On November 4, 2025, the National Assembly listened to the Government's Submission and the Inspection Report of the Economic and Financial Committee on the draft Law on Personal Income Tax (amended).

Accordingly, the Draft Law on Personal Income Tax (amended) includes 04 Chapters, 29 Articles, regulating taxpayers, taxable income, tax-exempt income, tax reduction and the basis for calculating personal income tax.

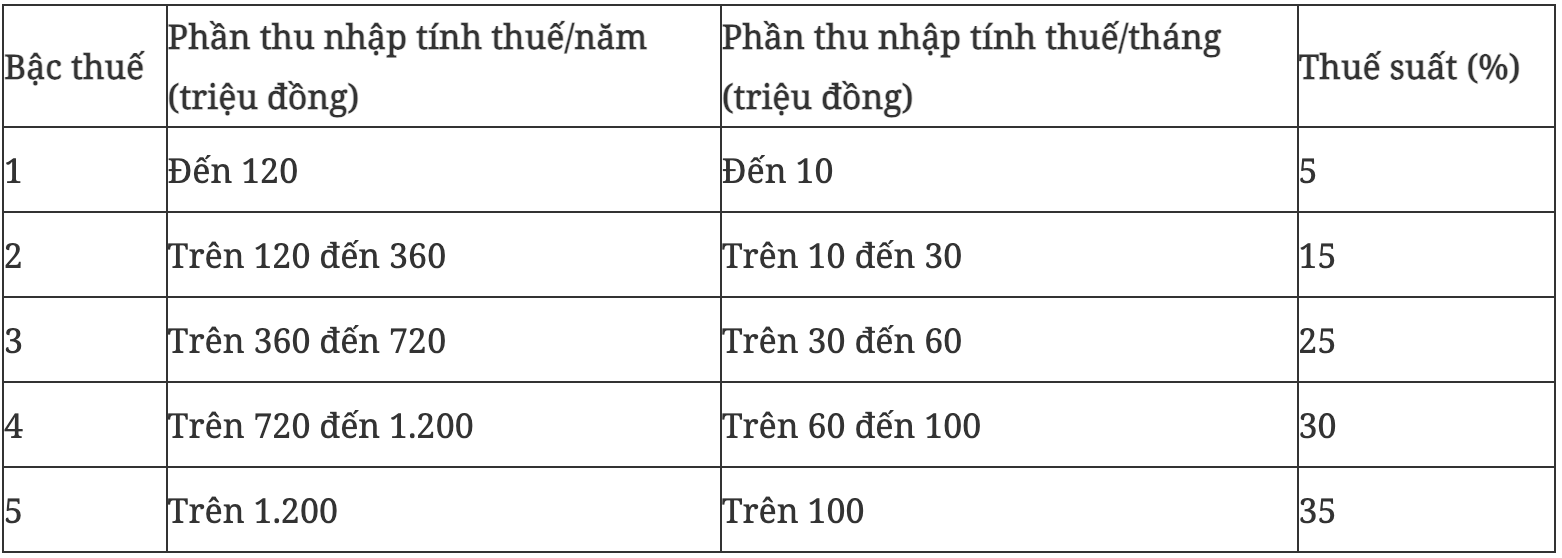

In particular, Article 9 of the Draft Law on Personal Income Tax (amended) proposes to change the tax table as follows:

Thus, the Draft has proposed narrowing the tax rate from 7 levels to 5 levels with the highest tax rate of 35% for income from 100 million VND/month. The gap between the extended and gradually increased tax rates is 10, 20, 30, 40 million VND; the lowest tax rate remains at 5% and the final tax rate is 35% applied to the taxable income of over 100 million VND/month.

The actual tax payable for the income of 100 million VND/month

According to the Law on Personal Income Tax, the income from personal salary and wages received (excluding allowances and subsidies as prescribed) and will be deducted from social insurance, health insurance, unemployment insurance (total of 03 items is 10.5% of monthly salary), professional liability insurance for some occupations that must participate in compulsory insurance, deducting the family deduction (15.5 million VND/person/month and 6.2 million VND/person/month for each dependent (if any) and deducting contributions to charity and humanitarian contributions according to regulations... the remaining amount is taxable income to be applied to the partial tax table.

The Ministry of Finance gave an example of an individual with an income of 100 million VND (no dependents), the income to be taxed to be applied to the tax table is 79.062 million VND (100 million - 4.446 million VND (health insurance, social insurance) - 0.992 million VND (vedential insurance)) - 15.5 million VND (deducted from self). If calculated according to the Tax Plan in the draft Law, the tax payable is 10 million VND x 5% + 20 million VND x 15% + 30 million VND x 25% + 19.062 million VND x 30% = 16.7186 million VND (accounting for 16.72% of total personal income).

Meanwhile, if calculated according to the current tax table, the tax payable is = 5 million VND x 5% + 5 million VND x 10% + 8 million VND x 15% + 14 million VND x 20% + 20 million VND x 25% + 27.062 million VND x 30% = 17.868 million VND (accounting for 17.87% of total personal income).

Thus, with the same family deduction and compulsory insurance, the tax rate framework in the draft law shows that the level of regulation for state budget ownership has decreased compared to the current level.