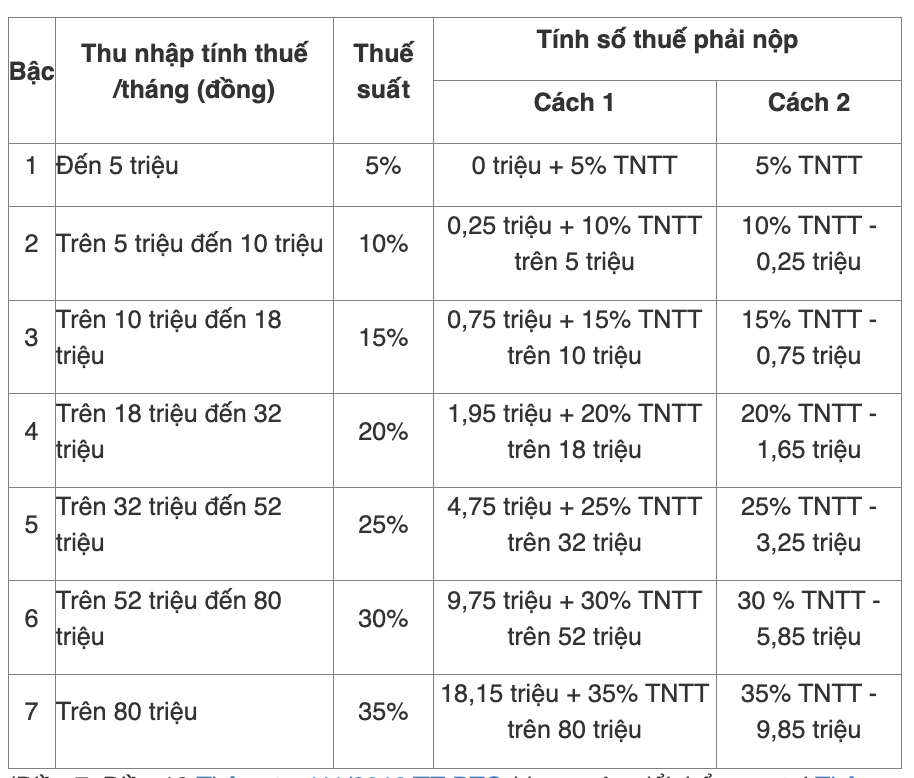

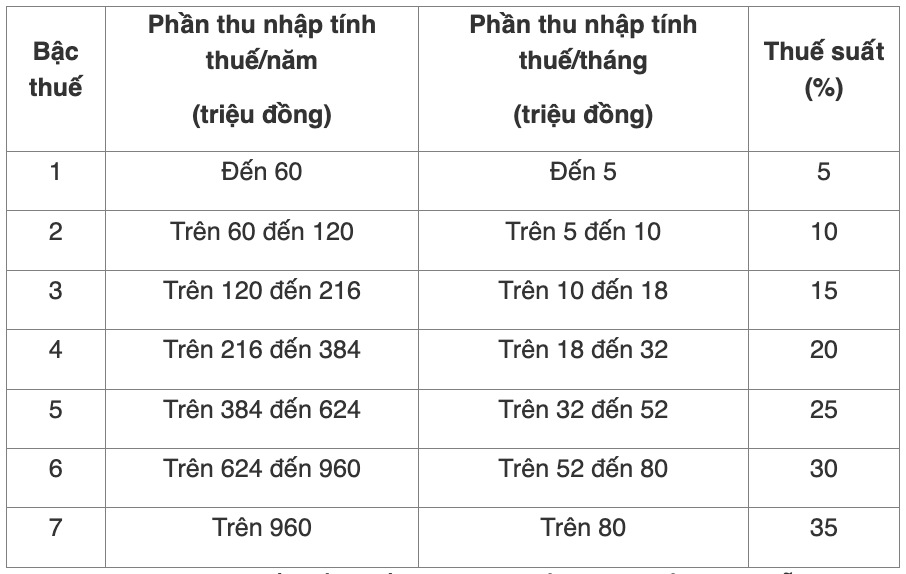

According to Article 22 of the Law on Personal Income Tax 2007 and Clause 2, Article 7 of Circular 111/2013/TT-BTC (amended and supplemented in Circular 92/2015/TT-BTC), the personal income tax rate on income from wages and wages is applied according to the Partial Progressive Tax Schedule as follows:

Thus, in 2025, the income tax rate from wages will still be applied in 7 levels: 5%, 10%, 15%, 20%, 25%, 30% and 35%.

How to calculate personal income tax from wages in 2025

The basis for calculating tax on income from wages and wages is income for tax calculation and tax rate, specifically as follows:

personal income tax payable = Taxable income x Tax rate.

In which:

Taxable income = Taxable income - Reductions.

Taxable income = Total income - Exempted expenses.

For individuals residing, the shortened method according to Appendix: 01/PL-TNCN issued with Circular 111/2013/TT-BTC can be applied as follows: