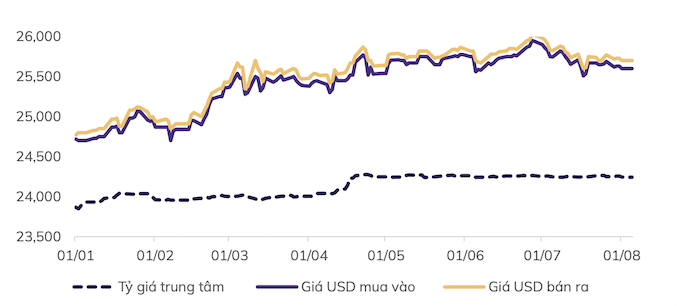

The domestic exchange rate continues its downward trend in parallel with the weakening momentum of the USD index. Accordingly, the downstream VND/USD central exchange rate has decreased slightly since July 22, currently listed at 24,256 VND, similar to the exchange rate on the interbank market. The exchange rate on the free market adjusted sharply after reaching a historic peak of 26,000 VND/USD, recording 2 consecutive weeks of decline from July 29 to August 5 and is trading at 25,540 - 25,640 VND (buy - sell). ). The current selling exchange rate at commercial banks has mostly decreased below the SBV's selling intervention ceiling.

Foreign currency supply is basically still positive when the trade balance has a surplus of 14 billion USD in 7 months or disbursed FDI capital flow of 12.5 billion USD.

The State Bank held a meeting on foreign currency policy and US dollar deposit interest rates (July 18). The State Bank of Vietnam and economic experts both assessed that there is no need to intervene and that the USD interest rate policy should remain at 0%. This is an effective solution to support the goal of stabilizing exchange rates, controlling inflation and increasing the value of VND, reducing the dollarization rate, increasing foreign exchange reserves and affecting remittance flows as well as FII capital flows. and FDI...

Not only that, in recent developments on August 5, the SBV reduced OMO interest rates for the first time since the end of 2023. The reduction of OMO interest rates and SBV bills is said to be aimed at establishing a lower interest rate corridor. on the interbank market, reducing pressure from mobilization costs for credit institutions.

According to assessment from MB Securities Company (MBS), as of July 3, the State Bank has sold about 6.5 billion USD since the end of April to restrain increased pressure on the exchange rate. Furthermore, the State Bank's maintenance of high interbank interest rates also contributes to reducing the interest rate difference between the USD and VND, thereby supporting the fight against the devaluation of the Vietnamese Dong.

MBS forecasts that exchange rate pressure will cool down and fluctuate between 25,100 - 25,300 VND/USD in the fourth quarter of 2024 under positive factors. These include a positive trade surplus, FDI inflows and a strong recovery in tourism. The stability of the macro environment is likely to be maintained and further improved, which will be the basis for stabilizing exchange rates in 2024.

The possibility that exchange rate pressure will be eased towards the end of the year was also pointed out by KB Securities Company thanks to the downtrend of DXY that will continue in the last months of the year. At the same time, foreign currency supply and demand in Vietnam will be more balanced as the peak raw material import season (June to August) is gradually passing. Entering the fourth quarter, foreign currency supply is expected to increase as Vietnam boosts exports to the US and EU to meet year-end consumer demand, combined with foreign currency supply coming from remittances and FDI continuing at a low level. High.