New legal foundation strengthens trust

Restructuring the corporate bond market is not just about adjusting policies or regulations, but also a comprehensive change to create a healthier, more transparent and sustainable ecosystem. After a difficult period with many cases of late payment and declining confidence, the market in early 2025 recorded clear changes.

Market restructuring activities focus on improving the quality of bonds, improving the liquidity of issuers and ensuring transparency. The amended Securities Law, effective from January 1, 2025, is considered an important turning point with strict regulations to control risks and strengthen market confidence.

One of the highlights of the new law is the mandatory credit rating for bonds issued to the public or on a large scale. This provision not only improves the quality of bonds but also enables investors to have more information to assess risks.

In addition, individual bonds issued to professional individual investors must have collateral and payment guarantees from credit institutions, increasing the level of safety for investors. Strengthening the responsibility of information disclosure by issuing enterprises, including requiring audits from reputable independent units, helps reduce the risk of fraud, thereby strengthening market confidence.

The new law also expands the scope of market participation by recognizing foreign organizations and individuals as professional securities investors. This is expected to attract more foreign capital flows, promoting diversity and sustainability for the corporate bond market.

According to Mr. Nguyen Khac Hai - Director of Compliance Control of SSI, tightening regulations on issuance and expanding the scope of participants will improve transparency and attract the attention of domestic and foreign investors.

Banking and real estate play a pivotal role

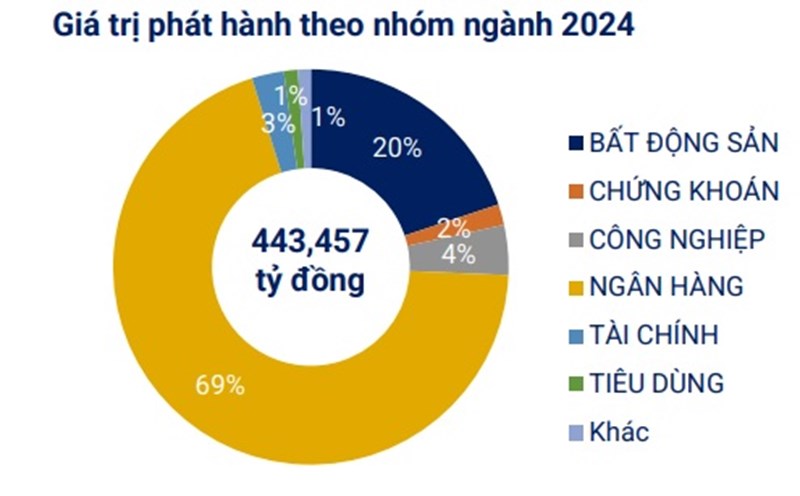

The restructuring process not only takes place at the policy level but is also clearly reflected in the transformation of bond-issuing enterprises. The banking group continues to play a leading role with large issuance values to consolidate Tier 2 capital and restructure capital sources.

In January 2025, major banks such as Techcombank, BIDV, and HDBank issued many batches of long-term bonds, helping to reduce short-term liquidity pressure and increase lending readiness in the context of recovering credit demand.

The real estate sector, despite facing many difficulties in previous years, is gradually returning to the market. Some large enterprises such as Vinhomes and Nam Long have taken advantage of the recovery of the real estate market - forecast to improve from the second quarter of 2025 - to issue bonds and raise capital for key projects.

In addition to new issuance, bond buyback activities have also been active. Banks such as OCB, BIDV, and Techcombank have bought back tens of thousands of billions of dong worth of bonds before maturity, reducing maturity pressure and strengthening investor confidence. For the real estate group, issuers such as Hoa Dong 2 Wind Power and Saigon Glory have successfully extended many bond lots with a total value of thousands of billions of dong, demonstrating their proactive financial management and maintaining their reputation with bondholders.

According to Dr. Can Van Luc, the market restructuring process is not only a solution to overcome immediate difficulties but also a strategic one, reshaping the bond ecosystem. Mr. Luc commented: "Improving institutions, developing a credit rating system and a secondary market will be decisive factors to restore investor confidence and promote sustainable market development."