Many concerns about the 5-level progressive tax rate

In the third working week of the 10th Session of the 15th National Assembly (from November 3 to November 7, 2025), delegates continued to hold plenary sessions in the hall, listening to presentations and reports on many important draft laws, including the draft Law on Personal Income Tax (amended).

According to the draft Law on Personal Income Tax (amended), the tax rate is proposed to be reduced from 7 levels to 5 levels, with the gap between levels increasing gradually by 10, 20, 30 and 40 million VND/month; the corresponding tax rates are 5%, 15%, 25%, 30% and 35%. The highest tax rate of 35% applies to taxable income over VND 100 million/month.

With this plan, most tax rates have reduced mobilization levels compared to the current one.

However, in the review report, Chairman of the National Assembly's Economic and Financial Committee Phan Van Mai said that many National Assembly deputies had the opinion that it is necessary to conduct a comprehensive study and carefully evaluate to ensure reasonableness because some taxable income ranges in the draft create greater tax obligations than the current Law, causing fairness between income groups to not be guaranteed.

Tax burden increases even though real income remains unchanged

At the scientific workshop "Tax, customs and logistics management policies" held on the afternoon of November 5 at the Academy of Finance, Associate Professor, Dr. Nguyen Van Hieu (University of Economics, Vietnam National University, Hanoi) said that in the progressive tax system, the tax rate determines the behavior of border residents, but the average tax rate is a general indicator of tax tolerance and fairness in the vertical direction, especially when considering changes in tax policies over time.

