According to Resolution 198/2025/QH15, from January 1, 2026, millions of business households across the country will no longer pay taxes under the contract method but will switch to self-declaration, self-calculation and self-payment of taxes based on actual revenue.

At the same time, from 2026, business households with a revenue of VND 200 million/year or more will have to pay tax, instead of the current VND 100 million threshold (Articles 17 and 18 of the Law on Value Added Tax 2024).

Although not subject to value added tax and personal income tax, households and individuals with a revenue of less than VND 200 million/year must still fulfill their obligations to declare taxes accurately, honestly and submit documents on time.

Tax declaration and submission of tax documents are carried out according to the instructions in Articles 11 and 13 of Circular 40/2021/TT-BTC.

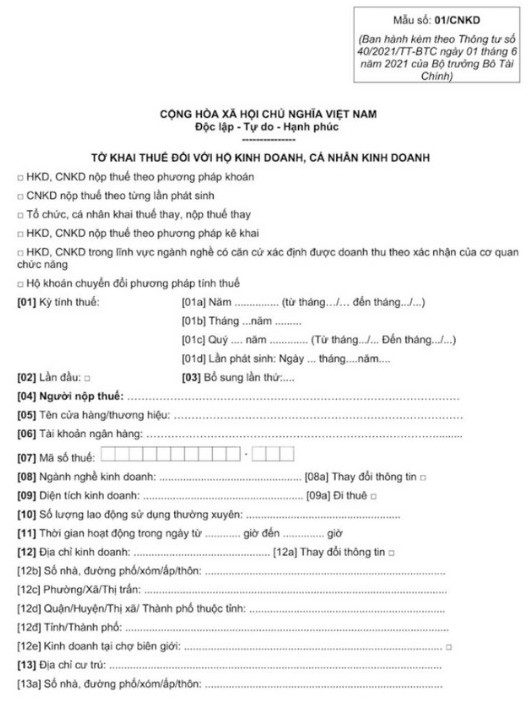

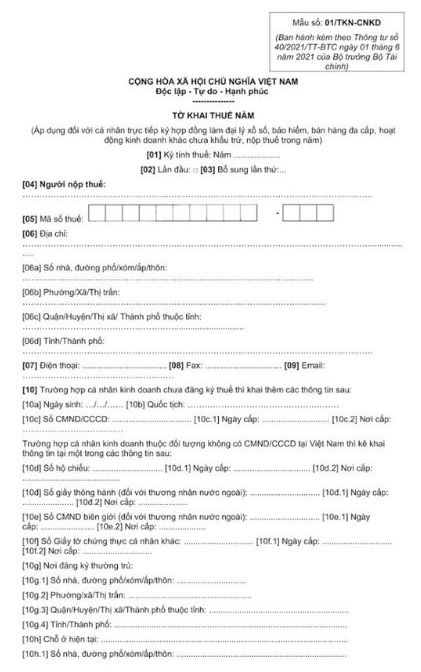

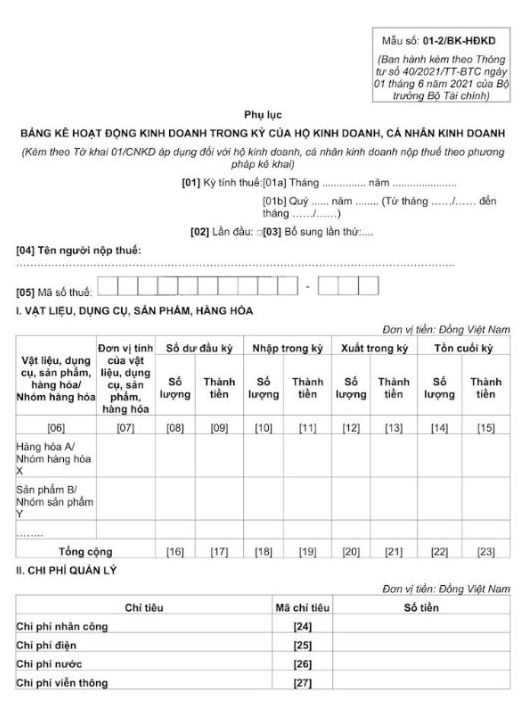

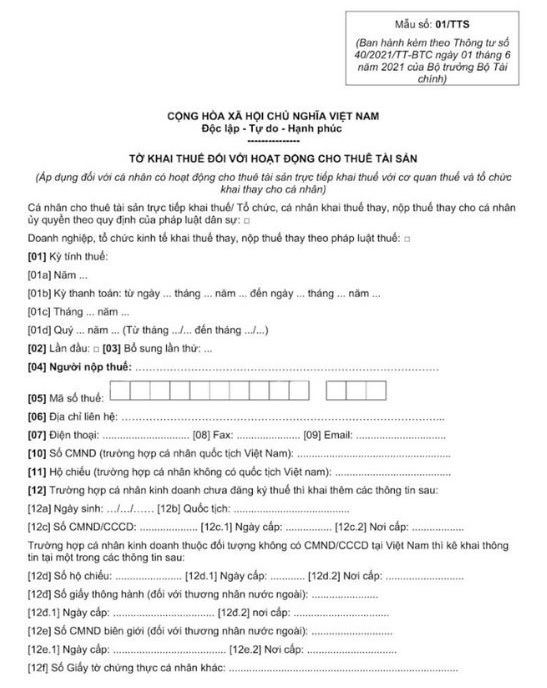

The forms of declaration commonly used for business households specified in the Appendix issued with Circular 40/2021/TT-BTC include:

Form 01/CCD: VAT and personal income tax declaration for business individuals.

Form 01/TKN-CNKD: Annual tax declaration.

