Developing the stock market in parallel with the goal of sustainable growth

At the working session with FTSE Russell on July 17, 2025, Minister of Finance Nguyen Van Thang affirmed that Vietnam is steadfast in its goal of reforming the capital market, improving operational efficiency and gradually meeting the criteria for upgrading the stock market.

Minister Nguyen Van Thang said that Vietnam is aiming for a stable, sustainable and high-quality economic growth target in the period of 2025-2030. In the first 6 months of 2025, GDP increased by 7.52% over the same period - a positive result in the context of many uncertainties in the global economy. The Government continues to maintain the GDP growth target of 8% or more in 2025; rapid growth but must go hand in hand with sustainability as a consistent orientation, towards the double-digit growth target in the next period.

To realize strategic goals, the Government has assigned the Ministry of Finance to focus on promoting public investment disbursement for key infrastructure projects, creating a connecting foundation, improving productivity and promoting regional and sectoral development. At the same time, it is necessary to implement solutions to develop the stock market to effectively attract domestic and foreign indirect investment flows to key sectors.

The Minister emphasized that a developed stock market is effectively the foundation for attracting long-term capital flows. The upgrading of the market from frontier to emerging market is not a destination, but a natural result of persistent reform towards a fair, transparent and efficient market.

Recently, the Ministry of Finance has directed the State Securities Commission to organize regular dialogues with rating agencies and investors, update market reform results as well as listen to recommendations from investors when participating in the Vietnamese stock market.

Promoting institutional reform, improving market infrastructure

On the side of FTSE Russell, the representative of the working group expressed their impression of the comprehensive reform efforts that Vietnam has been implementing to improve the quality of capital market operations. Mr. Donald Toledano said that FTSE Russell is committed to accompanying the State Bank of Vietnam in establishing index sets to help investors manage financial risks more effectively. At the same time, this organization is ready to support Vietnam in updating market infrastructure to strongly attract international investment capital.

Minister Nguyen Van Thang said that the Ministry of Finance is implementing many synchronous solutions. First of all, it is necessary to complete the Draft amending Decree 155/2020/ND-CP in the direction of publicity and transparency of foreign ownership ratio, eliminating inappropriate regulations; at the same time, building a legal framework for offering and issuing securities to increase the quality of goods on the market and expand the scale of capitalization.

The Ministry of Finance also reviewed the list of conditional investment industries to narrow areas with limited access, facilitating foreign investors to participate more deeply in the market. Equalization and divestment of state-owned enterprises will also be promoted in a clear and focused direction, after the Ministry takes over the role of owner representative from the State Capital Management Committee at Enterprises.

Regarding administrative procedure reform, the Ministry of Finance coordinates with the State Bank to review and simplify processes related to investment activities of foreign investors. The draft Circular amending Circular 17/2024/TT-NHNN is currently being consulted, with many innovations such as simplifying legal documents, reducing consular legalization requirements and allowing more flexibility in customer identification.

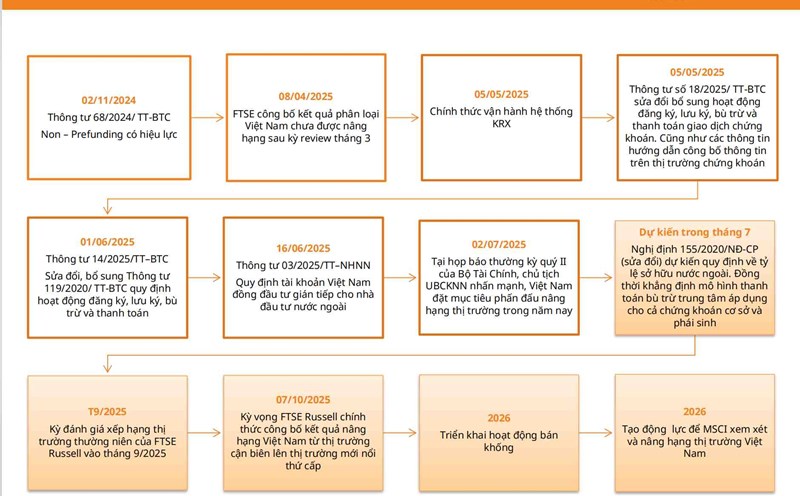

At the same time, the Ministry of Finance also promotes the application of digital technology in processing records, licensing and monitoring market activities, contributing to improving transparency, automation and reducing processing time. The Ministry is also studying a legal framework for foreign investors to access exchange rate risk hedging products, as well as implementing a central clearing counterparty (CCP) mechanism from the beginning of 2027, on the KRX system platform that has been in operation since May 2025.

The Minister welcomed FTSE Russell's proposal to expand indicators suitable for the Vietnamese market, and at the same time encouraged cooperation in training, technology transfer and knowledge to improve the capacity of domestic financial - securities experts. The Ministry of Finance is committed to continuing to dialogue, remove obstacles and perfect institutions so that the Vietnamese stock market can soon meet the upgrading criteria, becoming an attractive investment destination in the region.