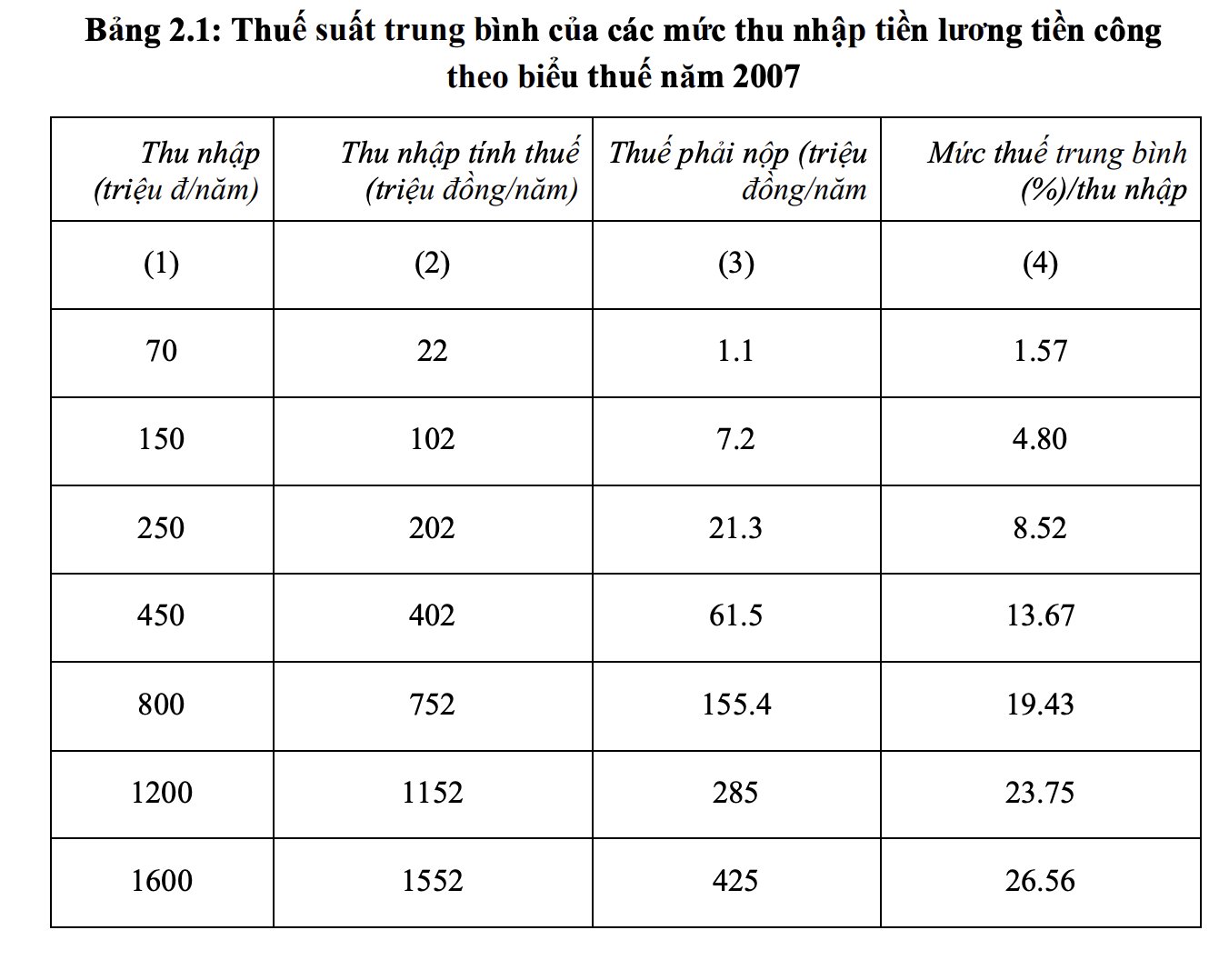

Associate Professor, Dr. Nguyen Van Hieu said that according to the initial regulations of the Law on personal income tax in 2007, with the family deduction for taxpayers of 4 million VND/month, the average tax rate will increase gradually according to the income level. For income of 70 million VND/year, the average tax rate is 1.57%; for income of 150 million VND/year is 4.80%; 250 million VND/year is 8.52%; 450 million VND/year is 13.67%; 800 million VND/year is 19.43%; 1 billion 200 million VND/year is 23.75%; and 1 billion 600 million VND/year is 26.56%. This is the "original design" tax rate of the system.

From 2009 to 2025, the family deduction level will be adjusted three times. In 2013, when the consumer price index doubled, the deduction for oneself was raised to 9 million VND/month. By 2020, when the CPI increased by 20%, the deduction was adjusted to 11 million VND/month. By 2025, the price index has increased a total of 2.88 times compared to the beginning of 2009.

However, the 7-level progressive tax rate of the 2007 Law will remain unchanged throughout this period. This leads to the fact that, even if the deduction level is adjusted, the taxable income will increase faster, causing the tax burden to increase significantly.

