Declare taxes in a complete, accurate and honest manner

Pursuant to Section 2 of Official Dispatch 4613/CT-CS in 2025 of the Ministry of Finance on tax policy, which clearly states regulations on tax management for individuals with a revenue of less than 100 million VND.

Business households and individuals with a revenue from production and business activities in the year of VND 100 million or less (from January 1, 2026 to VND 200 million or less) are not subject to VAT and do not have to pay personal income tax according to the provisions of the law on VAT and personal income tax.

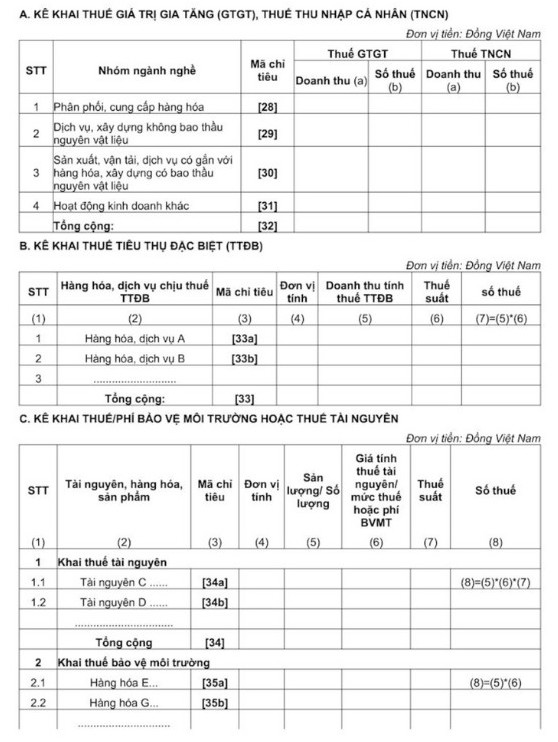

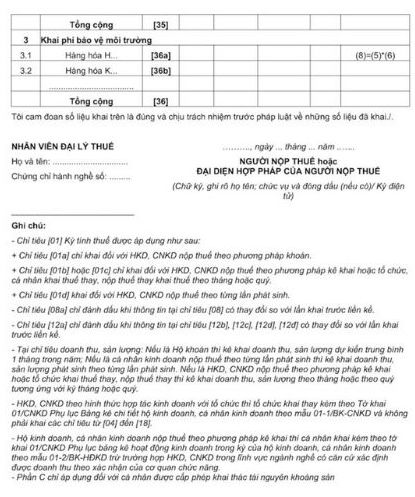

Business households and individuals are responsible for declaring taxes accurately, honestly, fully and submitting tax documents on time; responsible before the law for the accuracy, honesty and completeness of tax documents according to regulations. The declaration and submission of tax declarations are stipulated in Articles 11 and 13 of Circular No. 40/2021/TT-BTC dated June 1, 2021 of the Ministry of Finance.

Accordingly, business individuals with a revenue of less than 100 million from production and business activities in the calendar year are not subject to VAT and do not have to pay personal income tax according to the provisions of law on VAT and personal income tax (from January 1, 2026 is 200 million VND or less).

Individuals with a revenue of less than 100 million from production and business activities in the calendar year are responsible for declaring taxes accurately, honestly, fully and submitting tax records on time; responsible before the law for the accuracy, honesty, and completeness of tax records according to regulations

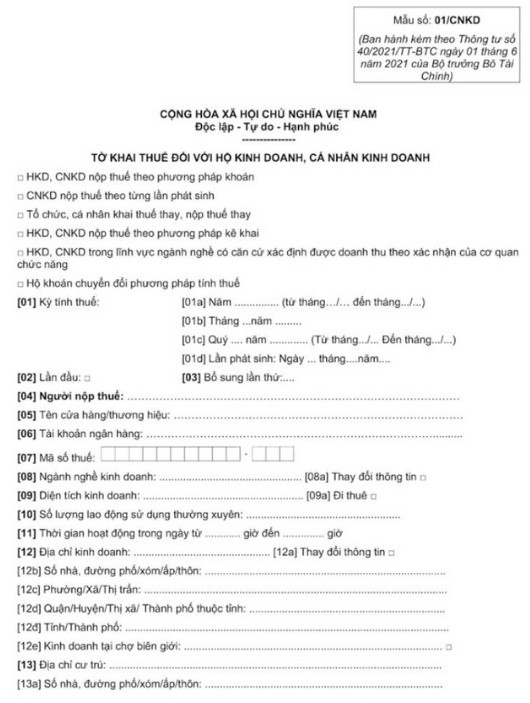

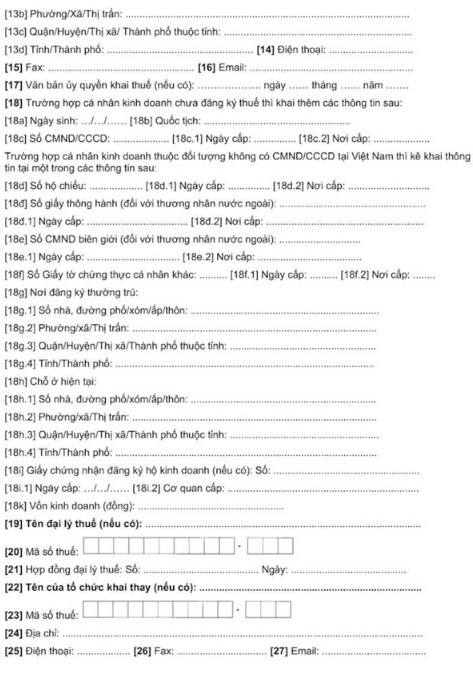

Tax declaration form for business individuals according to the latest declaration method

Pursuant to Appendix II issued with Circular 40/2021/TT-BTC, the Tax Declaration Form for Business Individuals (Form 01 CNKD) is amended by Point a, b, Clause 2, Article 8 of Circular 40/2025/TT-BT.

In addition, if a business individual pays tax according to the declaration method, the individual must declare with the declaration 01/CPD, Appendix to the business performance list for the period of the business individual according to form 01-2/BK-HDKD, except in cases where a business household or individual doing business in the field of a profession has a basis to determine revenue according to confirmation from the competent authority.