Form 01-2/BK-HDKD: Appendix to the business performance table for the period.

Form 01/TTS: For individuals leasing assets.

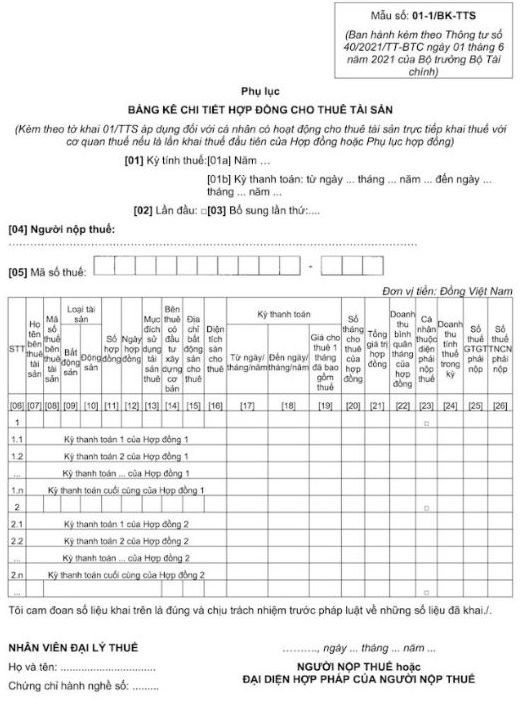

Form 01-1/BK-TTS: Detailed list of first-time lease of assets under the contract.

Business households with sales of less than 200 million/year from January 1, 2026 will declare taxes twice/year ( beginning/middle of the year and the end of the year) to determine tax obligations.

The Ministry of Finance sets a target that by the beginning of 2026, the contract tax mechanism will end, all business households with taxable revenue will self-declare and self-pay taxes according to actual revenue. Tax authorities play a role in guiding, supervising, and checking after-sales - instead of fixing collection from the beginning as a contract method.

However, based on listening to the opinions of the Delegates on the annual non-taxable revenue of individuals doing business from 100 million VND/year to 200 million VND/year, the Ministry of Finance will continue to study and adjust this level to be appropriate, ensuring relatively fairness for individuals with income from salaries and wages and is expected to amend the Law on Value Added Tax to increase the revenue level that does not require VAT to ensure consistency.