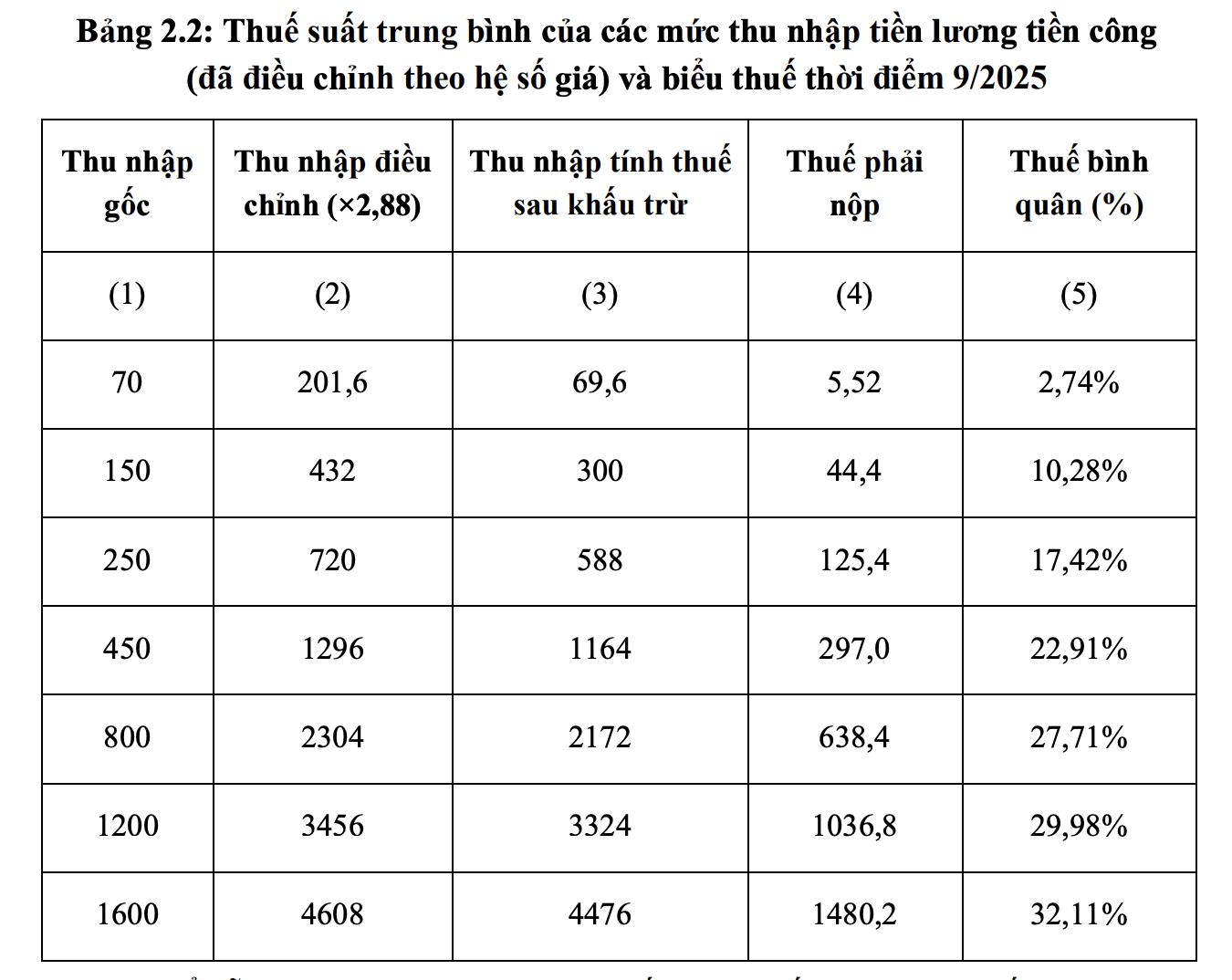

When adjusting basic income by a price drop coefficient of 2.88 and applying a family deduction of VND11 million/month, the average tax rate will increase in all income groups. With a basic income of VND 70 million/year, the average tax rate increased from 1.57% to 2.74%; VND 150 million increased from 4.80% to 10.28%; VND 250 million increased from 8.52% to 17.42%; VND 450 million increased from 13.67% to 22.91%; VND 800 million increased from 19.43% to 27.71%; VND 1 billion 200 million increased from 23.75% to 29.98%; and VND 1 billion 600 million increased from 26.56% to 32.11%.

Thus, even if real income remains unchanged (after converting to a below-priced price), employees have to pay significantly more tax than the original design because the tax rate does not change according to the price.

Associate Professor, Dr. Nguyen Van Hieu said that, in essence, only adjusting the family deduction level without adjusting the tax table has increased the tax regulation level, going against the trend in many countries, where updating tax tables according to inflation is carried out regularly to ensure fairness.

Option 2 still causes a higher tax burden than the original design

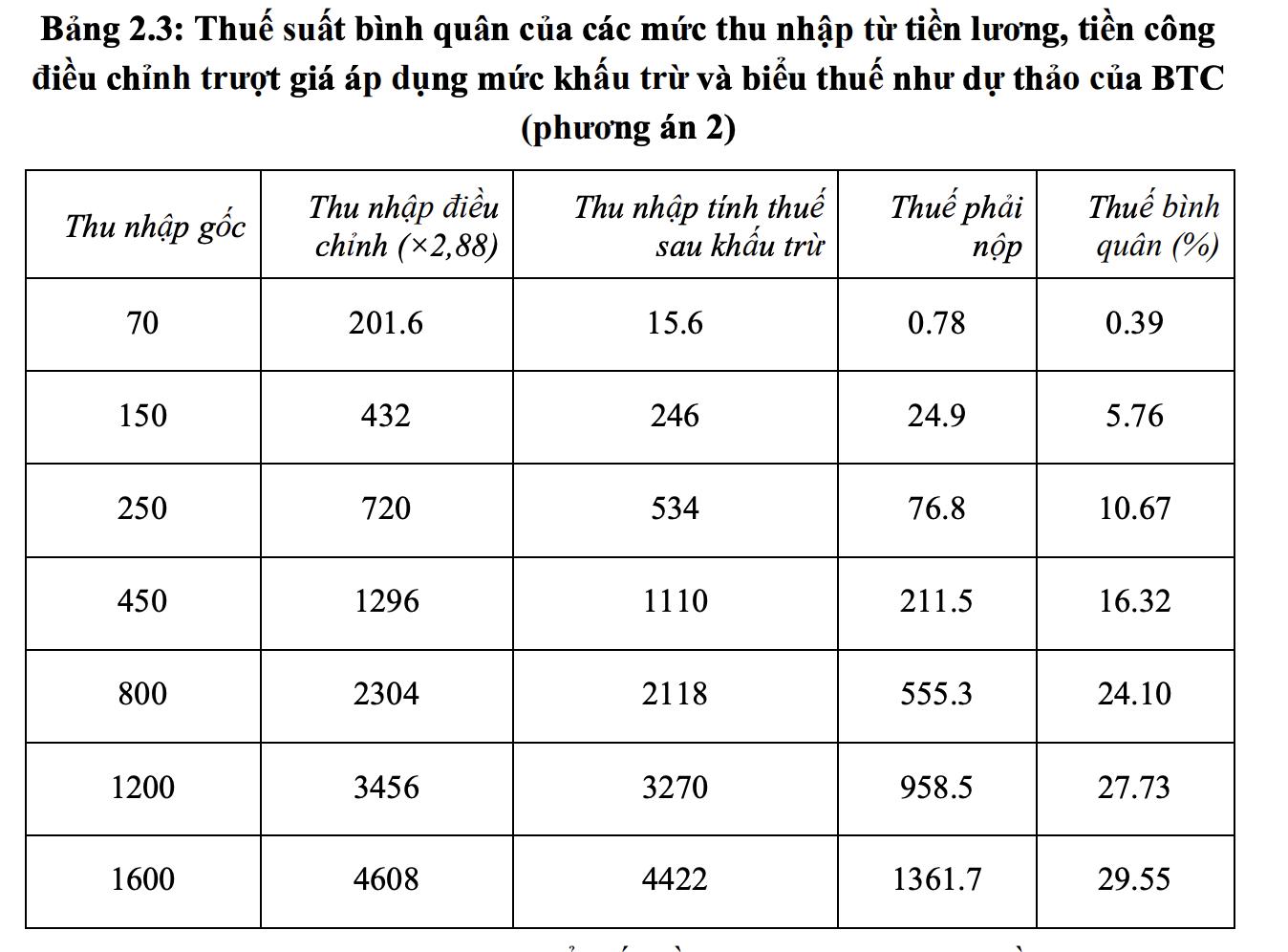

To assess whether the draft Law on personal income tax in 2025 can overcome this situation or not, Associate Professor, Dr. Nguyen Van Hieu continues to calculate the same income levels adjusted according to inflation, applying a family deduction of 15.5 million VND/month and a tax rate of 5 levels according to option 2 of the Ministry of Finance.

The results show that the tax burden has decreased compared to the actual level in 2025 but is still much higher than the original design level in 2007. Average tax rates at income levels of 150 million VND/year and 250 million VND/year increased by about 20% and 25% respectively compared to the beginning. Only the basic income of VND70 million/year recorded a slight reduction in tax burden due to the household deduction increasing faster than the rate of price decline.

According to Associate Professor, Dr. Nguyen Van Hieu, although option 2 has adjusted the number of tax levels and extended the income gap between levels, the tax burden has not yet been brought to the designed level in 2007.

This shows that the current draft has not completely resolved the increase in tax burden over time. This amendment to the tax table, according to him, needs to ensure the principle of fairness in tax obligations and be consistent with the ability to bear the burden of taxpayers, especially the group of salaried workers, who are subjects subject to direct regulation and are unlikely to be able to transfer the tax burden.